This will be a very controversial article where I’m going to explain to you how to win more trades even if you’re wrong and your entries are bad and impatient. This is a very aggressive way of trading and can result in bigger losses but if your bias is correct most often than not you will find yourself winning a lot more trades. I mainly use this way of trading during my flips and if you’ve known me for a while, you definitely know the insane percentages some of my flips had.

“Forex gurus” hate begins now…

Know your bias

When I say know your bias I mean you have two options. Price will either go up or down. It doesn’t matter if we’re in a trending market or a consolidation period. If you can’t find your bias either go up or down in time frame until you do.

This is the most important and actually the easiest step in any trading strategy. I mean, how hard is it to find a trend? If you know the price wants to go up, you wait for an opportunity and you buy. You don’t need a perfect sniper entry, it doesn’t matter if you get into a bit of a drawdown as long as at the end of the day you end up in profit.

You don’t even need to trade with a stop loss this way, as long as you’re aware of your risk and the potential overall loss you’re willing to take in case the bias shifts in the opposite direction.

As a trader you must understand that every single strategy, every single indicator works but it doesn’t at the same time. The market can shift its bias any minute and you must be prepared to act instantly when that happens. That’s why this way of trading is not for the emotionally weak traders, you can’t let your ego and your emotions cloud your judgment as you’re already taking extra risk here.

Our members already secured 7-figures in funding capital. Take our premium courses and take your trading to the next level, click here to learn more.

How to find your trade bias

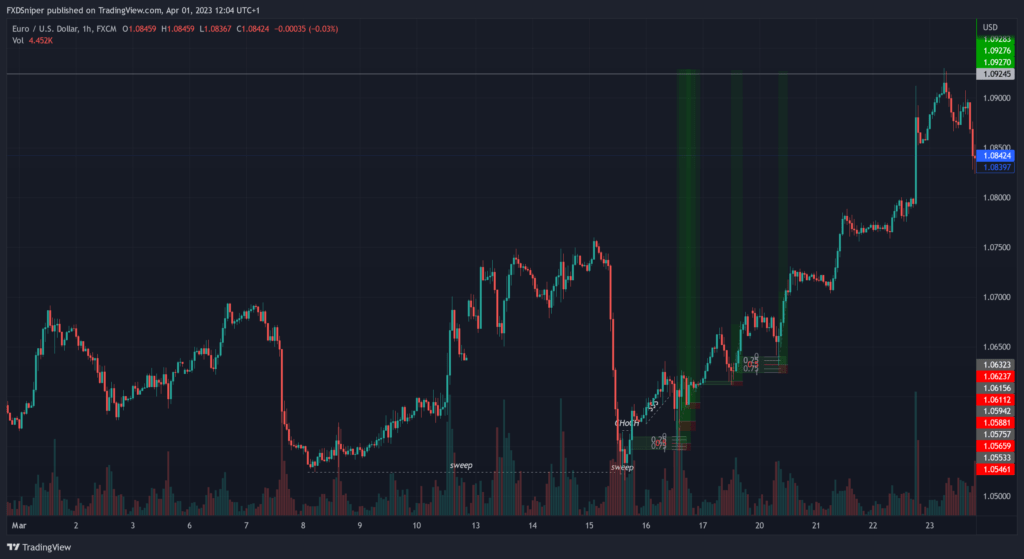

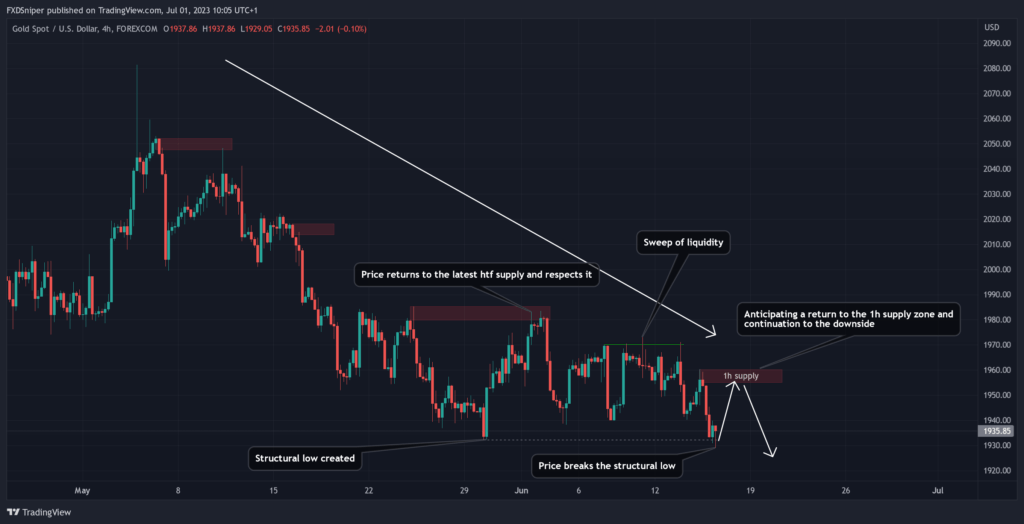

Look at the example above. It is extremly obvious price wants to continue pushing to the downside, there is no doubt in mind. So you know your bias is bearish and you want to short. You have your latest supply zone drawn out and all you have to do now is wait for the price to tap into your zone so you can take your entry.

So let’s go down in timeframe and see what happens.

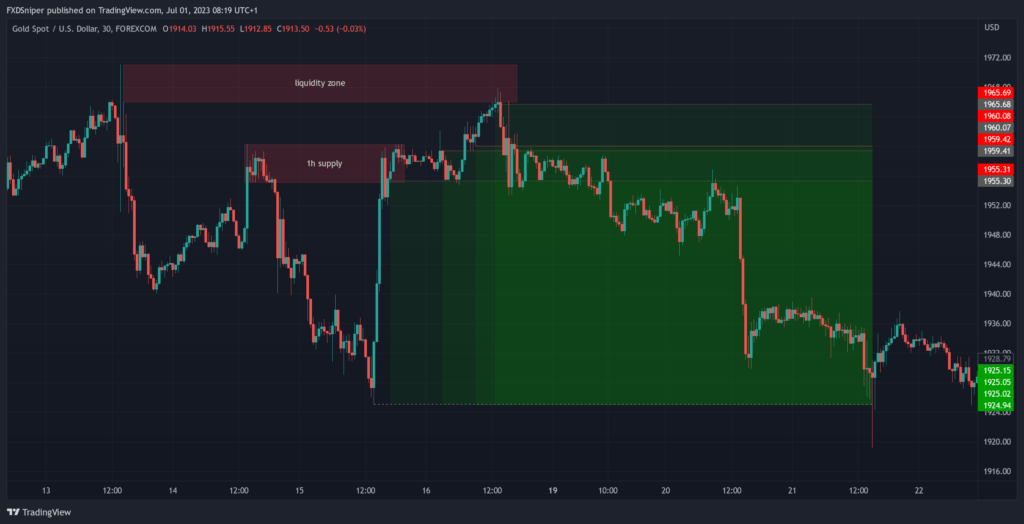

First entry taps into your zone, you enter, sl hit. But you know the price will continue going down. You see price swept the high of your 1h zone so you enter again, sl hit. Price pushed higher again you see a bit of consolidation thinking that’s it now so you enter, sl hit again.

Most people have a “3 strikes and out” rule in their strategy because literally everyone tells you to stop trading if you hit 3 losses in a row for the day which is stupid in my opinion but that’s a topic for a different article. What happens next? Price took out the impatient traders, trapped some buyers and went all the way down. You were right about the direction but you were wrong about the trade, you lost money and now your emotions are through the roof, you begin to revenge trade and so on… Sound familiar?

So how could you avoid this type of situation in the future?

Same set up, same bias. You know your strategy works but you also know anything can happen. You have your 1h supply zone drawn but you know how manipulative price is and it is just as likely price might tap into the zone above but it might not, you just don’t know until it happens.

So instead of entering trades like every guru would tell you to, you simply enter with a smaller risk without a stop loss. If anything goes wrong you’re ready to close all trades if the price breaks the highs but until that happens you’re happy to enter more smaller risk trades as price moves against you. Now only you increased your win rate doing this you also generated much more profit for a little sacrifice of getting into a short term drawdown.

Of course you can use any risk management strategies of your choice, if you’re too afraid to trade without a stop loss you don’t have to.

See I’m not like your every other trader who trades like a brain dead monkey based on some stupid probabilities that work as well as flipping the coin. If you study each of the articles on my website I’m actually trying to teach you how the market moves and understand the reason behind its movements. You can only trade with such high risk strategies if you understand the market’s behaviour. There is no probabilities here, it’s all skill based.

I’m sure you know by now the main concept of my strategy is based around supply and demand and market structure. That’s what I use and that’s what I recommend for everyone to use to find their trade bias and for technical analysis in general.

However you can use any strategy that you’re comftable with as long as it allows you to know which direction price wants to go, not predict, know.

The only regulated broker with up to 1:2000 leverage

Spreads starting from 0.0 pips

Min deposit $10 | Trade from 0.001 lots

Trade Forex, Stocks and Cryptocurrencies

Up to 60% sign up bonus

To Summarise

- Knowing your bias is the most important part of any trading strategy.

- As long as you know which direction the price wants to go, your entries don’t matter.

- Stop loss is not necessaryin this way of trading.

- Stacking your trades works best in trend continuations and reversals.