This is a bundle of our most important articles organized in order with additional explanations. We organized the articles in such an order which we think will benefit you the most and will allow you to progress gradually and improve with each article.

Our goal is to make you understand the markets and how it behaves so you have the ability to always adapt to the current market conditions and find your edge no matter where the price is or what it does.

1. Market Structure

Understanding market structure will allow you to easily identify trends and reversals. Market structure is one of the main components of our strategy and how we trade at the FXD community. Finding your way in structure will allow you to keep track of what the markets are currently doing and you will always know which way the price wants to go.

Identifying and Trading Market Structure.

2. Supply and Demand

Structure alone isn’t enough to make you understand the markets. Our second main component of our strategy is supply and demand. Understanding how the markets operate based on supply and demand will allow you to identify zones and areas in price where the markets are likely to tap into and respect. This gives you the opportunity to start finding entries for your trades.

Identifying Supply & Demand Zones – The Improved SMC Way

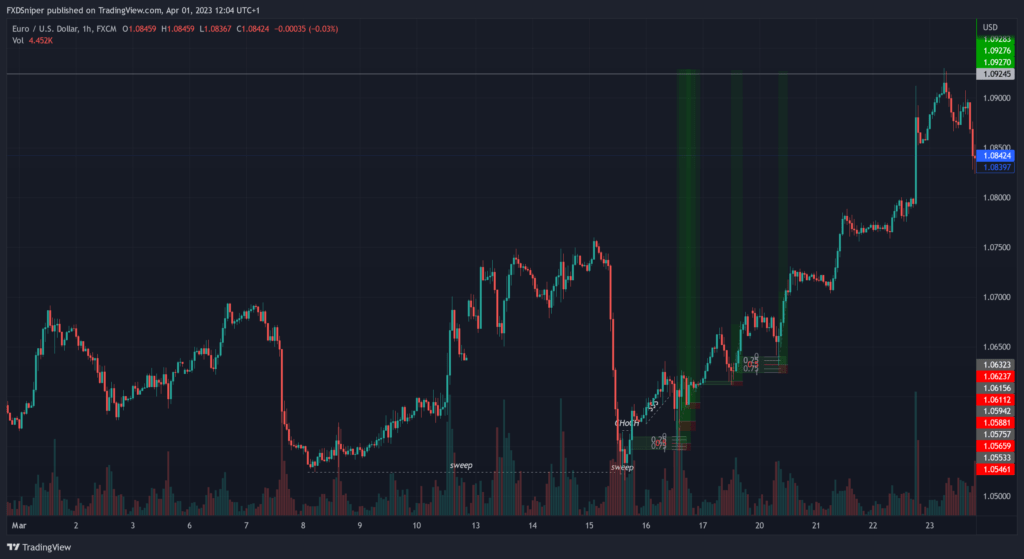

3. Liquidity

Liquidity is the third of the main components of our strategy. The markets are always looking to take out liquidity before making its major move. Finding areas of liquidity in price will allow you to avoid being taken out of a trade before going in your favor. It will also deepen your understanding of price and the market’s behavior.

How To Identify Areas of High Liquidity In Forex

4. Premium and Discount

Premium and discount zones are used to help you understand the current position of price in the chart. It allows you to pick higher quality trades with much higher win rates.

Limit Your Losses Using Premium and Discount Zones

5. Volume

Volume is used to give us extra confluence to our trades. It also allows us to distinguish real market moves from fake moves. Understanding volume and how it plays part in the market will allow you to pick the most probable trades and will drastically improve your win rate.

How To Read The Volume Indicator

Our members already secured 7-figures in funding capital. Join the FXD Academy and take your trading to the next level, click here to learn more.

6. ChoCh

ChoCh, also known as a change of character, is a market structure concept that allows us to identify trend reversals. Understanding when the market shifts its bias is crucial to any other strategy out there. It will allow you to get out of trades as soon as you notice the bias shifts and it will allow you to pick the early waves of major and minor trends.

What Is a ChoCh and How To Trade It Correctly

7. Orderblocks

Orderblock is a very popular term in the SMC community but most people trade them incorrectly and don’t really understand them. The concept of orderblocks is actually a part of a supply and demand strategy, the only difference is how we draw them. We always expect orderblock to be taken out as they are a major pool of liquidity so understanding our view of orderblock will allow you to eliminate more potential losses and enter higher probability trades.

How To Trade Order Blocks and Why They Don’t Work

8. Trading Psychology

Having the right mindset is probably the most important thing when it comes to trading. You can have the worst strategy in the world, but if your mindset is in the right place you will still end up profitable. We all have bad habits and we all go through the same emotions, being profitable or not doesn’t change that. Being profitable only changes the fact that you accept whatever you’re feeling and you can control the impulses that push you into those bad habits, but they never go away. This is a 4 part series where we go through different stages of emotion and bad habits and how to overcome them.

Trading Psychology: Managing Your Emotions

Trading Psychology: Bad Habits Ruining Your Progress

Trading Psychology: Confirmation Bias

Trading Psychology: Life of a Trader

9. Risk Management

You can’t become a profitable trader if you don’t understand the importance of managing your risk. Just like with your mindset, even the worst strategy in the world can be a profitable strategy if your risk management is solid. Even if you had a 100% profitable strategy, without proper risk management you will make that strategy unprofitable.

10. How To Build a Successful Trading Strategy

Every person on this planet is different. We all have different personalities, different lifestyles etc. So naturally having the same strategy isn’t going to work. It may work for many, but for many it may not. Some people are scalers, some are swing traders. Some trade on the 1 minute chart, some trade on the 1 hour chart. Even if we trade the same strategy, we may have different styles. The way we trade at the FXD community is not by following a strict plan 1 to 1. It is by figuring out the markets and learning how they operate. This allows each individual to understand the market’s behavior in its own way. Once you truly understand the markets you will learn to adapt with it.

How To Build a Successful Trading Strategy

Everything taught up to this point should be more than enough to make you a profitable trader. This is all there is to know to develop a strategy with an edge and maintain that edge for the rest of your life. All you have to do is study it like your life depends on it and put the work in. You can’t expect to achieve success in one the toughest industries in the world just by drawing lines on your chart. You have to go through the struggle and the hard work which will shape you into the best version of yourself that will then become a successful trader.

Our members already secured 7-figures in funding capital. Join the FXD Academy and take your trading to the next level, click here to learn more.

Bonus

Feel free to also check out these bonus articles. They are not necessary to implement into your strategy but you might find them very helpful and they may give you a better understanding of the markets or some of our previous concepts.

Know Your Bias, Win Trades Even If You’re Wrong

3 Most Common SMC 1 Minute Entry Models

Sweep vs BoS, What’s The Difference?

Accumulation, Manipulation, Distribution Market Cycle

Manipulation, Accumulation, Distribution Markey Cycle

Range, Initiation, Mitigation, Continuation Orderflow Pattern

Why Candles and Candlestick Patterns Don’t Matter In Trading

Become a VIP and get access to exclusive insights, profitable signals, and a supportive community that will elevate your trading success, click here to join now.