Before I show you and explain the entry models I often use while trading on the 1 minute timeframe, please bear in mind this style of trading is extremely aggressive and may often lead to taking an extra amount of losses. However if executed correctly the risk to reward ratio should be enough to cover any previous losses and more.

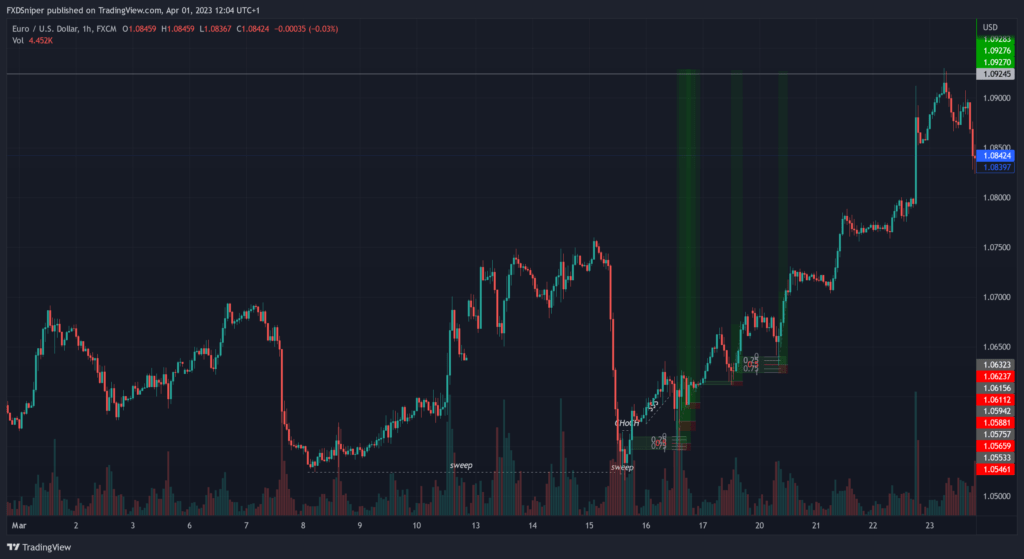

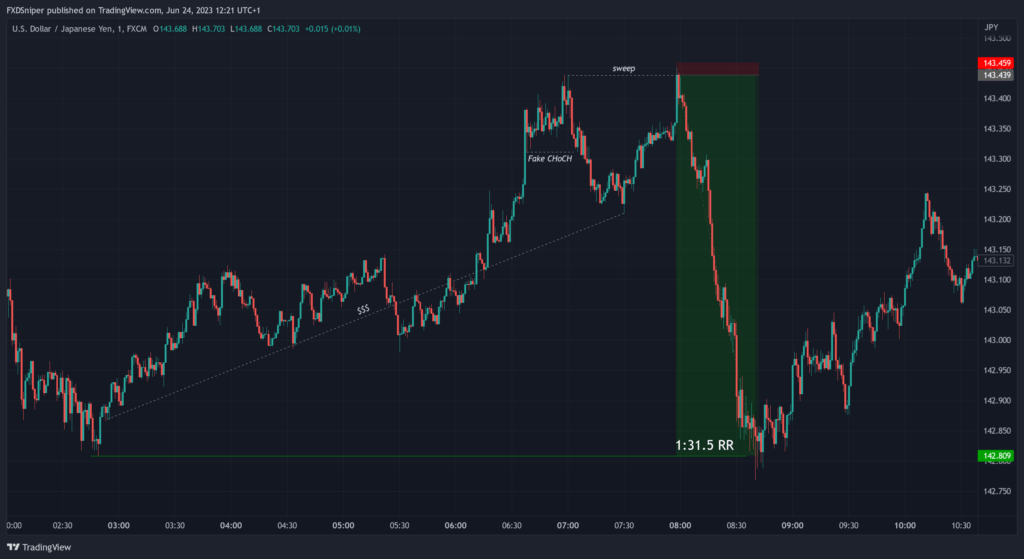

Fake ChoCH + Sweep

This is one of my favorite entry models, however it’s one of the most aggressive ones too. All you have to do is wait for the price to break the higher time frame high or low, spot the fake chock forming and enter the trade at the sweep of the structure with a tiny stop loss. The hardest part of spotting this type of setup is identifying the fake choch.

How do you identify the fake choch?

I’ve mentioned it before in one of my previous articles. Fake choch usually happens when the price breaks a higher timeframe high/low for the first time. If you look closely at that chart there was a fake choch + sweep earlier on but it happened within the structure so it doesn’t count you need a clear break of structure for it to be valid. The one we could have taken the trade from broke the higher timeframe structure that’s why it was valid.

Stop loss & Take profit

Because this style of trading is very aggressive the stop loss placement might be a bit tricky for most. You can’t predict how big the sweep will be in most cases, that’s why your stop loss size can’t be set at a fixed value.

What I like to do is open my trade with half the risk and no stop loss and if price continues higher I’ll add the other half to my trade and if it continues even higher I’ll have a mental stop loss level in my head where I would just close all trades at a loss. You could also wait for a sign of rejection when the sweep happens but this would result in you having a bigger stop loss. Or you can enter with like a 2-3pip stop loss each time. Personally I wouldn’t mind taking a few losses in a row to catch a huge risk to reward trade.

As for the take profit you simply target the lowest point of structure or liquidity.

Become a VIP and get access to exclusive insights, profitable signals, and a supportive community that will elevate your trading success, click here to join now.

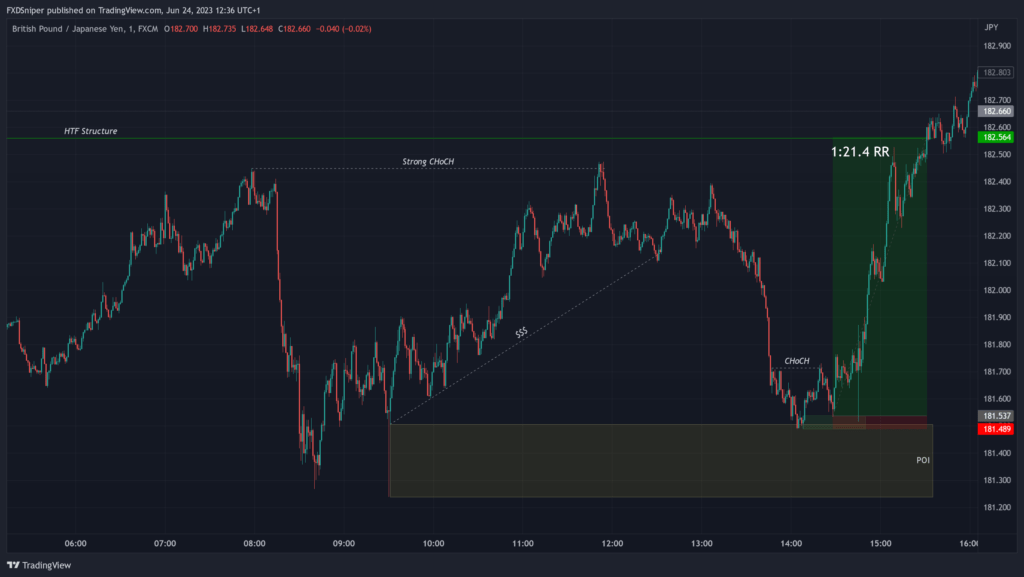

ChoCH in Poi

This is a fairly safe entry model, it also guarantees a much higher win rate than the previous one. You may have seen it before in my previous articles and there’s a reason why. It’s very easy to spot even for the beginner traders and it happens very often, if you kept track of all the major pairs I’m sure you could find at least one setup like this per day.

The key thing in this setup is knowing your bias. This is done by analysing the higher time frame, using this chart as an example we know the higher time frame is bullish. That’s our job done, all you have to do now is watch the price break the highest/lowest point in structure on the 1min chart(Strong ChoCH). What this does is, it gives you confirmation that the price wants to continue in its direction.

Then you simply draw your point of interest (PoI) zone which is a supply & demand zone and you wait for price to change character after approaching your zone. The rest is very straightforward, price changes character, you set a buy/sell limit at your s&d zone and target the higher time frame structure.

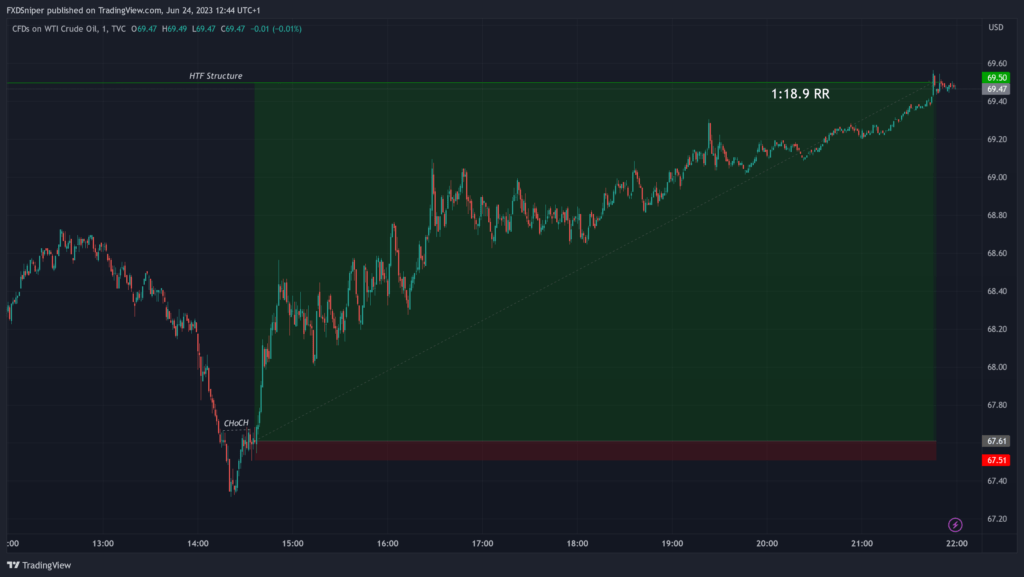

Consolidation ChoCH

A lot of the time when the price is pushing heavily in one direction and changes character then consolidates in a tiny range around where the choch occurred, it will not come back to retest a s&d zone.

Remember this is a 1 minute chart, so the consolidation you see only lasted less than 10 minutes, sometimes it may last even less than that, so you have to be quick in making your decision.

When you see that pattern forming all you have to do is enter the trade within that zone and your stop loss right below. If you want to be extra safe you can enter the trade as price is breaking out of the zone, but this will result in a bigger stop loss and a smaller risk to reward. As for you target I’m sure you see the pattern now, you target the higher time frame structure.

Leading broker 16+ years in the industry

Spreads starting from 0.0 pips

Up to 1:2000 leverage

Trade Forex, Futures, Stocks and Commodities

Instant withdrawals get paid in under a minute

To Summaraise

- Each of this entry models is high risk, taking trades using them may result in more losses.

- There are no strict rules here, adapt to the current price action and trade what you see.

- Each of these models is based on structure and supply and demand trading.