Accumulation, Manipulation, Distribution also known as the power of 3 and AMD for short. This is a very common pattern, concept or a market cycle, whatever you want to call it. It happens in every market in existence and it is one of the main driving force of the market makers.

- Accumulation: This phase occurs when smart money or institutional investors believe that an asset is undervalued and offers potential for future appreciation. During accumulation, these investors start buying the asset gradually, often at lower prices, while trying to avoid attracting attention. As a result, prices may trade within a relatively tight range or undergo consolidation. Accumulation is characterized by subdued trading activity and may last for an extended period as investors build their positions.

- Manipulation: In the manipulation phase, market participants with significant resources or influence seek to control the price of the asset to their advantage. This manipulation can take various forms, such as spreading false rumors, creating artificial supply or demand through large trades, or engaging in deceptive trading practices. The goal of manipulation is to influence market sentiment and attract other traders to participate in the market. Manipulation can lead to temporary price distortions, causing inexperienced traders to enter positions based on false signals.

- Distribution: Once the asset’s price has been artificially inflated through manipulation and reaches levels deemed favorable by smart money or institutional investors, the distribution phase begins. During this phase, those who accumulated the asset during the early stages start selling their positions to less informed traders who were attracted to the market by the manipulated price movements. Prices may rise further as demand increases, but this upward movement is often unsustainable. Eventually, the smart money begins to exit their positions, leading to a reversal or downturn in prices as supply exceeds demand. Distribution is marked by increasing volatility and volume as selling pressure intensifies.

These phases of the AMD cycle are often associated with the broader principles of market manipulation and investor psychology. Traders and analysts use techniques such as volume analysis, price patterns, and trend indicators to identify signs of accumulation, manipulation, and distribution in price charts. Understanding these phases can help traders anticipate potential market reversals or trend continuations and develop more informed trading strategies.

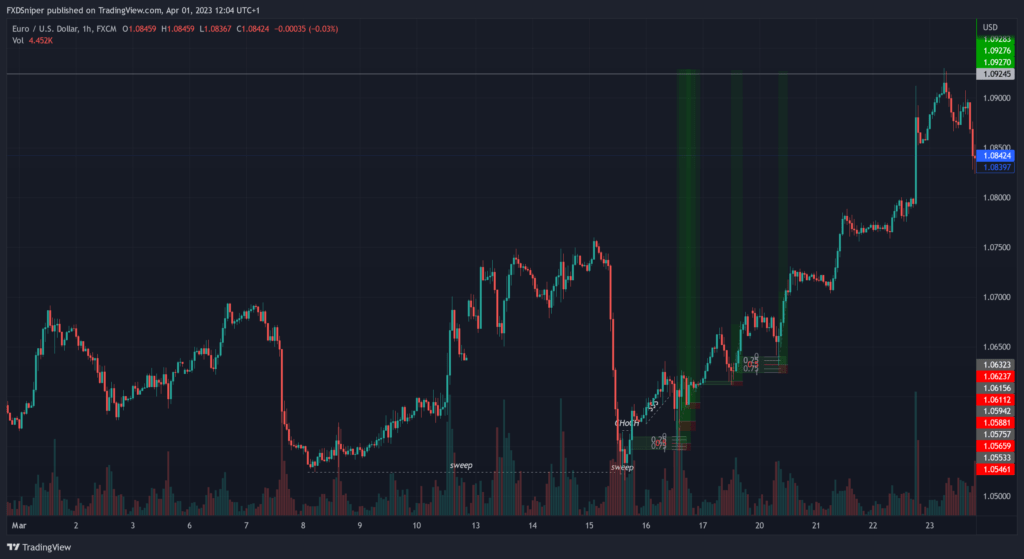

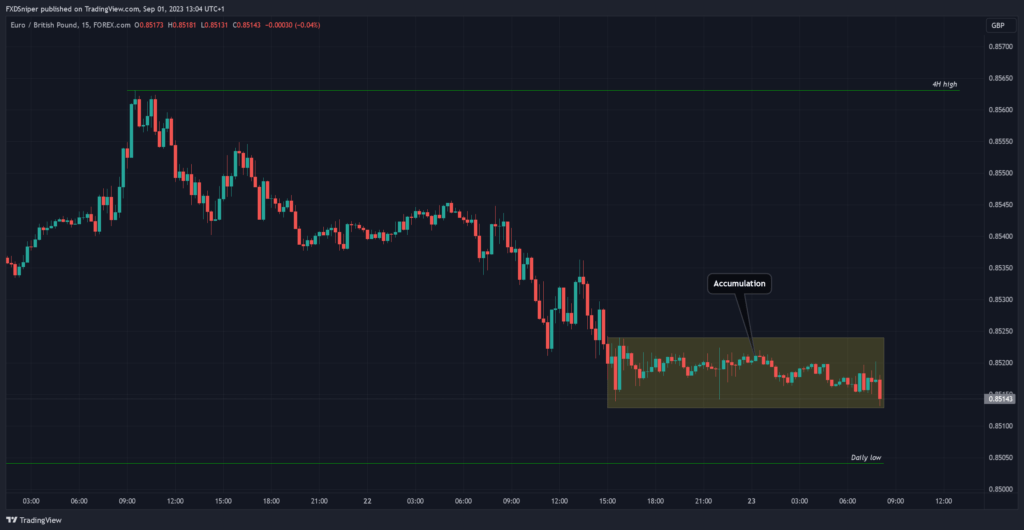

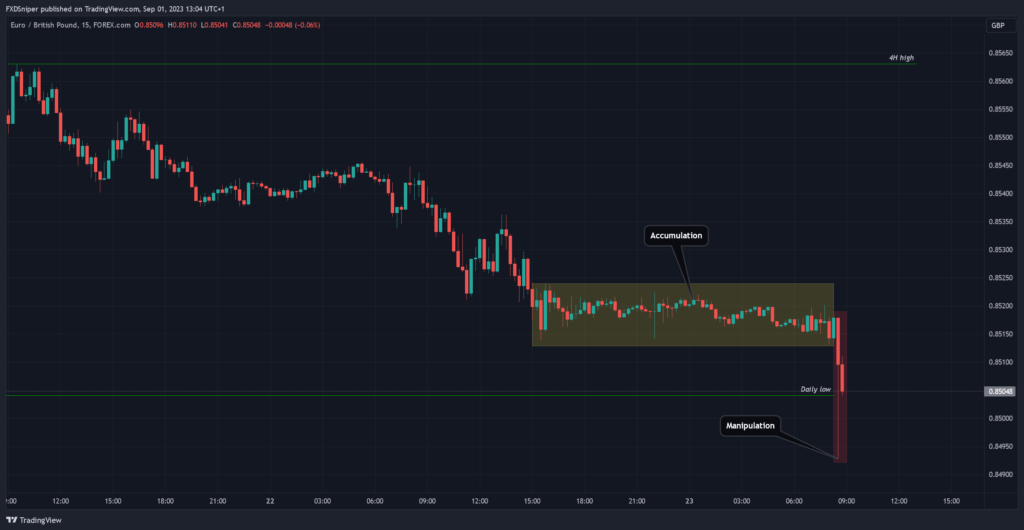

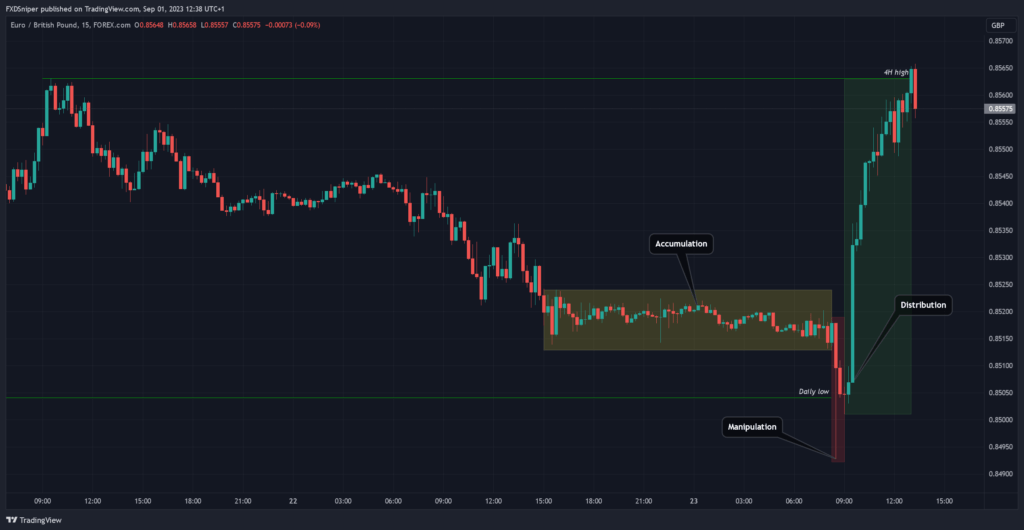

Let’s look at some chart examples now:

Accumulation

Accumulation represents a critical consolidation phase within the broader market cycle, signaling a period when price movements are confined within a defined range. During this stage, early participants—whether buyers or sellers—begin to position themselves in the market, often anticipating a future directional move. However, this phase is primarily characterized by market makers discreetly accumulating substantial orders, laying the groundwork for future price manipulation.

Our members already secured 7-figures in funding capital. Join the FXD Academy and take your trading to the next level, click here to learn more.

Prolonged consolidation periods are often a precursor to a sharp move, as they build up liquidity on both sides of the range. When this liquidity is sufficiently loaded, a sweep of orders typically occurs, triggering stop-losses and trapping unsuspecting traders before the market moves decisively in the intended direction. This is why it’s crucial to avoid entering trades within a range that has persisted without a clear breakout, as the potential for false moves and liquidity grabs is significantly heightened.

Within the accumulation phase, market makers engage in both buying and selling activities, intentionally maintaining the price within a tight range. This phase often transpires around critical levels, such as a strong daily or 4-hour low/high or a significant psychological price level. For instance, as shown in the previous example, price experiences a sharp drop and then consolidates just above a daily low. Many traders interpret this as a retest of a prior demand zone and prematurely enter buy positions, expecting a reversal. However, market makers exploit this expectation by continuing to stack orders, manipulating price downward to sweep the lows and capture additional liquidity before initiating a bullish reversal.

This deliberate manipulation by market makers is what defines the accumulation phase. The sideways movement within this range entices retail traders into making premature decisions, only to see their positions get swept out as the true direction materializes. Recognizing these accumulation patterns and understanding the motivations behind them is essential for avoiding liquidity traps and positioning yourself in alignment with smart money. Ultimately, patience and an understanding of these market dynamics are key, as true breakouts from prolonged consolidation tend to be explosive and offer high-probability trading opportunities.

Manipulation

Manipulation, also referred to as the “fake move,” typically follows the accumulation phase in the market cycle. It is the stage where market makers strategically create deceptive price movements, leading to many retail traders being stopped out of their positions. During this phase, market makers take advantage of the liquidity generated by retail traders’ stop-losses, enabling them to close their short positions and accumulate more long positions before driving the price higher. In a bearish scenario, this dynamic is reversed, where the manipulation phase allows market makers to offload longs and accumulate shorts before pushing prices lower.

One of the key signs of impending manipulation is a prolonged range during the accumulation phase. When a range remains unbroken for an extended period, it builds up liquidity above and below key levels, making it ripe for a liquidity sweep. Traders who are aware of this pattern can anticipate manipulation and wait for the liquidity grab before entering their trades. By doing so, they avoid falling into the trap set by market makers, who are often looking to exploit those who enter trades prematurely within the range.

The manipulation phase is also designed to capture breakout traders who expect a directional move once price breaks out of the range. However, due to the swift and often volatile nature of manipulation, these traders frequently find themselves trapped as the market quickly reverses. For instance, in a bearish scenario, when price appears to break below a key support level, breakout traders might rush to enter short positions. But before they can secure their profits, the market swiftly reverses, surging upward and stopping them out, while the market makers accumulate buy orders at a discount.

Become a VIP and get access to exclusive insights, powerful trading indicators and other resources, click here to join now.

Manipulation often coincides with high-impact news events, as these are prime opportunities for creating significant spikes in liquidity. News-driven volatility provides the perfect cover for market makers to execute their strategies. The sudden, sharp moves triggered by news releases can sweep liquidity levels that have been building up for days or even weeks. The uncertainty and rapid price fluctuations during news events make it easy for market makers to disguise their intentions, leading retail traders to misinterpret the move as a genuine breakout, only to find out that it was a fake move designed to trap them.

Understanding the manipulation phase is essential for traders looking to align their strategies with the “smart money.” By recognizing the signs of a liquidity sweep and being patient enough to wait for the true move, traders can avoid becoming liquidity targets themselves. Mastering this concept allows traders to enter positions with more confidence, knowing that they are trading in harmony with the underlying market dynamics, rather than being swept out by deceptive moves engineered by market makers.

Distribution

The third phase in this market cycle is the distribution phase, which typically follows the manipulation or “fake move” phase. By the time this phase begins, the market has already trapped retail traders, stopped out early positions, and driven the price in the direction it intended from the start. In doing so, market makers have not only secured liquidity but also strategically positioned themselves for the next major move.

During the distribution phase, the market often experiences a strong, decisive push in the desired direction, typically breaking significant structural levels that were established during the manipulation and accumulation periods. This move is usually characterized by rapid momentum as the price accelerates toward its intended target. The orders that market makers quietly accumulated during the first phase (accumulation) and amplified during the second phase (manipulation) now start to pay off substantially, with those positions being well in profit. At this point, other traders who missed the initial phases begin to notice the momentum and rush to join the move, unknowingly reinforcing the market makers’ strategy.

The influx of new traders entering the market as they see the price moving in a strong trend plays directly into the hands of market makers. These retail traders help push the price even further in the intended direction, adding additional liquidity for the market makers to offload their positions at a premium. As market makers begin to close out their positions, the strong momentum starts to diminish, leading to a noticeable slowdown in price action as the price nears a key resistance level, such as a significant high or low. This deceleration in momentum is often a telltale sign that the distribution phase is reaching its conclusion and that a reversal or retracement may be on the horizon.

The distribution phase marks the peak of the market cycle for smart money, as they have successfully manipulated the price to reach their target while simultaneously exiting their positions at optimal levels. Retail traders who entered late during this phase are often left holding positions just as the market begins to turn against them, resulting in potential losses or diminished profits.

Understanding the full scope of the accumulation-manipulation-distribution (AMD) market cycle is crucial for avoiding common pitfalls that arise in the earlier phases. Traders who lack this understanding often find themselves entering positions too early during accumulation, getting stopped out during manipulation, or joining the trend too late during distribution, when the move is nearly exhausted. By recognizing the signs of each phase, particularly the transition into distribution, traders can better time their entries and potentially capitalize on the significant momentum before it starts to wane.

Mastering the dynamics behind the distribution phase allows traders to position themselves strategically in anticipation of the move, rather than chasing it after it has already developed. This level of insight enables them to ride the momentum when it is strongest while avoiding the traps set during the earlier phases of the cycle.

Leading broker 16+ years in the industry

Spreads starting from 0.0 pips

Up to 1:2000 leverage

Trade Forex, Futures, Stocks and Commodities

Instant withdrawals get paid in under a minute

To Summaraise

Accumulation Phase:

- Occurs after a downtrend; price consolidates in a range.

- Early buyers and sellers enter the market, but market makers primarily accumulate positions.

- Price stays within a tight range, often near key levels like daily or 4-hour lows/highs.

- Market makers build liquidity by stacking orders, setting the stage for future price manipulation.

Manipulation Phase:

- Follows the accumulation phase and is characterized by a deceptive “fake move.”

- Retail traders get stopped out as market makers trigger liquidity sweeps.

- Price sharply reverses after trapping breakout traders, allowing market makers to load positions in the intended direction.

- Often coincides with high-impact news events to generate volatility and liquidity spikes.

Distribution Phase:

- Occurs after the manipulation phase; the market moves decisively in the intended direction.

- Breaks key structures formed during accumulation and manipulation, with strong momentum.

- Retail traders enter late, reinforcing the move, while market makers begin offloading positions.

- Momentum slows as price approaches key resistance, signaling the end of the distribution phase and potential for reversal.

General Insights:

- Understanding the full Accumulation-Manipulation-Distribution (AMD) cycle helps avoid early entry traps and missed opportunities.

- Anticipating the distribution phase allows traders to ride the strong momentum and avoid entering trades as the move weakens.