I would argue that around 98% of trading strategies out there revolve around candles. How they’re shaped, how they open, when they close etc. The truth is, none of it matters. All your shooting stars, morning stars, hammers, dojis, crows or whatever other fancy terms you’ve heard before don’t actually matter. It’s all just fancy terms created by sheep and spread by other sheep to the point where it’s the most searched for strategy in the trading industry.

Don’t get me wrong, candles are very helpful and are much better than any other type of chart such as the plain old line chart. But that’s only because candles have much more visible information about them. You can tell when the candle opened, when it closed, the wicks tell you the highest/lowest point during the candle’s timeframe. It’s all very useful information, but the shape and size of the candle doesn’t matter.

Price will go where price wants to go. End of story.

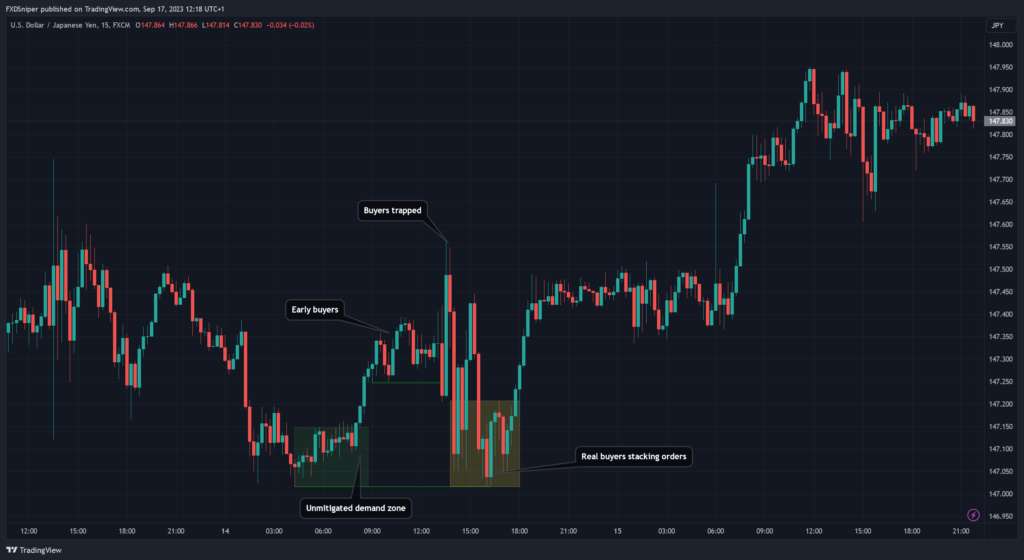

As I’ve mentioned in one of my earlier articles about liquidity, around 95% of the total trading volume is created by algorithms. The algorithm doesn’t care about a doji candle forming at your resistance. It only cares about liquidity. Where are the majority of players entering their positions, and how can I trick them into giving me their liquidity to fill my positions and push the price where I want to. That’s basically how the algos operate. If there is a doji candle forming at resistance it’s probably because the market makers are accumulating their positions and to grab the extra liquidity, they will trap and liquidate anyone who is entering their positions within that area of price. That’s when you’ll see a bearish move, not because there was a doji candle but because everyone who saw that doji candle entered early, becoming the liquidity for the market maker.

This is why a strategy such as supply and demand is so powerful and so much superior than any other strategy. If you trade based on S&D zones properly, you don’t care about what the candles look like. You simply follow the price and look for areas where the price created supply and demand. If you have an unmitigated area of supply or demand you know the price will have to come back and retest that area, it’s basic economics. It’s all based on price, not candles.

Become a VIP and get access to exclusive insights, profitable signals, and a supportive community that will elevate your trading success, click here to join now.

Let’s look at an example.

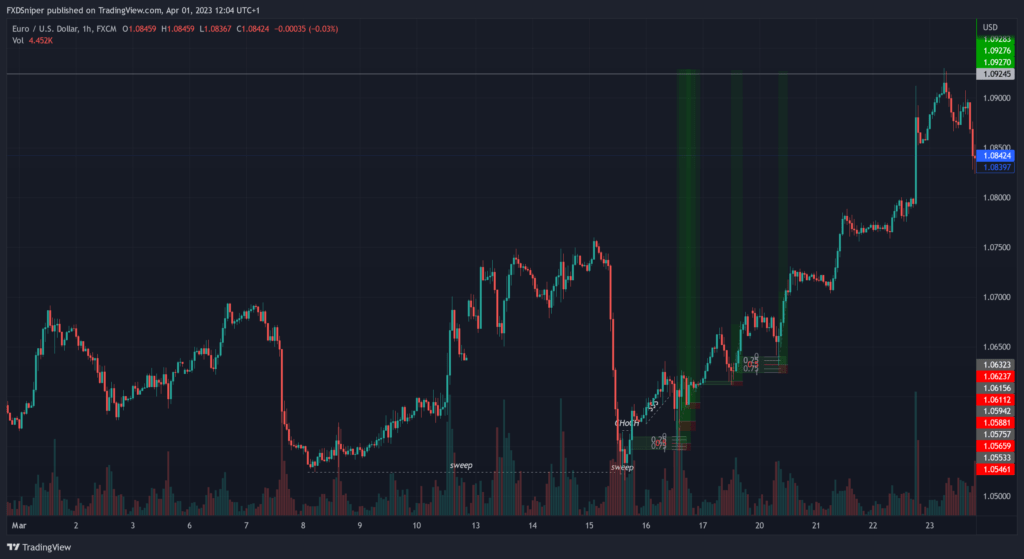

The price was trending down and then reversed, leaving a fresh unmitigated demand zone. Then you notice a range forming at resistance, you may be thinking the price wants to break that resistance or respect it and continue moving down. You have both buyers and sellers entering trades. Then you see the red engulfing candle, buyers got liquidated, more sellers are coming in now. Then you get the massive green engulfing, now the buyers that got liquidated before see this as confirmation so they enter again. What happens? Price comes down into our unmitigated demand zone, accumulates orders and then continues its move up. After both the buyers and sellers were liquidated.

Do you see now, why candles don’t matter? All the engulfing candlesticks and none of them worked. The price simply came to retest the unmitigated demand and that’s where the real move happened.

What’s the moral of the story? Follow the price, not the candles.

Leading broker 16+ years in the industry

Spreads starting from 0.0 pips

Up to 1:2000 leverage

Trade Forex, Futures, Stocks and Commodities

Instant withdrawals get paid in under a minute

To Summaraise

- Markets are controlled by an algorithm.

- Candestick patterns don’t work.

- Candles don’t matter.

- Follow the price not the candles.