The main concept behind a ChoCh is to identify a shift in bias using market structure. For those that don’t know, ChoCh stands for Change of Character, some people also call it a “flip” or a “shift” but most people know it as a ChoCh so let’s stick with that.

The idea behind trading using a ChoCh is to find a higher timeframe point of interest, this can be a supply or demand zone or any other zone using a strategy of your choice, but in my experience it works best with s&d zones.

Once you have your higher timeframe POI selected you can refine it on lower timeframes or just keep it as it is, it’s a matter of preference. Then you simply wait for a shift in structure on a smaller timeframe like the 1 minute, this shift in structure confirms the reversal and you can simply wait for a pullback into the latest supply/demand zone and take your entry from there with a very small stop loss.

Let’s look at some examples.

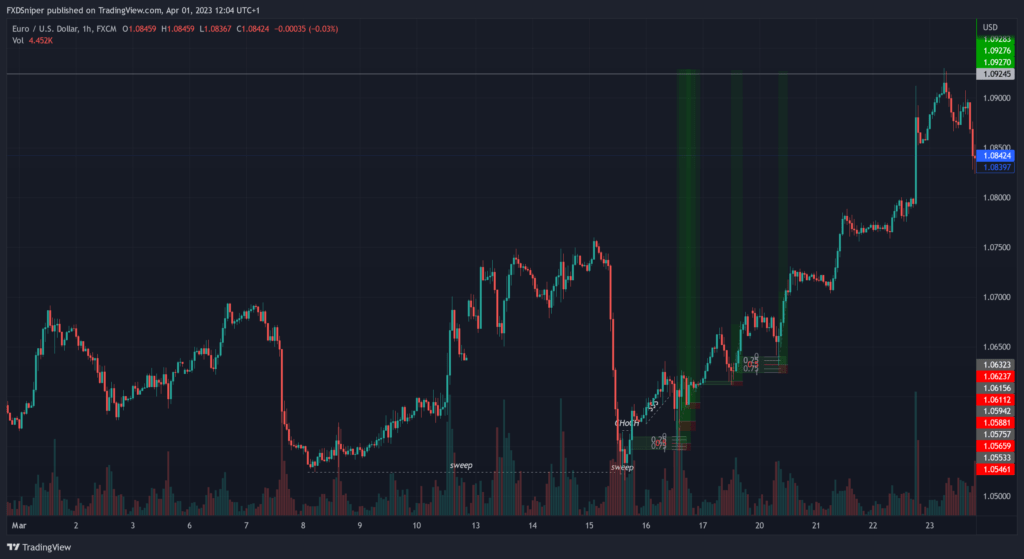

Ideally what you wan to see in a bullish trend is price pulling back, breaking structure to the downside and hitting your POI. In your POI you wait for the bearish structure to be broken, this is your ChoCh and this is your confirmation that the structure is shifting back to bullish. From there all you have to do is wait for the entry.

It doesn’t always happen but in most cases before a ChoCh happens there will be a sweep of the previous low/high. Just like the example above. If there is a sweep it just adds more strength to the ChoCh.

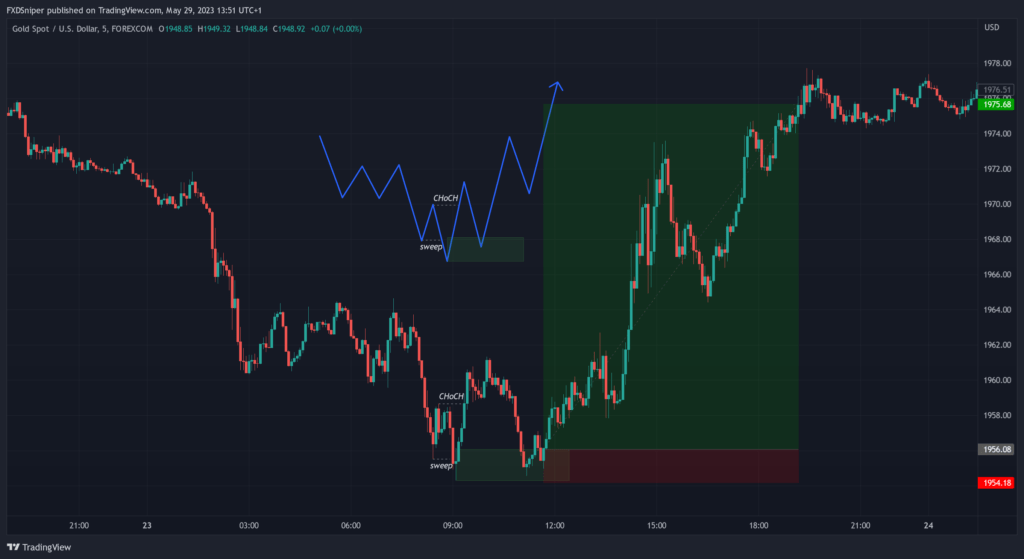

This is an example of a ChoCh without the sweep.

Usually in my experience there will be a sweep present if the market is about to reverse from a longer term pullback. ChoCh without a sweep usually happens after the price has already started to reverse and you’re looking to enter later on in the move.

Become a VIP and get access to exclusive insights, profitable signals, and a supportive community that will elevate your trading success, click here to join now.

If you compare my 1st and 2nd example you will notice that the 1st example reached its lowest point and then price reversed. In the 2nd example price slowly started pulling back without any clear signs of reversal and then had a big move up changing character.

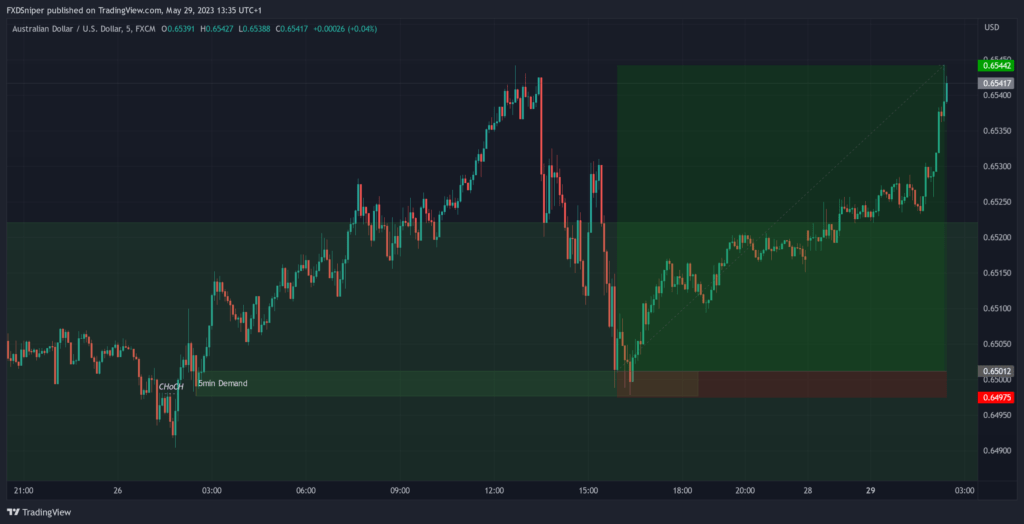

Now let me show you an example starting from identifying your point of interest.

This is a daily chart on AUD/USD. Ideally you want your point of interest zones to be placed under/above liquidity areas. We know that the market will often take out the previous low/high before the actual move happens.

In this case we can see there was a big range formed on the daily timeframe so we can expect the price to take out the low before it goes back up so we look for our POI below the lows. There’s a very strong demand zone right below that haven’t been tested yet. That’s our point of interest. All you have to do now is go down to a smaller timeframe and look for a break of structure. Once you get that you simply take the trade from the last s&d zone.

Following these simple steps would have given you an opportunity for a beautiful 1:11,6 RR trade.

Leading broker 16+ years in the industry

Spreads starting from 0.0 pips

Up to 1:2000 leverage

Trade Forex, Futures, Stocks and Commodities

Instant withdrawals get paid in under a minute

To Summarise

- ChoCh is a market structure term that identifies a shift in bias.

- Look for a smaller timeframe ChoCh in higher timeframe POI.

- Sweeps add strength to your ChoCh.