One thing more important than your trading strategy is your understanding of proper risk management. Without it you’re not a trader, you’re a gambler. Having a solid risk management plan is what separates the consistently losing traders from the consistently winning traders. It is the first thing everyone should learn before they even think about starting trading, yet it is also the number one neglected thing by people who pursue trading.

Rule number 1 of proper risk management is to never invest any money you are not willing to lose. Any money you deposit into your MetaTrader or your crypto broker or stock broker is money you must not care about if you lose it all. Don’t live with the false hopes of turning your little accounts into millions, that’s not going to happen.

Why is risk management so important?

Your job as a trader is to protect your capital at all cost. Having proper risk management is the ability to survive a streak of losing trades without making a significant dent in your account size.

Any risk management plan narrows down to basically one thing, your risk to reward ratio. If your risk to reward ratio has a positive expectancy you will always end up making money in the long term. If you’re risking $10 to make $50 you have a 1:5 risk to reward ratio, therefore you only need a 20.1% win ratio to have a profitable strategy. On the other hand if you have a strategy with a 1:1 RRR you require 50.1% win rate to be profitable.

What is risk?

You’d be surprised but a lot of people don’t even know what it means to risk 1% per trade. To risk 1% per trade means you’re willing to lose 1% of your total account balance on one particular trade.

Our members already secured 7-figures in funding capital. Join the FXD Academy and take your trading to the next level, click here to learn more.

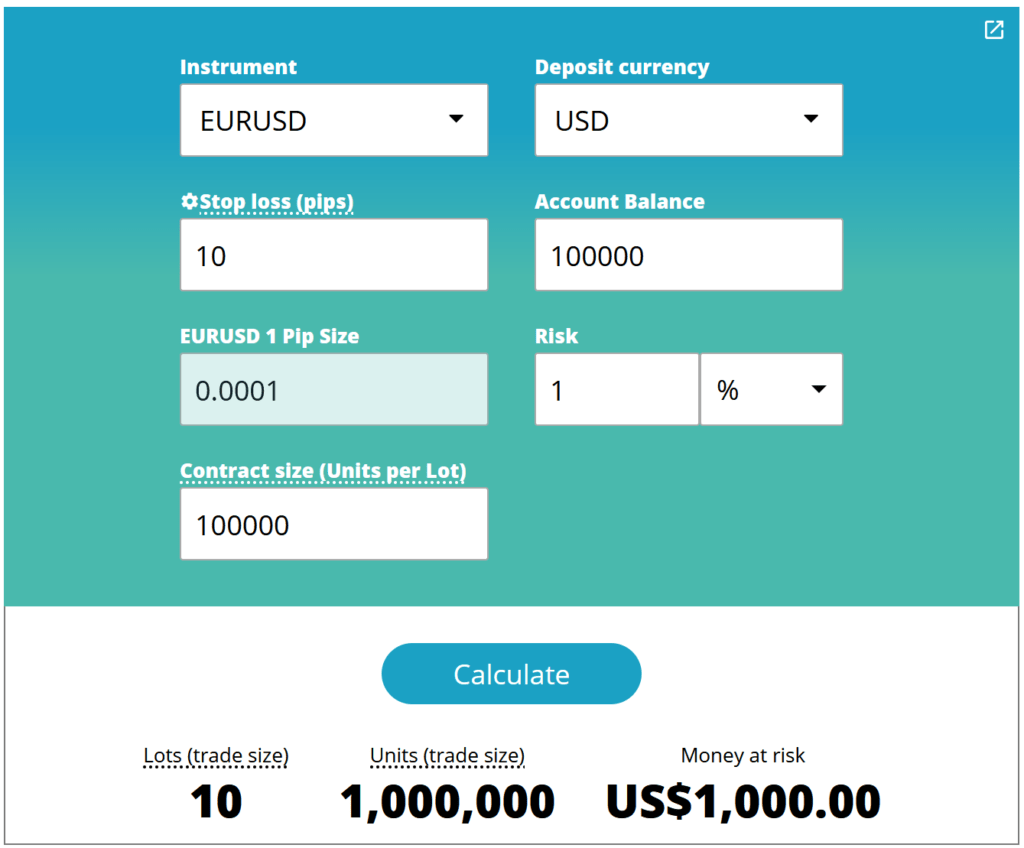

To calculate your risk you must know your stop loss (in pips) before you even place the trade. There are a lot of position size calculators online to help you determine your position size based on your risk. I also have one on my website you can use Position Size Calculator.

This is how it works:

Let’s say you have a $100k account and you want to open a trade on EUR/USD with a 10 pip stop loss risking 1%. You input the numbers into the calculator and click calculate.

This means you can open 10 lots on this particular trade and you’re risking $1k (1%) of your total $100k balance. If you have a 1:5 risk to reward ratio you’re basically risking $1k(1%) to potentially make $5k(5%).

Using such a calculator before you place a trade is the best way to compound your account because you adjust each position accordingly to your account balance and you take away all the guesswork.

How much should you risk?

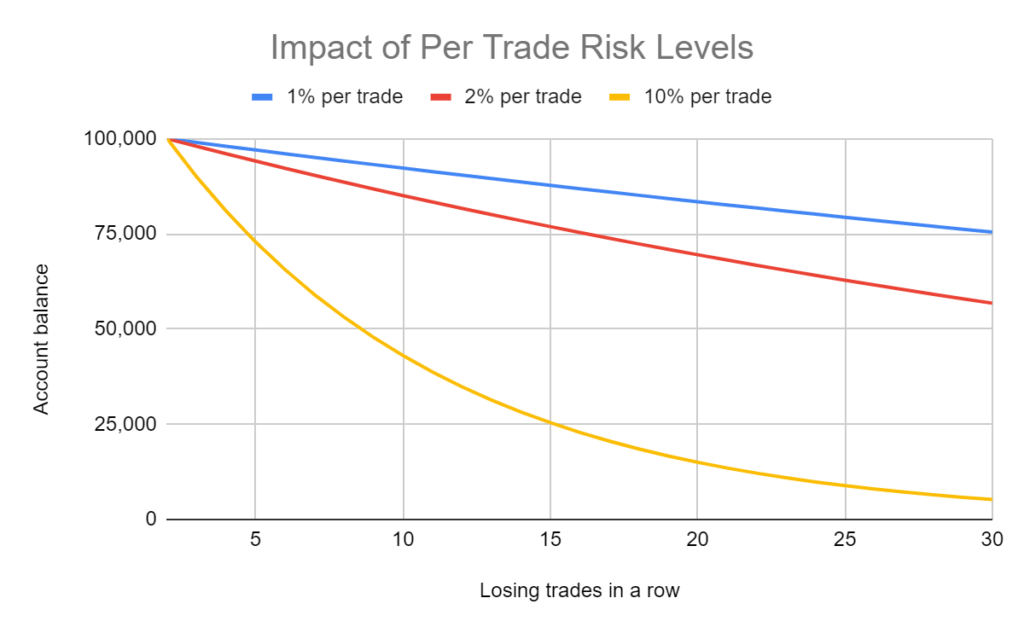

I’m sure you’ve noticed everyone keeps saying you should risk 1-2% per trade at most. There’s a good reason for it. Like I mentioned before, your job as a trader is to protect your capital. Risking a lower percentage amount per trade means the risk of you losing 100% of your account is much lower and any potential drawdown is much easier to return back to profit.

The graph below shows you what would happen if you suffered up to 30 trades losing streak.

Risking 1% per trade and losing 30 trades in a row would put your account in a 25% drawdown. Whereas 30 losing trades in a row with a 10% risk would put your account at a 95% drawdown.

Now let’s look at the table below. The 25% drawdown only requires a 33.3% gain to break even, that’s very achievable. However the 95% drawdown requires a 1900% gain to break even. Do you see why lower risk is preferable for maintaining long term success in the markets.

| Percentage Loss | Percentage Gain | Percentage Loss | Percentage Gain |

|---|---|---|---|

| 5% | 5.3% | 55% | 122.2% |

| 10% | 11.1% | 60% | 150% |

| 15% | 17.6% | 65% | 185.7% |

| 20% | 25% | 70% | 233.3% |

| 25% | 33.3% | 75% | 300% |

| 30% | 42.9% | 80% | 400% |

| 35% | 53.8% | 85% | 566.7% |

| 40% | 66.7% | 90% | 900% |

| 45% | 81.8% | 95% | 1900% |

| 50% | 100% | 100% | GG |

Also notice how quickly the required percentage gain grows as your drawdown gets bigger. Realistically your drawdown should never go below 10%, which coincidentally is also the max drawdown most funding companies have as a rule. So if you have a strategy that guarantees you a drawdown lower than 10% over 1000 trades, you are guaranteed to pass every single verification and secure max funding in each funding company without much trouble.

Become a VIP and get access to exclusive insights, profitable signals, and a supportive community that will elevate your trading success, click here to join now.

Does leverage matter?

Have you ever had someone tell you that you will never succeed in trading if your leverage is anything higher than 1:50. I hear that all the time, and I honestly don’t understand the reasoning why people think that because with all honesty, leverage does not matter. Use as much leverage as your broker allows you to. I will clarify, just let me explain the basics.

What is leverage?

The basic definition of leverage is the ability to control a large amount of money using very little of your own money. In forex the way it works, let’s say your account has a 1:100 leverage and you have a balance of $1000, this allows you to open a position size of $100,000 (1 standard lot) because your broker provides you with 100x the amount of money for every $1 you have.

This is also why trading forex makes sense, imagine if you could only trade using your own money having 0 leverage. It would be impossible to make any substantial gains without owning millions in capital.

The reason why I say leverage doesn’t matter is because it doesn’t change anything to how you trade. In fact, having more leverage makes trading easier in my opinion.

Let’s say you have a $1000 account.

Most regulated brokers and a lot of countries have a restriction for retail traders that only allow you to have a max leverage of 1:30. That would only allow you to open a max position worth $30,000 (0.3 lots) on your account. That means you would have to place a full margin trade just to open a 0.3 lot trade.

Now if you have a leverage of 1:500 which is what I personally use and recommend. That same account would allow you to open a max position worth $500,000 (5 lots). Obviously I don’t recommend that as that would mean you’re going full margin but that would allow you to open that same 0.3 lots trade with only $66 in your account.

This gives you much more room to open multiple trades and diversify your risk. Higher leverage changes nothing to how you trade, it only gives you more margin to open more trades. Your strategy and your risk stays the same.

Risk management strategies

Of course the simple way to manage your risk is to stick with a strict risk of 1% per trade. But there is a lot more to it than that, what about securing your profits or maximizing the gains and controling the risk? That’s what I’ll explain now. Keep in mind, all of this is optional and how you manage your risk is up to your own preference.

Adjusting stop losses / multiple stop losses

Most common strategy to limit your risk and secure profits is to move your stop loss to break even after price moves in your favor, however there are some downsides to this. A lot of people move their stops way too early and end up getting their trade closed. In my experience moving stops only makes sense if the price breaks a major point of structure on a higher timeframe. Which also means you should only move your stops if you’re going to swing trade your positions, if you’re scalping or day trading you should be taking your profit before you even consider moving your stops as the price can easily spike in both directions just to stop you out.

Also if the trade is going against you and you feel like it will very likely hit your stop loss, you can close 50% of your trade and let the other 50% hit the stop loss. This way your overall loss is much smaller and you have more risk left over of your total daily loss.

Trailing stop loss and take profit

Although you should use a fixed stop loss when you enter a trade you can use trailing SL and TP to manage your trade along the way. How much you want to trail your SL and TP depends on the pair you’re trading and the current volatility but anywhere between 10-50 pips is a good place to start.

Hedging

This is something extremely difficult and it requires an article of its own, but it’s worth mentioning here. Hedging is a common practice where a trader opens a trade on the opposite side of his/her current trade to offset some of the risk.

For example, you’re holding a buy swing trade on EUR/USD, price has reached a potential short term reversal area. Instead of closing your trade or taking partials which lower your potential max gain in this trade, you open a short trade to counter the loss in profit. This allows you to keep the same or bigger profit no matter which direction the price moves.

Hedging is also used to cover for losing trades. If you have a trade that’s at a loss, opening the same size (or bigger) trade on the opposite side would prevent you from getting into a bigger loss. But that’s a very risky practice that requires a lot of precision.

Leading broker 16+ years in the industry

Spreads starting from 0.0 pips

Up to 1:2000 leverage

Trade Forex, Futures, Stocks and Commodities

Instant withdrawals get paid in under a minute

To Summarise

- Only invest money you are willing to lose.

- Trading lower risk (>1%) guarantees longevity in the markets as a trader.

- Required profit to make up for losses scales up exponentially as your drawdown grows.

- Leverage does not matter, utilize as much of it as possible.

- Moving SL to break even only makes sense if a major higher timeframe structure is broken.