In the previous article I talked about the accumulation, manipulation, distribution (AMD) market cycle. In this article I will describe the manipulation, accumulation, distribution (MAD) market cycle. The overall concept behind them is pretty much the same, the only difference is the manipulation phase, which comes first instead of second. I used a bullish example in the previous article so in this one I will show you a bearish one.

Manipulation

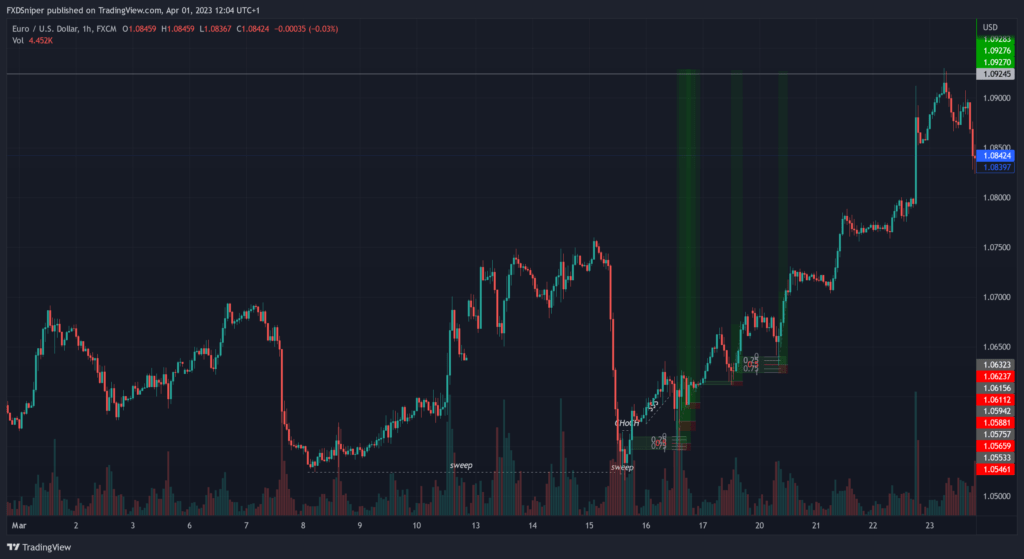

Just like with the AMD market cycle, when the price approaches a key level, such as the daily high/low or a strong psychological level you will see a strong manipulation move. The manipulation move happens during high volatility periods or during high impact news releases. To understand the intentions behind this market cycle you have to look at the whole picture, starting from the big range, followed by a big bullish move that happened much earlier.

Our members already secured 7-figures in funding capital. Join the FXD Academy and take your trading to the next level, click here to learn more.

The range is an area where the market makers stacked their buys. The range then gets liquidated, followed by a big push to the upside. This signals that the market makers are bullish and are in control. You see as the price approaches the daily high, the momentum slows down. That’s where most traders would look to short because the price may have reached their supply zones, that’s also where the market makers may be slowly offloading some positions. The reason this wouldn’t be a good area to short is because there weren’t any big shifts in momentum signaling further upside, also the price hasn’t broken any major points of liquidity, in this case, the daily high.

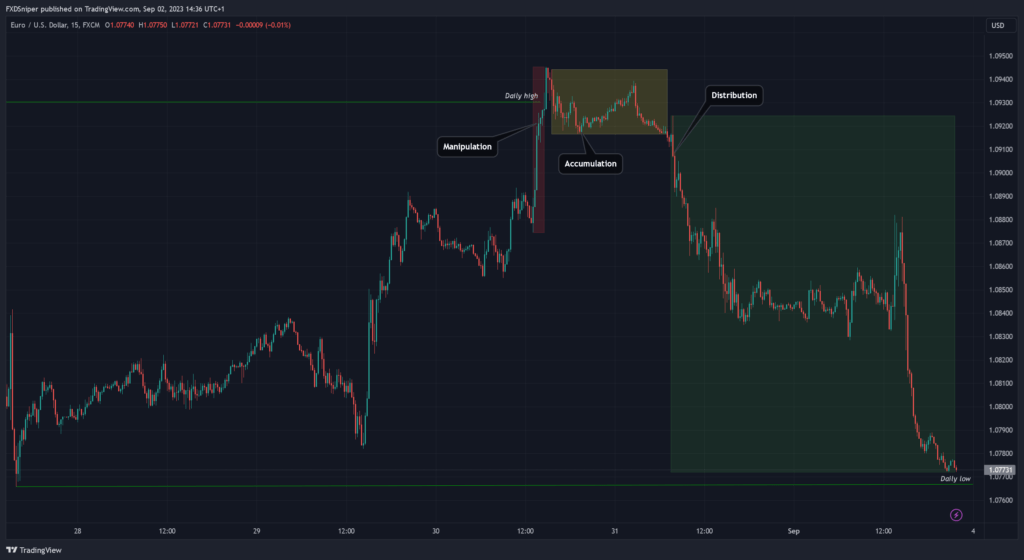

The manipulation move which breaks the daily high triggers the required volume for the market makers to close all of their buy positions and creates an opportunity for you to look for short trades.

Accumulation

After the manipulation move, the price consolidates in a small range near the high. This price action may trigger a lot of traders to go long hoping for continuation because of the high momentum which broke the daily structure. But in reality this is the market makers using you as their liquidity to stack their short trades. Remember when the price breaks a major level of structure it has to retrace. You don’t know how much it will retrace and there’s no way for anyone to know but it will, that’s why you wait and watch the price action and try to find a set up to enter as price begins to retrace. This will give you much higher probability trades than trying to buy something that’s already up, even if you get stopped out at break even.

Distribution

The last phase of this market cycle is pretty straightforward. After the market makers accumulated their short positions they were ready to push the price down. Again trapping all the buyers and liquidating all the early sellers during the manipulation phase.

Become a VIP and get access to exclusive insights, profitable signals, and a supportive community that will elevate your trading success, click here to join now.

This market cycle usually happens during strong trending markets also liquidating all the trend traders. That’s why you never win with the market makers.

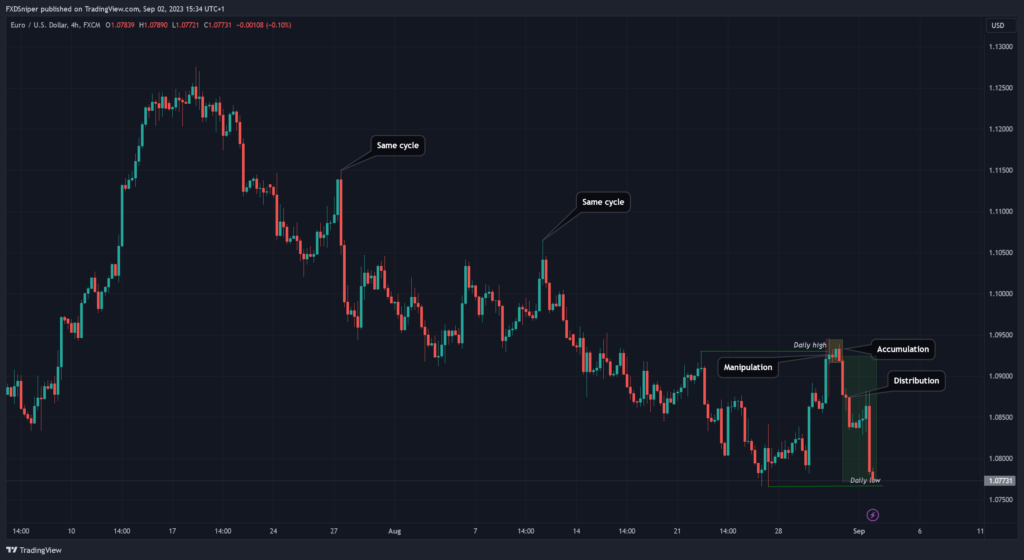

Let’s look at this cycle on a 4 hour time frame.

EUR/USD is in a strong bearish trend at the moment. This cycle already appeared twice before, each time with a strong momentum to the upside and then sweeping the major high stopping out most traders. All you can do as a trader is try to understand the market makers intentions and react to them. If most traders lose, why follow their footsteps when you can watch them get eaten alive by the market makers and then jump in when it’s safe.

Leading broker 16+ years in the industry

Spreads starting from 0.0 pips

Up to 1:2000 leverage

Trade Forex, Futures, Stocks and Commodities

Instant withdrawals get paid in under a minute

To Summaraise

- Break of a major point in structure always creates a retracement.

- MAD is not used to predict the future, it is to understand the intentions and actions of the market makers so you can adjust your strategy accordingly.

- Finding entry opportunities during the manipulation/accumulation phase is ideal.