Trading order blocks have become very popular in recent years. It’s mostly popular amongst SMC traders who praise order blocks as if it was a holy grail of trading but the truth is, they don’t work. At least not in the standard way everyone is thought to trade them.

Most people’s definition of an order block is an area of price where banks and institutions have left their orders so if the market comes back into that area, the price must reverse. Wrong, unless you’re a trader in a big bank, you will never know where banks have their orders. This is just a fancy definition marketers use to sell their courses.

The actual and the simple definition of an order block is an area of price which created a sudden change in price. This is usually seen as the last candle (or multiple candles) followed by an engulfing candle in the opposite direction.

However, yes an order block is also an area where more orders are placed, which creates liquidity and as we know. The markets are always looking to take out both sides to grab as much liquidity as they can. Meaning, order blocks (almost) always get taken out, that’s why they don’t work but I will show you a way to make them work.

How to identify and trade order blocks

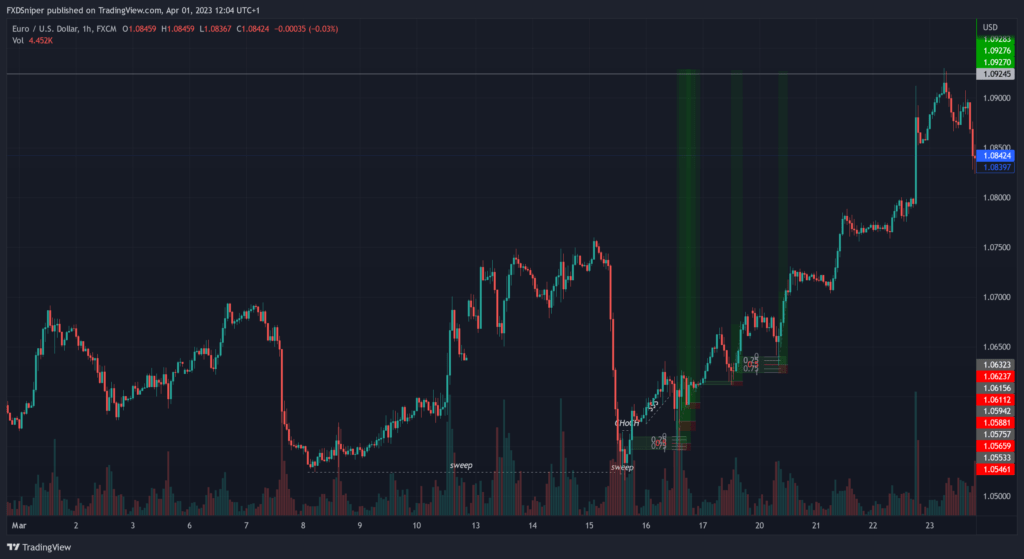

As mentioned earlier, an order block is the last candle that creates a sudden change in price. In a bullish scenario you can also look at it as the last candle where sellers had control in the market before the bulls took over. Which looks like this on a chart:

Ideally you want to mark your zone from the top of the candle including the wick to the lowest point which may also include the engulfing candle, that’s an order block.

In my experience order blocks that consist of a single candle as in the example above will most likely get taken out. Also order blocks created by news, always get taken out.

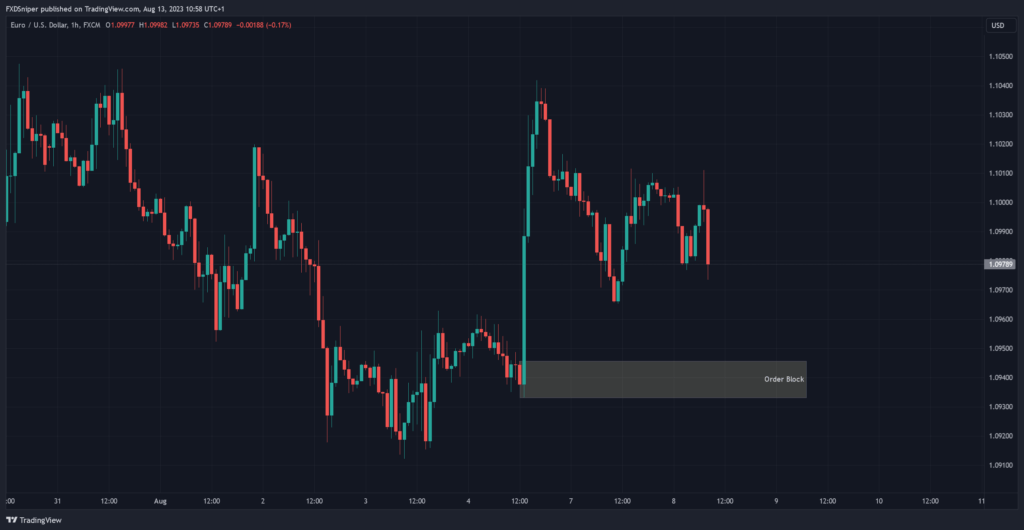

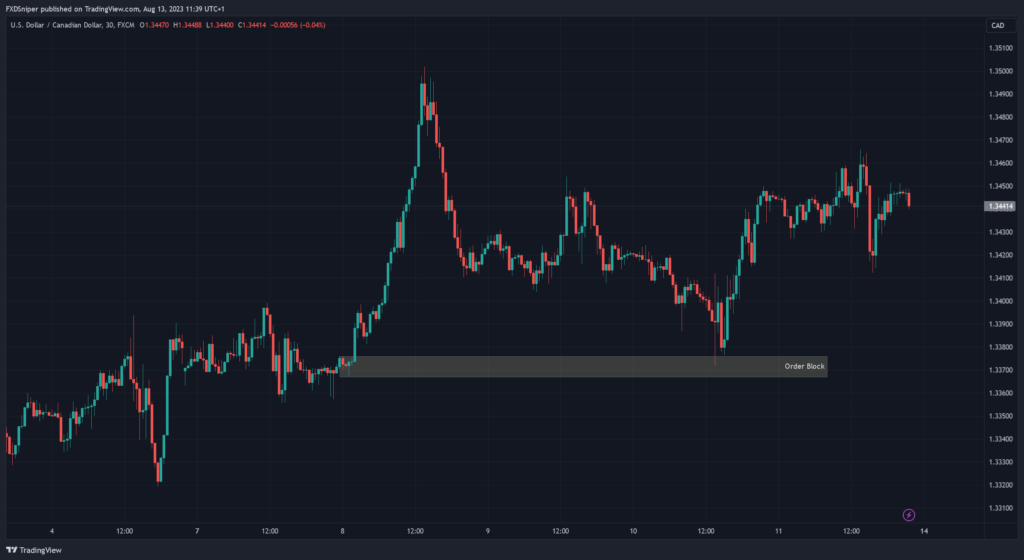

Let’s see what happened.

Price came into the order block, early buyers jumped in. Price then sweeps the order block and continues to hit take profit, yet most people trading order blocks get taken out.

The only way to avoid being stopped out in such a set up is to wait for the order block to be swept. Your stop loss placement may be a bit tricky here, but usually you will find there is some form of supply/demand zone or a point in structure below your order block that works as your stop loss.

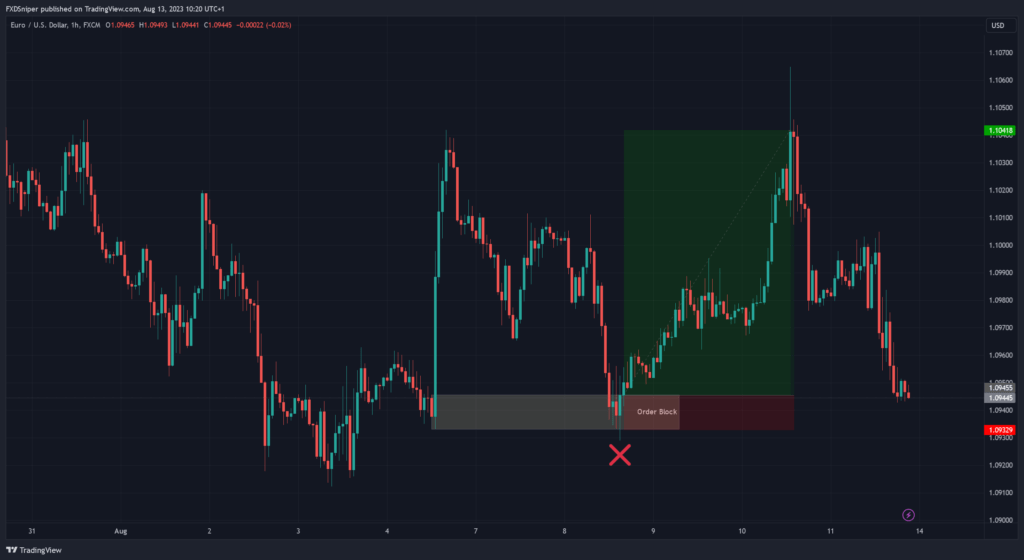

As you can see, not only would this trade hit your take profit, the risk to reward ratio was also much bigger. Waiting and anticipating a sweep before entering a trade is my most favorable way to spot high risk to reward trades with a high win rate.

I should also mention, if you’re trading a pair with lower volatility the chances of any kind of sweeps happening are less likely as compared to higher volatility pairs. That’s because there is a lot more manipulation going on with high volatility pairs such as Gold or EU/GU. Lower volatility pairs are more likely to respect structure and supply and demand zones. This also applies to higher/lower voltile times of day but at the end of the day, markets do what they want, it’s just something you want to keep in mind.

Finding order blocks that work

The above example shows you an order block that was respected, why?

Number one reason is because it was a natural move, not created by the news. Price simply consolidated in a range and broke out of it. Notice there were multiple order blocks created by the bullish move which had some form of reaction as price was coming down, that’s the early buyers trying to get in on the move. You should always target the lowest/highest order block, that guarantees much higher win rates.

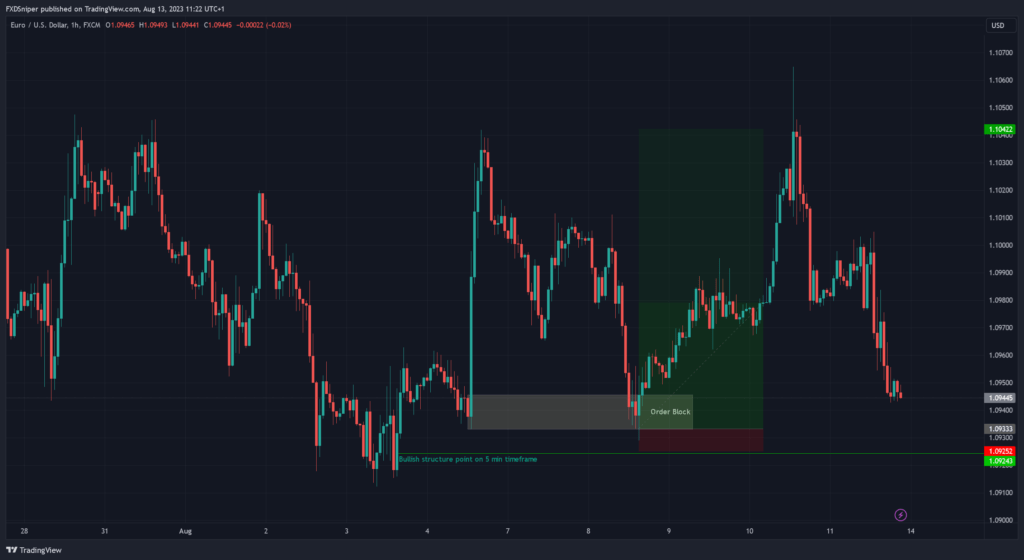

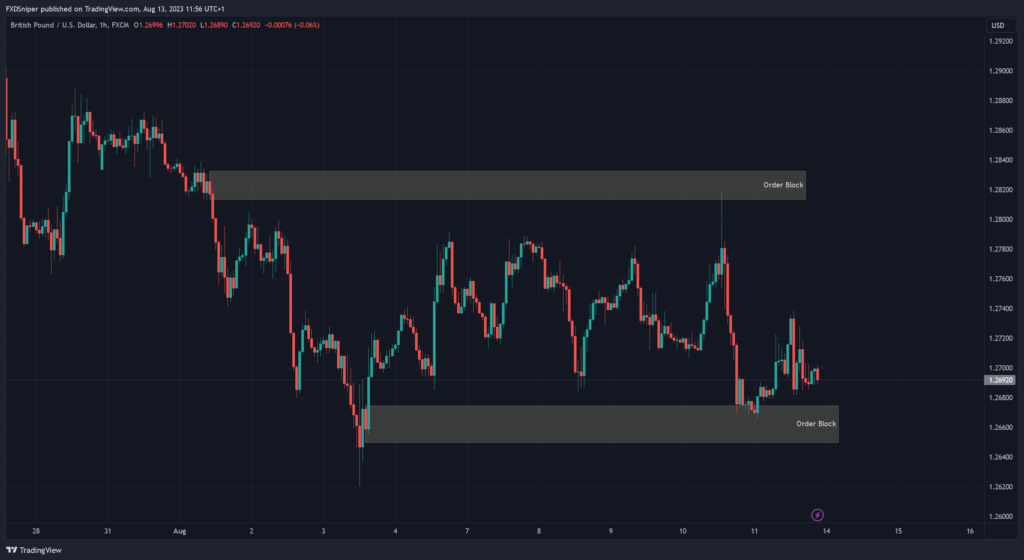

Let me give you another example.

Same here, the price was creating a bearish structure, had a little range and broke out of it leaving a valid order block behind. After creating the low, price reversed and consolidated in a massive range, as news came out, the price tapped into the order block sweeping all previous liquidity before coming down and reacting from its lowest order block.

Placing limit orders in such order blocks before major news releases can be a very profitable strategy for high risk traders. Just make sure your order blocks are above/below major liquidity.

Leading broker 16+ years in the industry

Spreads starting from 0.0 pips

Up to 1:2000 leverage

Trade Forex, Futures, Stocks and Commodities

Instant withdrawals get paid in under a minute

To Summaraise

- Most order blocks get taken out, wait for a sweep before entering.

- Order blocks created by news always get taken out.

- Order blocks created by natural price movement such as breaking out of a range have a high chance of being respected.

- Use order blocks placed at the top/bottom of your chart.

- Pairs with lower volatility have higher chances of its zones being respected.