Today I want to share my little journey with you of how I was able to to generate over $11,000 in payouts without spending a single penny of my own money.

I will show you my strategy for passing prop firm accounts and explain the trades I took to pass phase 1 and phase 2 under the minimum days requirement both times and the overall process and my experience trading with FTMO.

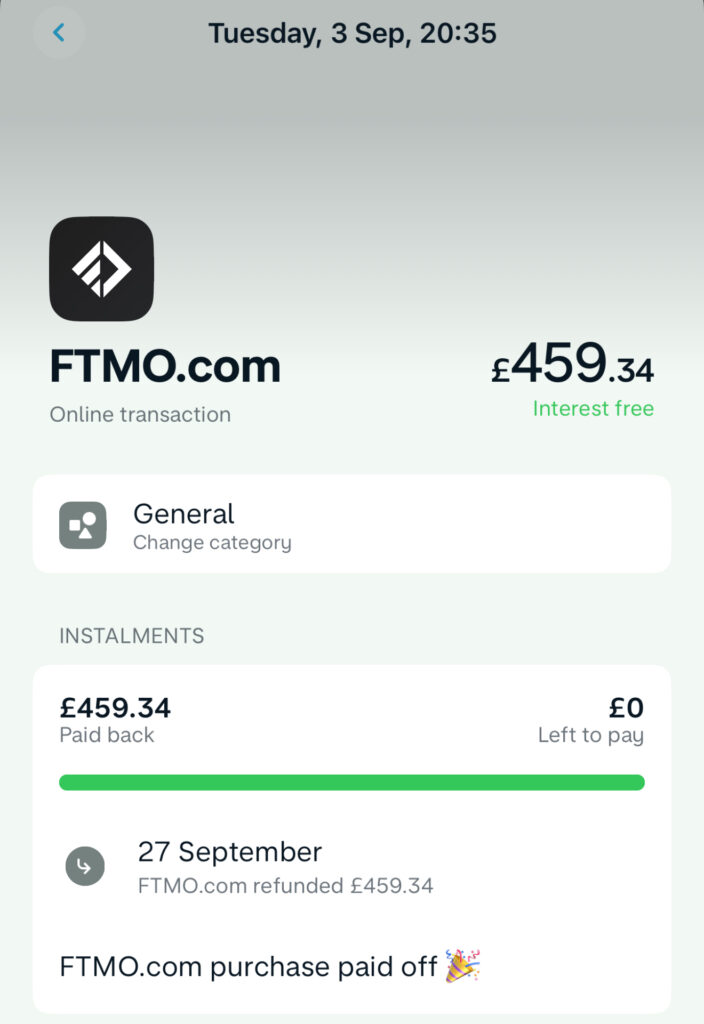

September 3rd 2024 I made a purchase. I purchased a $100k FTMO challenge using my interest free credit card for $599 (£459.34). I know I did spend money but it was a credit card purchase so technically I didn’t spend my own money and it was refunded to me later on. Which means my total investment was $0.

My refund from FTMO came on the 27th of September. 24 days after the initial purchase of the challenge. So if you ever wondered, how long it would take to get paid if you complete phase 1 and 2 under the minimum days requirement, sign the contracts, get funded and get your first payout. It’s 24 days. Give or take 1 day in case of any delays.

My credit card payments are due every month just like most other credit cards. That means I didn’t even have to make a single payment towards the original purchase, and that’s why my total investment was $0. So not only did I generate over $11,000 in free money, paying off the credit card on time, even earlier and in full helps build my credit score which in return allows me to take more credit out in the future and get offered better deals or other bonuses from banks and credit providers.

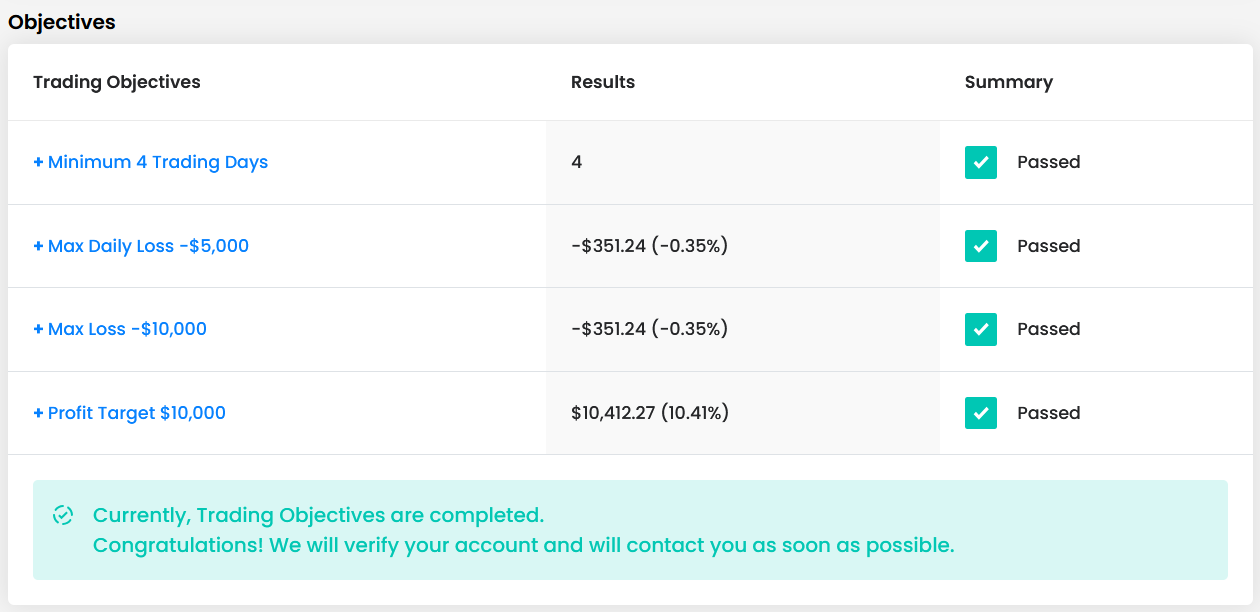

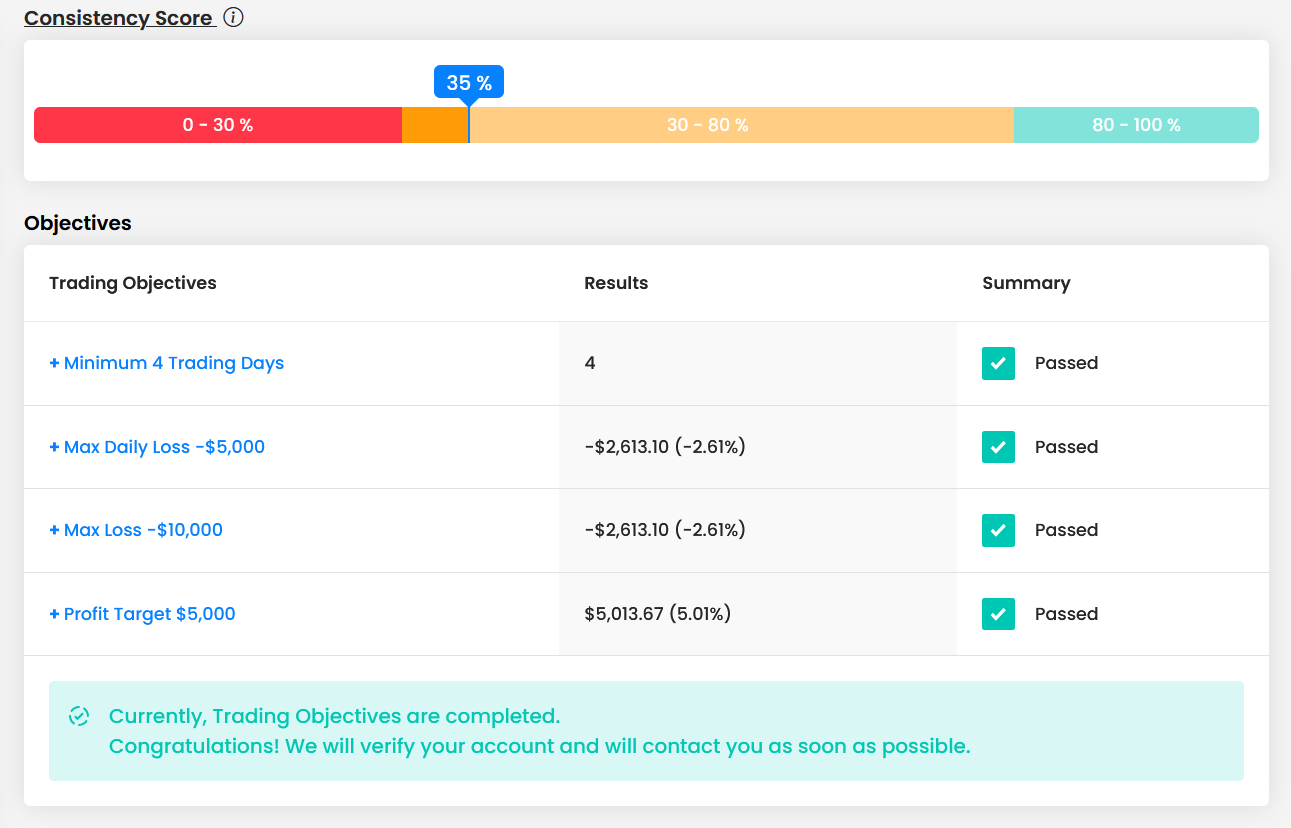

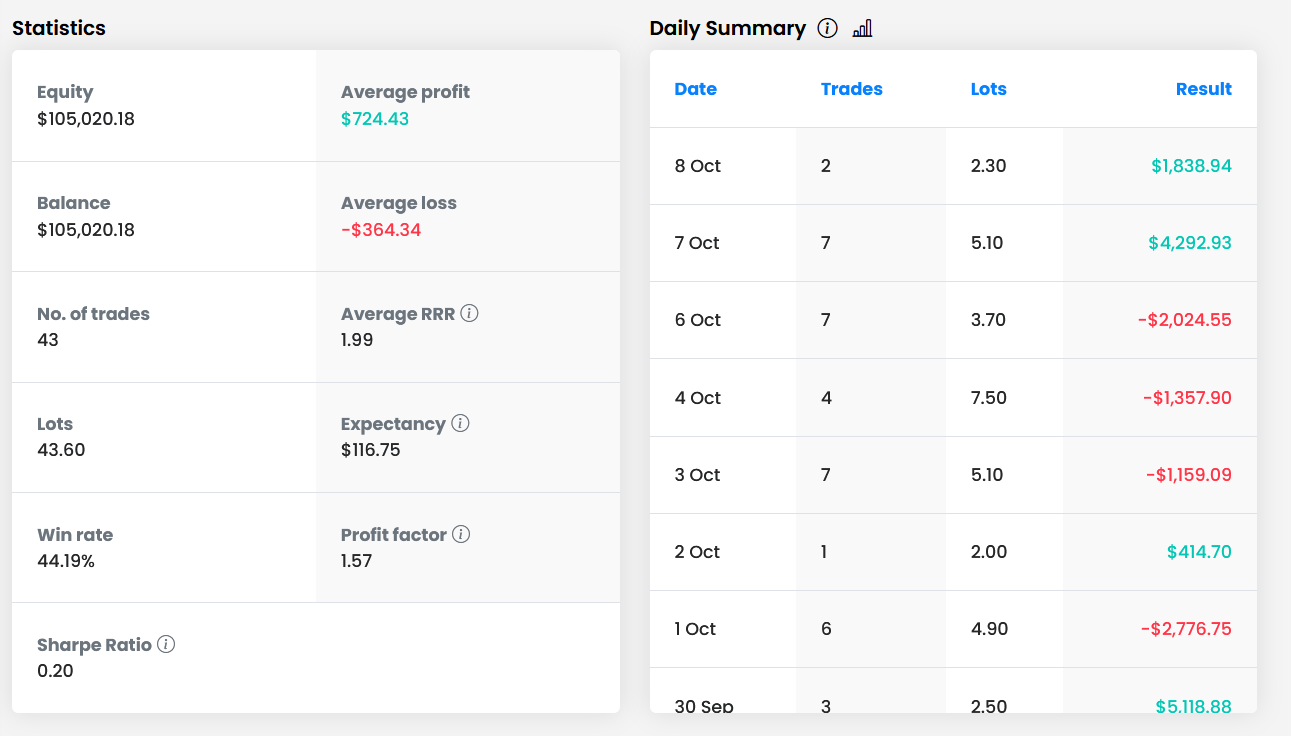

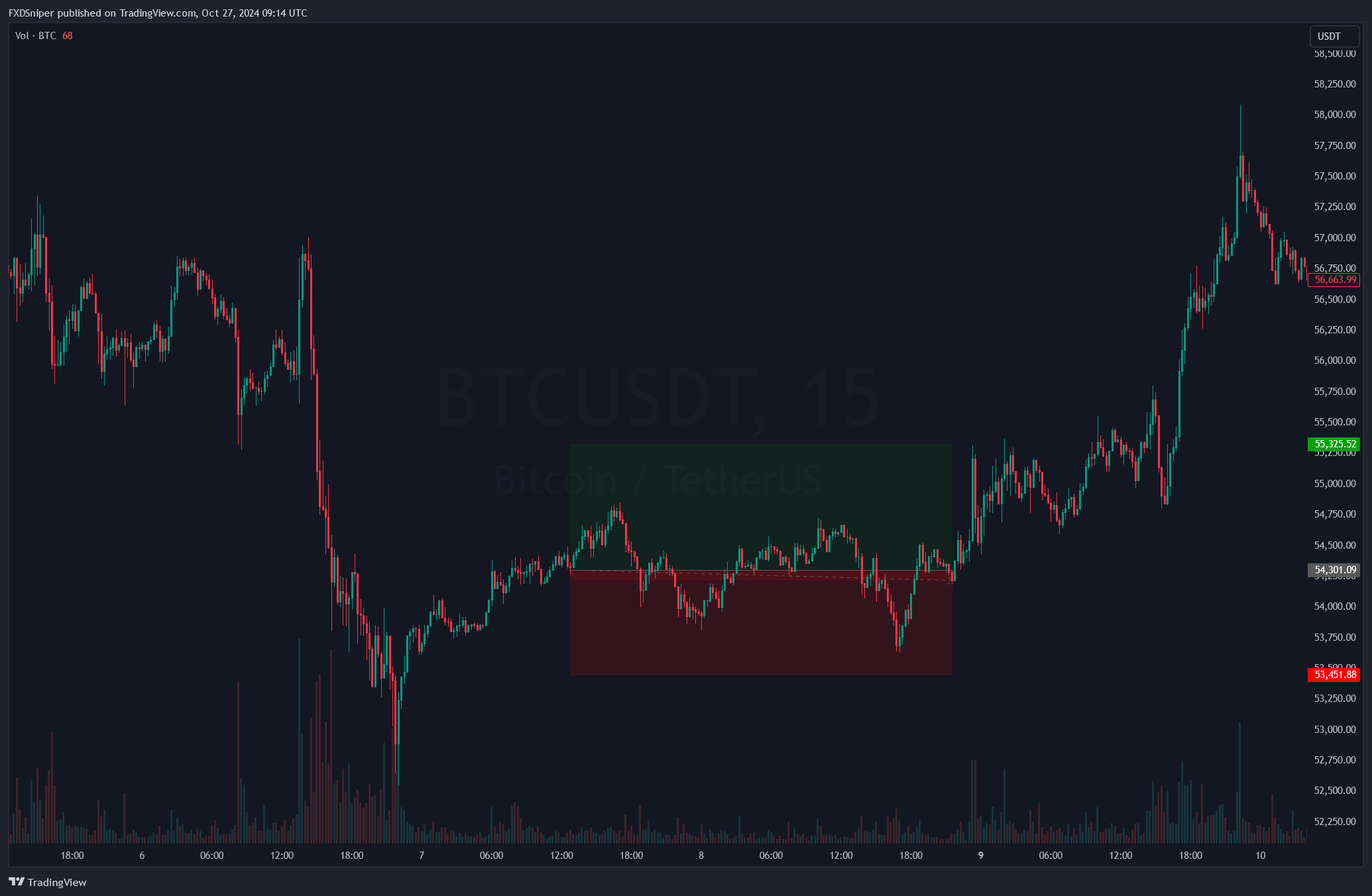

FTMO Phase 1

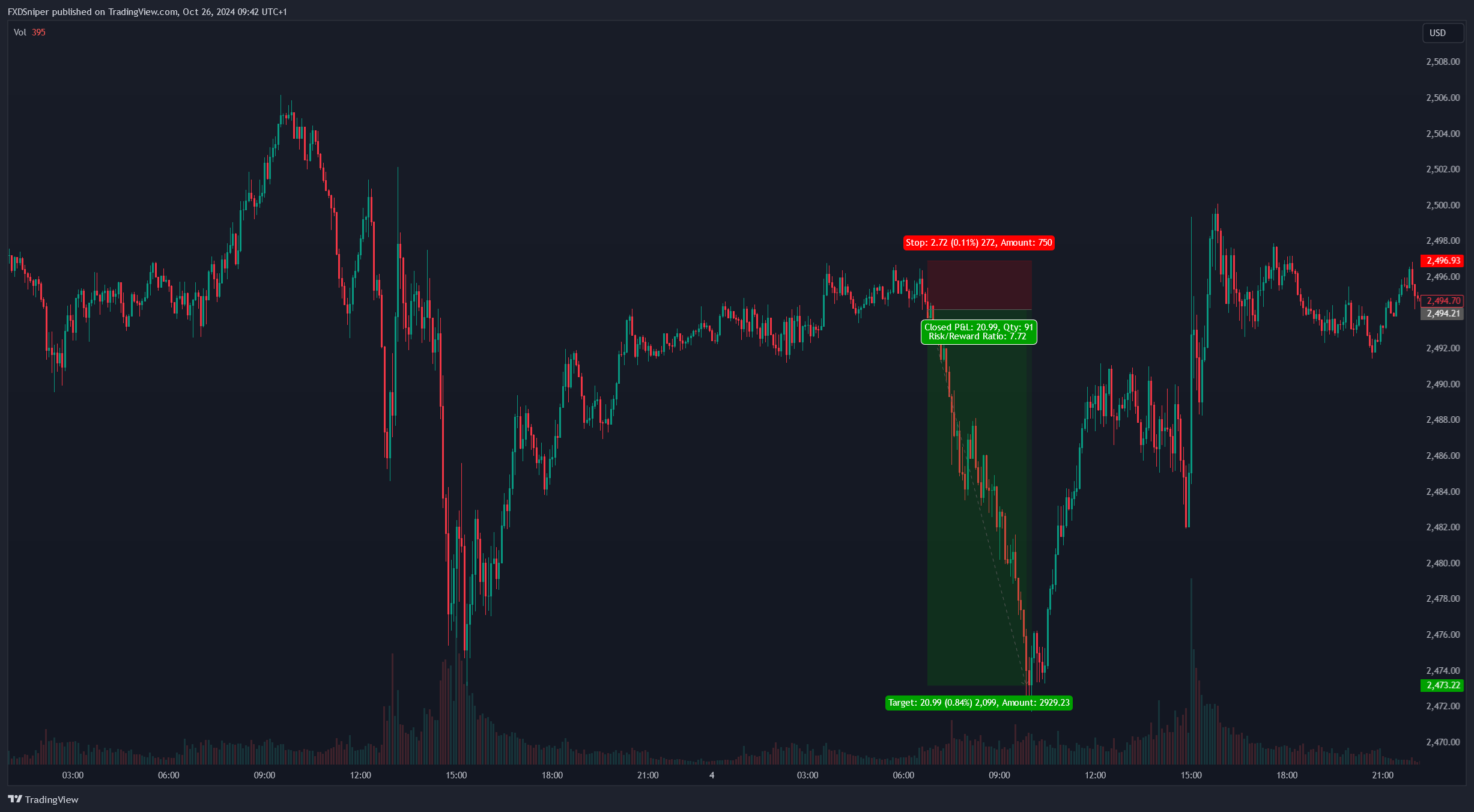

This was the trade that got me to complete phase 1 in a single trade. It was one of my typical pre-London open gold trade that gave me 200+ pips with a 5 lot trade which lasted just over 3 hours.

This has been the quickest challenge I ever passed so don’t think making 10%+ to pass a challenge in 3 hours is normal, even for me. I have shown on my Instagram stories me passing multiple accounts in a single day, but usually it would at least take 2 trades to do so.

This was a 1:7.7 RR trade, my original target for this trade was around 1:5 which would have given me around 6-7% profit and at that point I would have to take that second trade to complete the challenge but I didn’t get any reversal signals around my target level so I decided to hold until the lows were taken out.

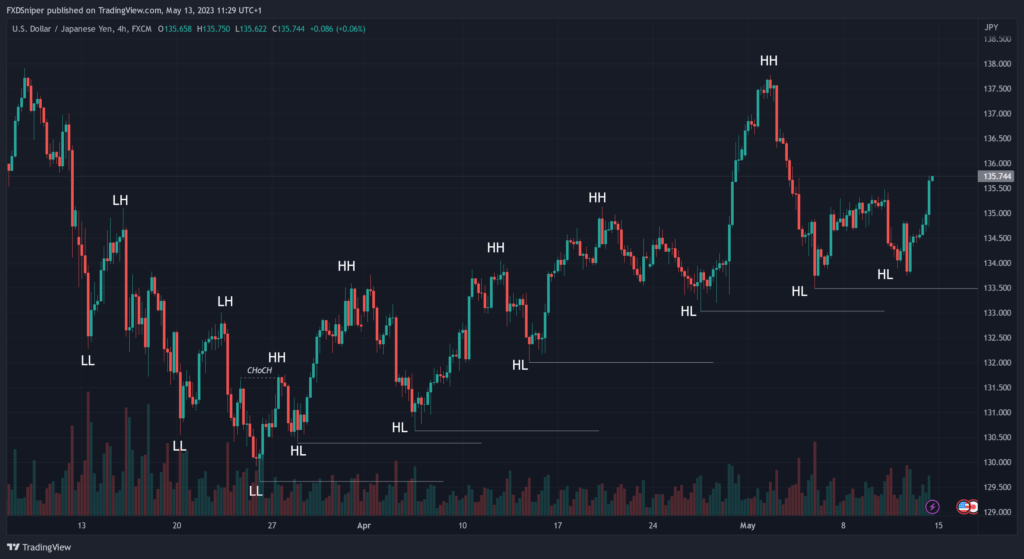

So let me break it down and show you why I took the trade.

This trade allowed me to complete the phase 1 on September the 7th and few hours later I got my login details for the verification phase.

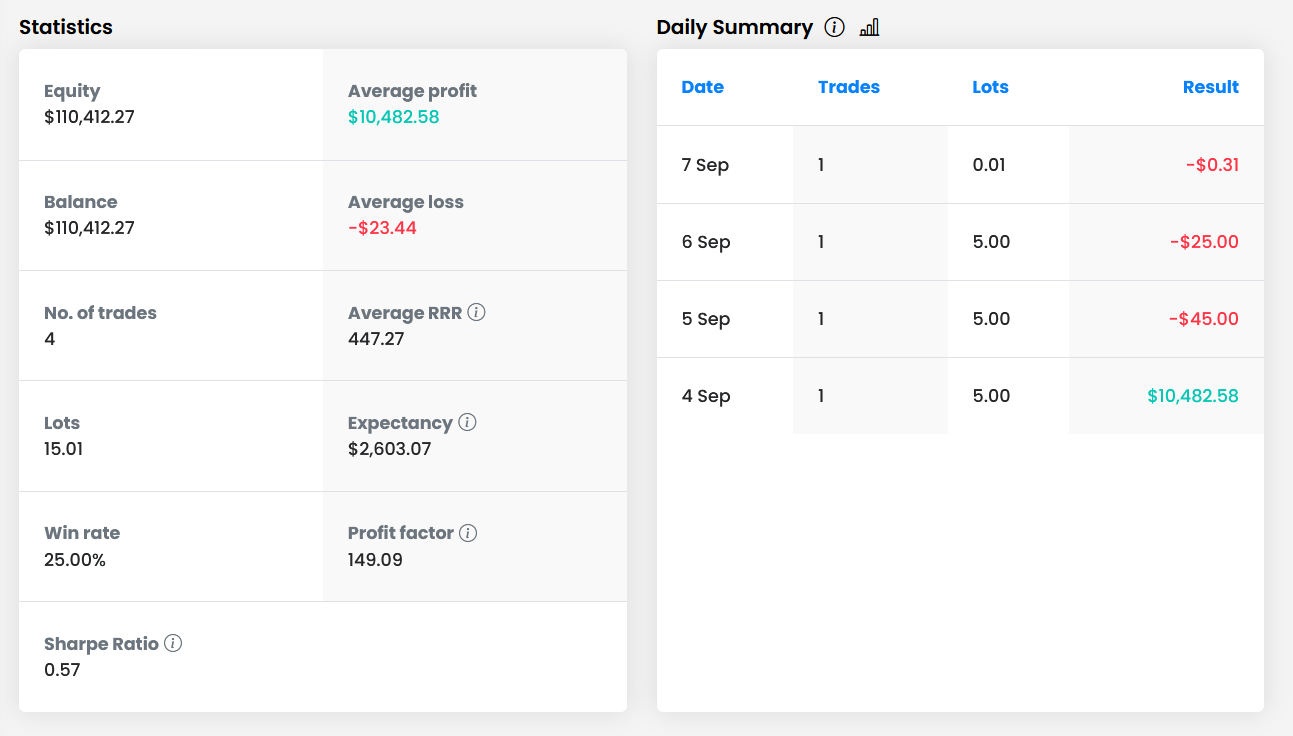

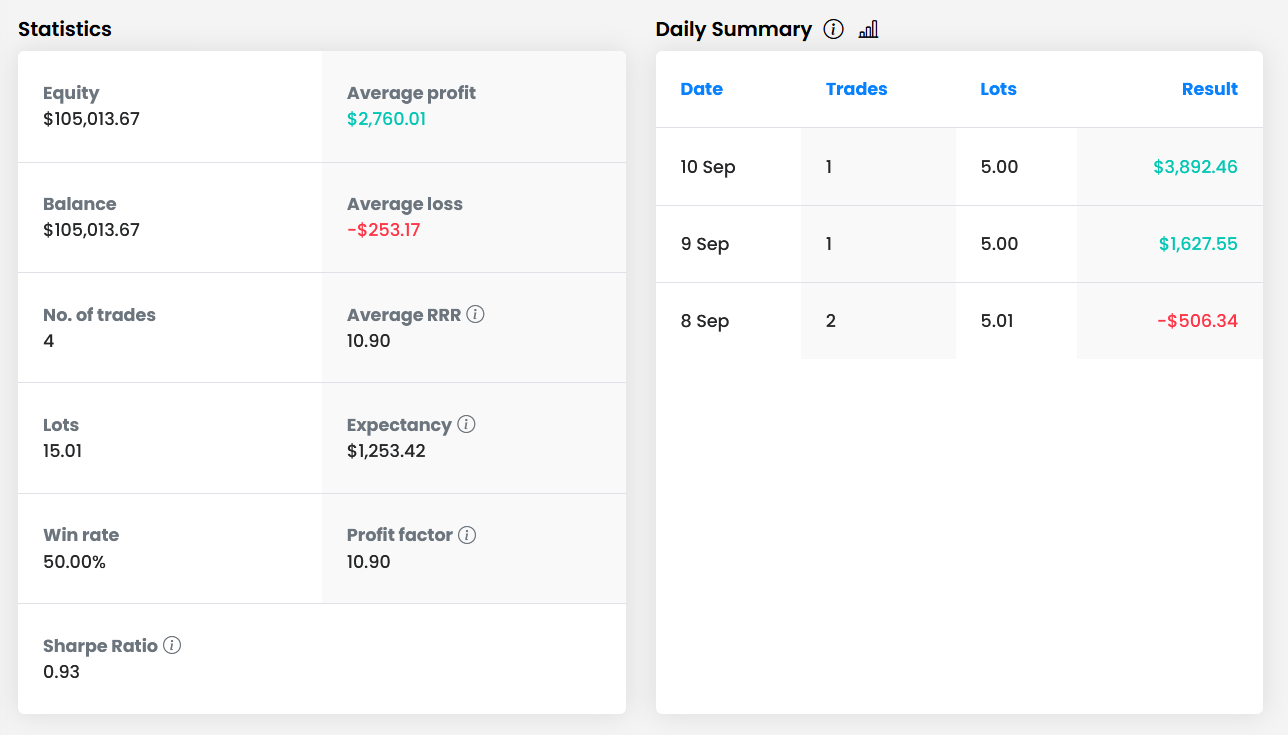

FTMO Phase 2

Phase two took a little longer to pass, unfortunately I couldn’t get it done in 1 trade again but I did try and that’s why my first trade resulted in a loss, even tough it was up over 3% at its peak.

This is why you should always take what the market gives you because anything can happen at any time and you never know when the market may reverse.

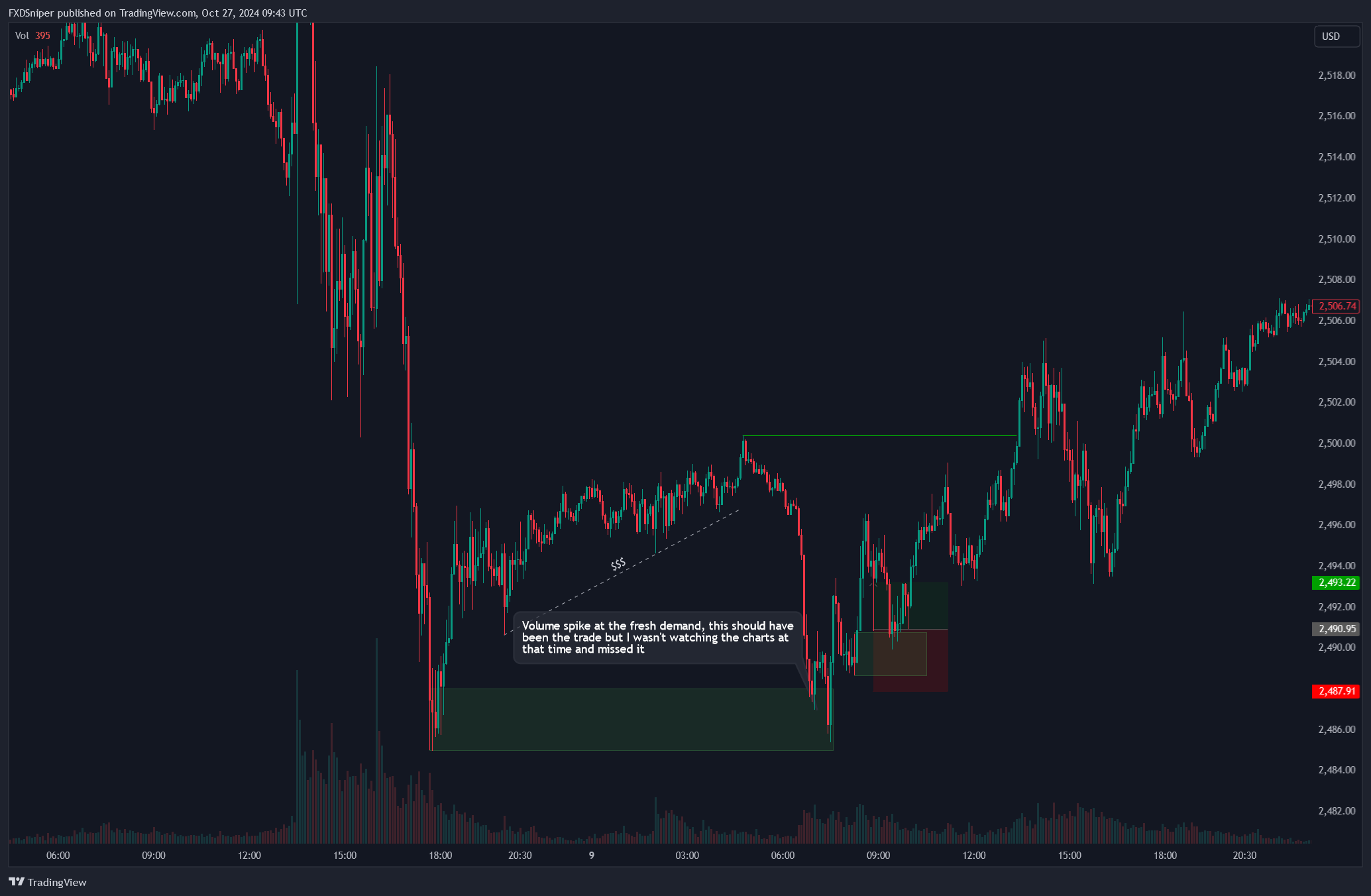

The day I started phase 2 was a Saturday, so the only thing I could trade was bitcoin.

This was the trade:

This was a 5 lot Bitcoin trade and the idea for this trade was simply to jump in on the retracement after the massive sell off the day before. The trade went straight into profit and peak at around +3%. At that point I didn’t close because I though my TP for 5% is within reach but the price had a different plan and the sell off continued.

The price still looked bullish to me so I held the trade overnight. Mid day Sunday, we had another sell off, even bigger this time where I almost had to close the trade not to violate the 5% drawdown rule but we had a strong buying momentum come in and it gave me the confirmation to keep holding. I did close the trade just before going to bed and the daily close for a small loss of 0.5%, which obviously now was a mistake and my TP would’ve been hit during my sleep but these things happen.

The reason I closed the trade before going to bed was because Mondays on Bitcoin usually have a big move early into the Asian session and because I was asleep I wouldn’t have been able to monitor the trade in case anything did happen. The price may have easily swept the Sunday’s low and then reverse. So better safe than sorry.

2nd trade:

This was a 5 lot gold buy which resulted in a +1.6% gain so I was able to make up for the bitcoin loss and put the account in profit. It was a late entry and I messed up closing so early as I could have completed the verification on this trade but because it was a late entry for me and I wasn’t getting the momentum I was expecting and as soon as I closed it started flying…. Happens to all of us.

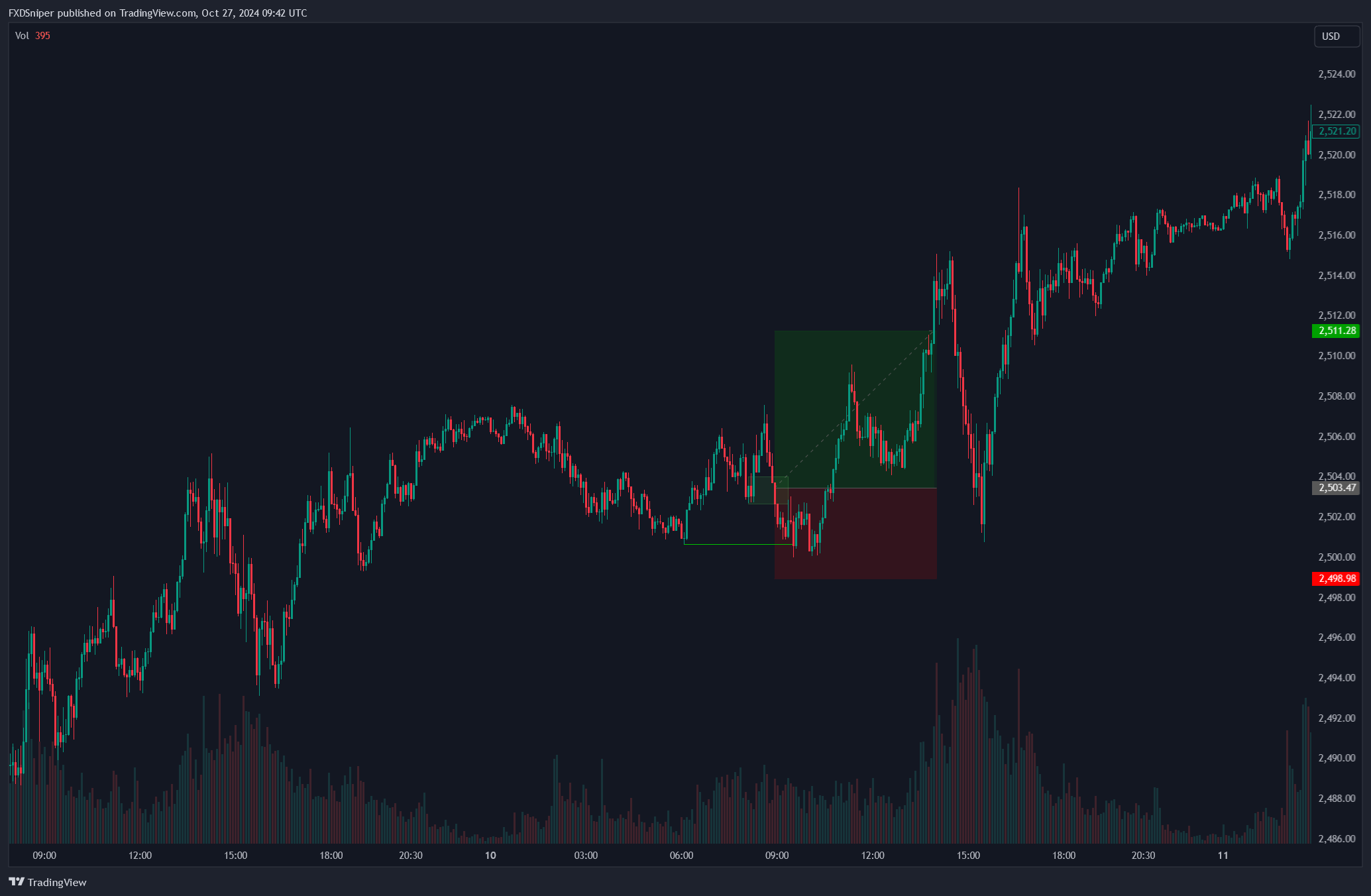

3rd trade:

This trade was a bit annoying. The volume was there, the structure was there so I entered another 5 lot buys within the fresh demand zone but the price decided to go sweep the Asian lows before heading higher. Just because the price went straight into drawdown it didn’t mean the analysis or the bias was wrong. Sweep of the Asian lows was something I considered, that’s why the stop loss for this trade was lower.

Price did reverse after the sweep and a bit of accumulation and I got to close the trade for a +3.9% win at the same time passing the phase 2 of FTMO.

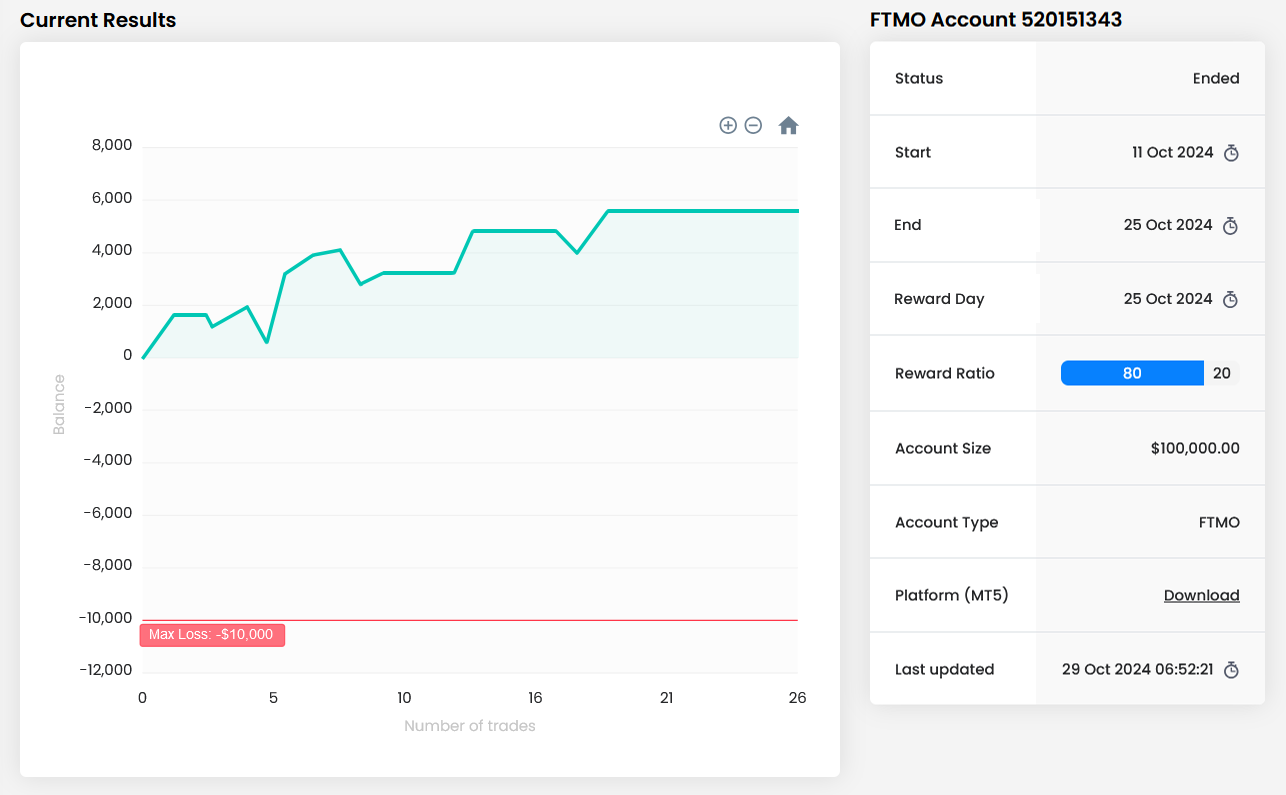

This was Tuesday the 10th of September. I got my funded account on the 11th the next day. Usually the whole contract signing process and you getting your funded account takes a few days so I was pleasantly surprised that it only took 1 day.

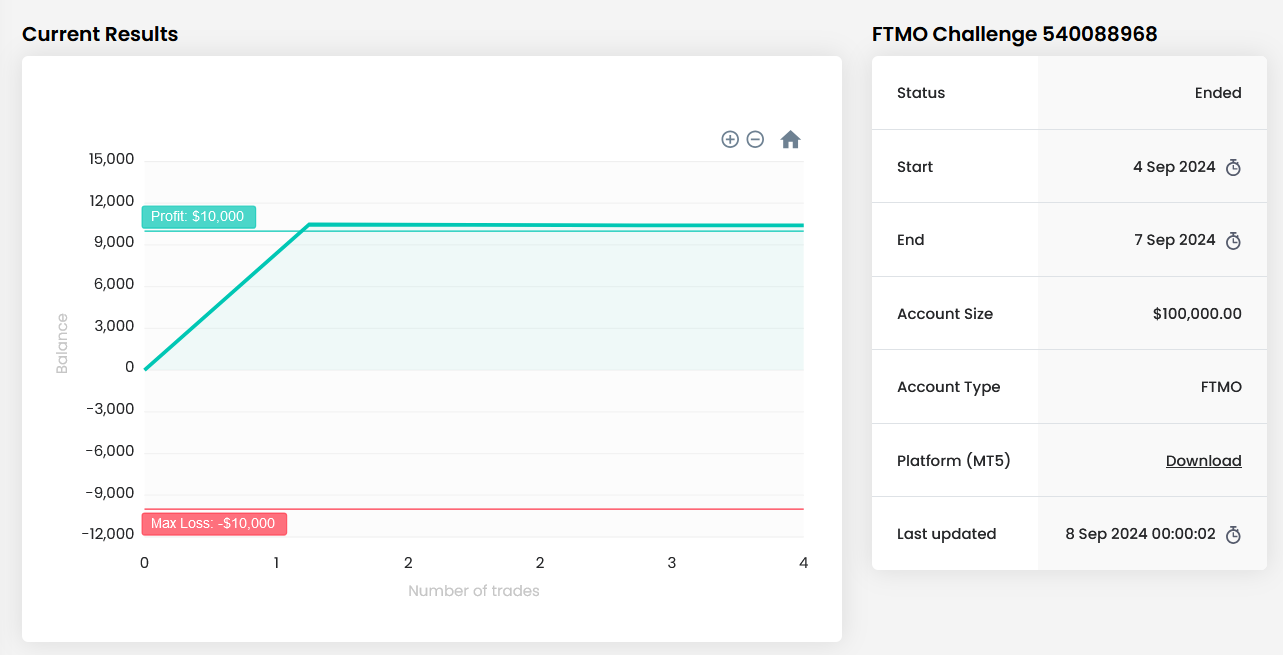

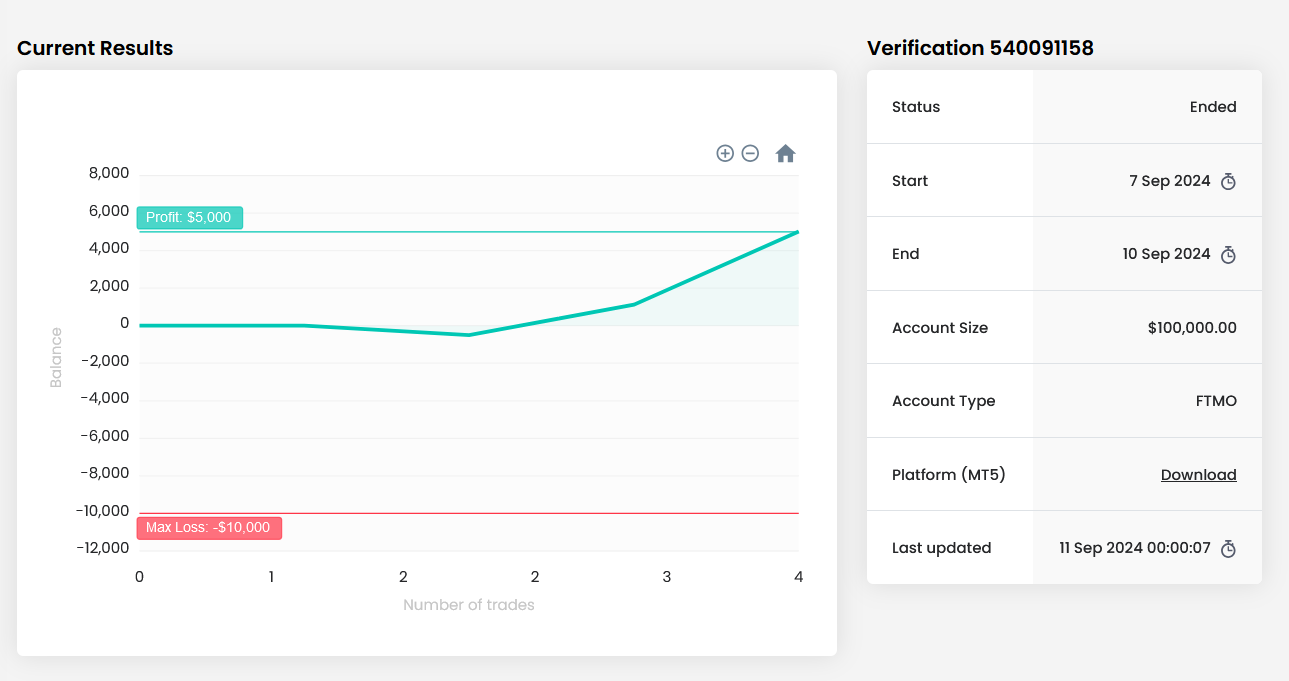

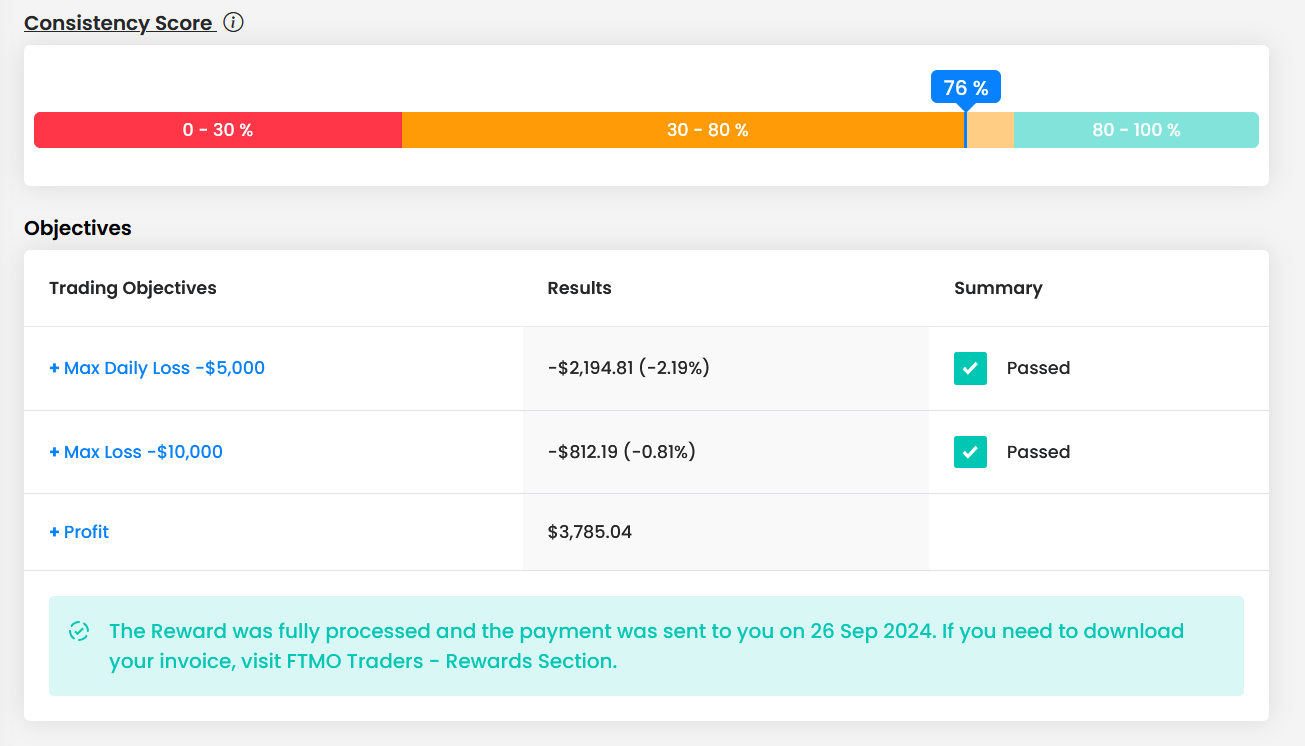

1st Payout

I’m not gonna breakdown all the trades I took on the funded accounts as I went from taking 1-2 trades to taking 10-20 trades, so I will only share the stats and my experience during the funded stage and at the end I will share with you my prop firm strategy.

As soon as I got the funded account I placed a trade so I could change my profit split day to the earliest date which was the 25th of September.

This one went fairly smoothly. The first trade I took was a small loss of -$264 and that was the only time the account went below the starting balance. The next trade however was a +$4.6k win which gave me a nice start to the account. However if you look at the equity curve for this account. 30 trades later I ended the account with a smaller profit than I was on the 2nd trade and I lost around 4% of the total profits from the peak of the account.

The reason why all my funded accounts have 10x the amount of trades as during the verification stages is because I used smaller risk and often stacked a few trades. I didn’t actually take 30+ trades on this account, it was more like 5-10 trades with multiple entries.

Keep in mind, trading prop firm accounts isn’t my main thing. I trade my own funds and will always choose to trade my own funds so my trade management for these accounts wasn’t as good as it should have been simply because I wasn’t paying attention as much and was more focused on my own account. That’s why I ended up holding some trades longer than I should have or close them too early at a loss or for little profit. This account easily could have made over $10k if I just managed the trades better.

I’ve also hit a little losing streak at the end so just decided to leave the account alone and wait for my profit split and the refund.

The moral of this account is that after 32 trades I ended up with a smaller profit than I was after the 2nd trade. This is something that happens, many people in this situation would’ve started revenge trading trying to make up for it and lose the account in the process and I was slowly getting into that mindset myself that’s why I took the step back. We all go through those emotions, no matter where you are in your journey. It’s important you identify when you’re starting to go off the road, slow down or take a step back. Any profit is better than no profit at all. Once you reach the funded stage your main goal should be to get a refund, not to make 10-20% on your account in a day. After you get your refund, it’s all risk free.

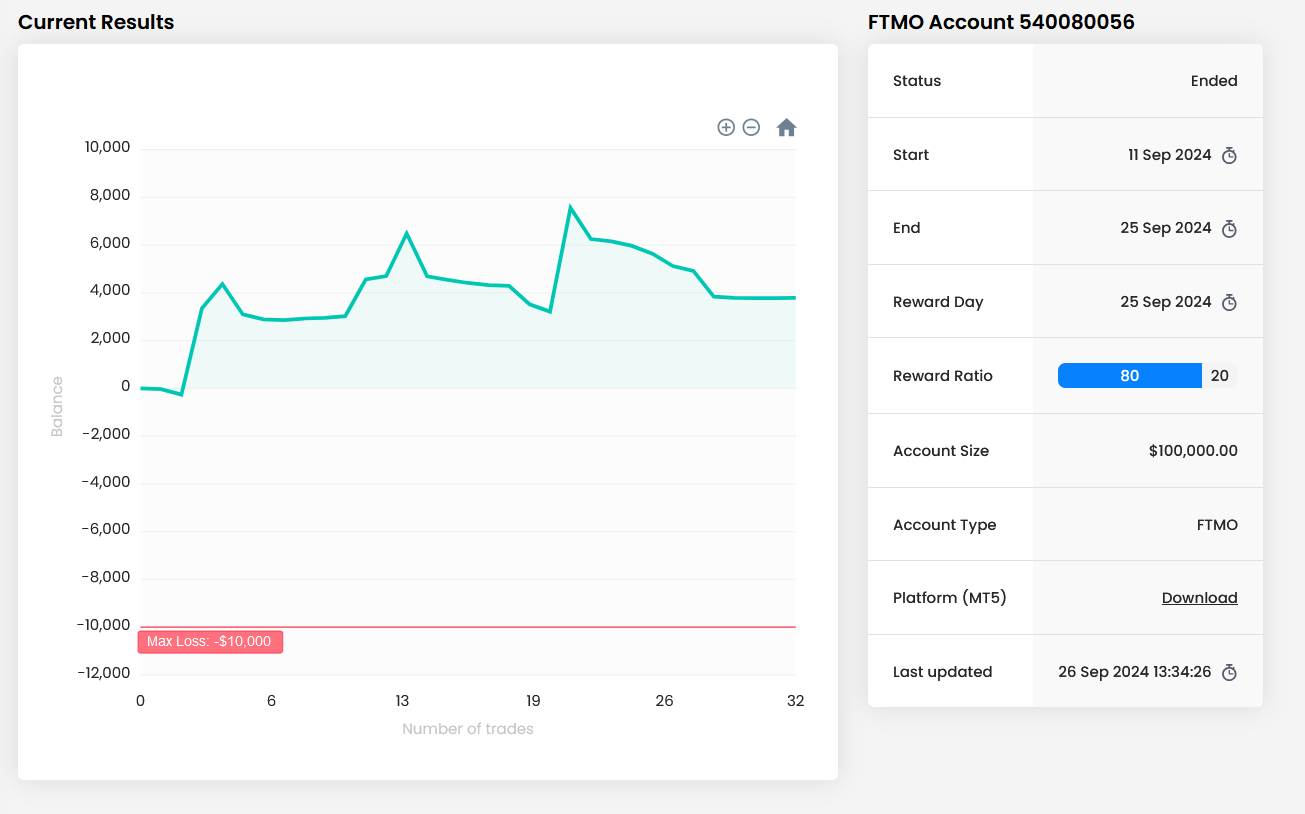

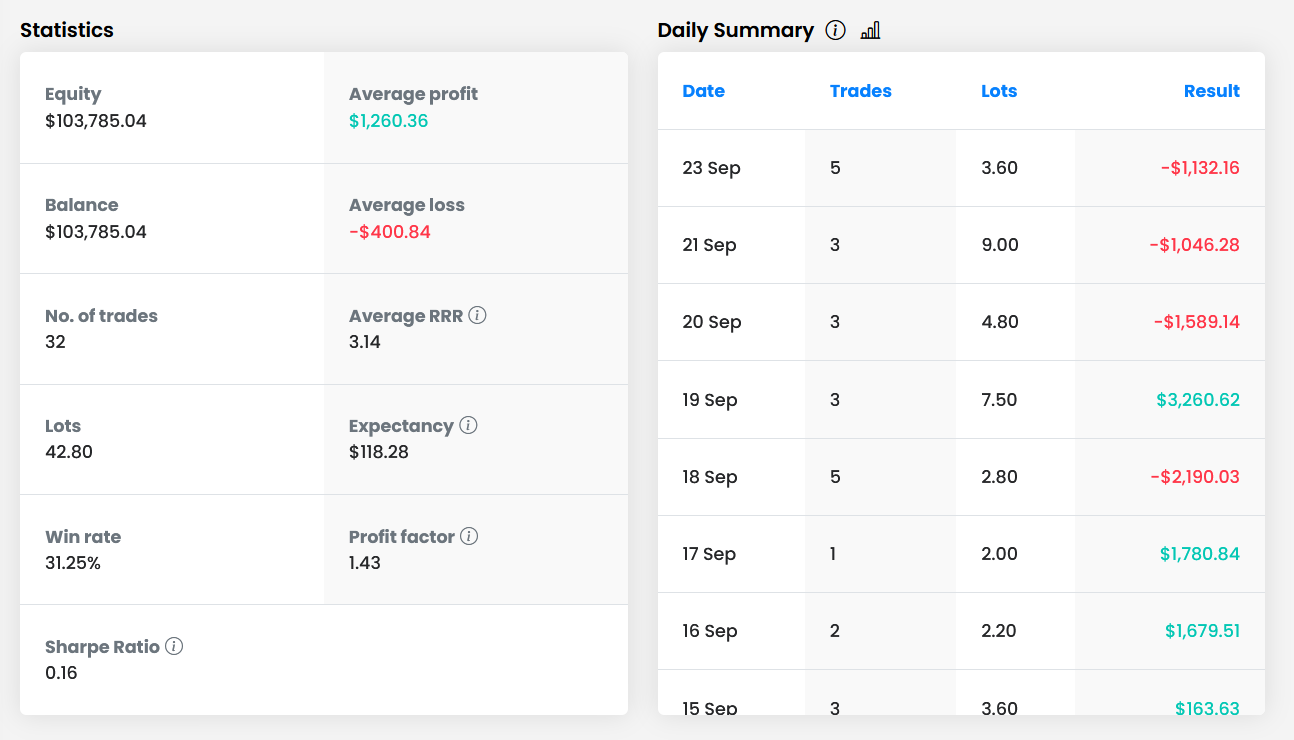

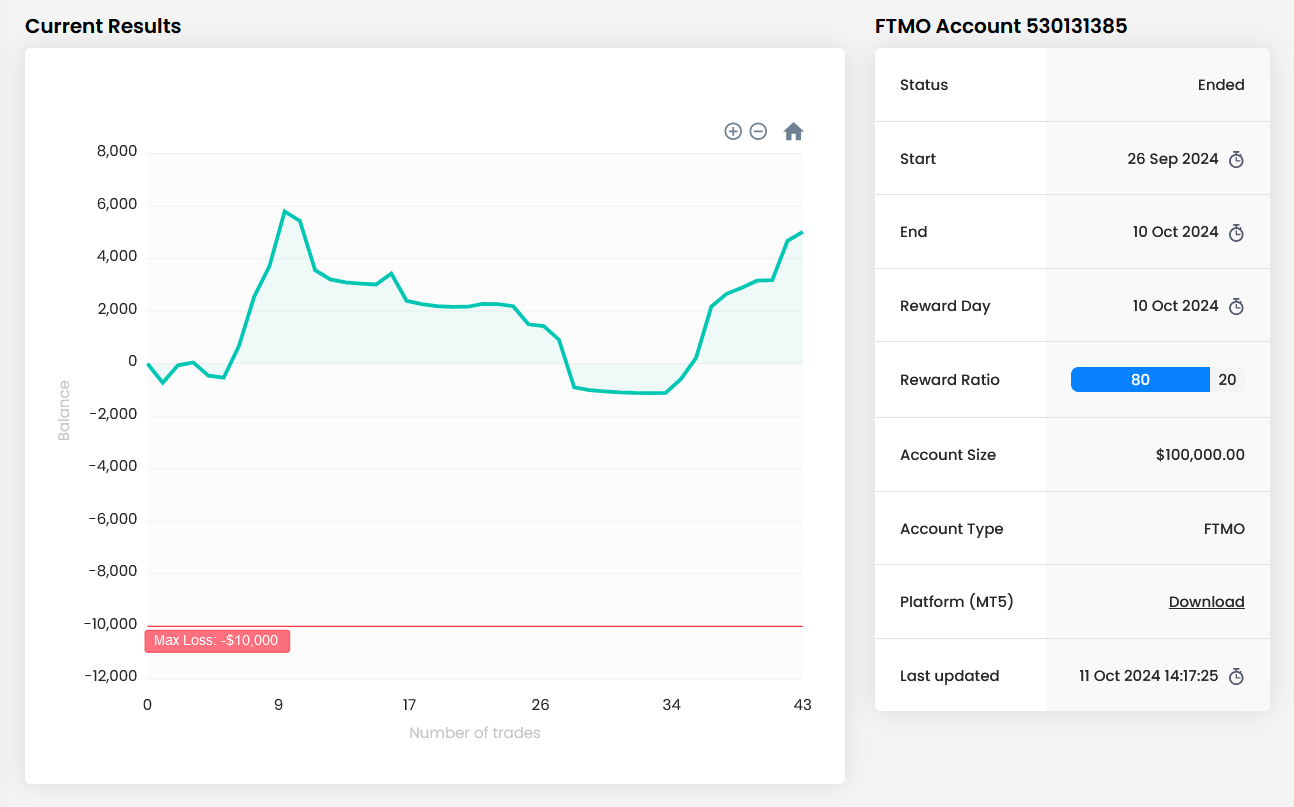

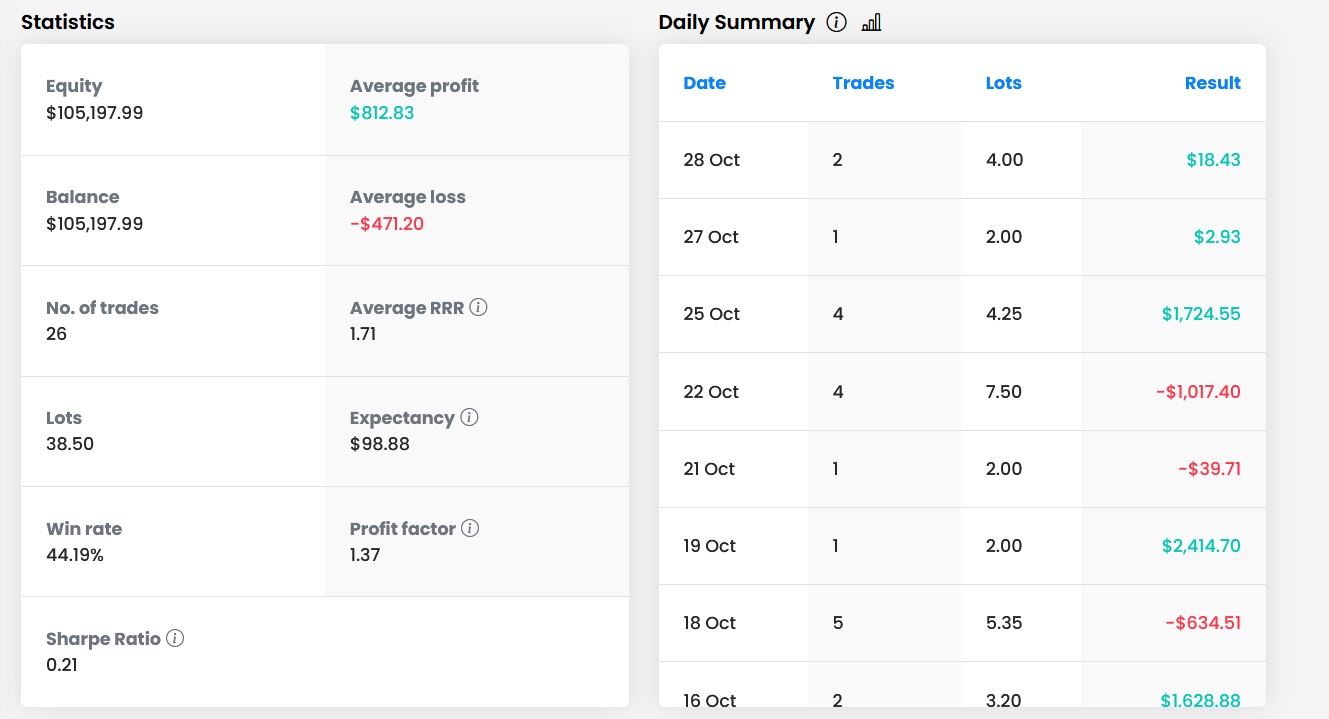

2nd Payout

Similar scenario happen on this account too. First 2 days I had some small losses and break even trades then on the 3rd day a big +$5.1k profit win followed by 20 break even and losing trades wiping all the profits and putting the account in a -1% loss overall loss.

This was the same case of mismanagement of my open trades as pretty much all of them were in profit which again would’ve put the account above $10k but I didn’t put the same effort into managing them as I did with my main and I took some trades outside of my main trades which I took on my personal account and which I normally send in my signals group, just to get a quick “bump” on the account, which didn’t work out too well and that’s why the account got into drawdown.

Once the account was in drawdown, the fight or flight instincts kicked in, I stopped trading my personal account for a few days and only focused on this FTMO account and managed to get it back to 5% profit ready for the split.

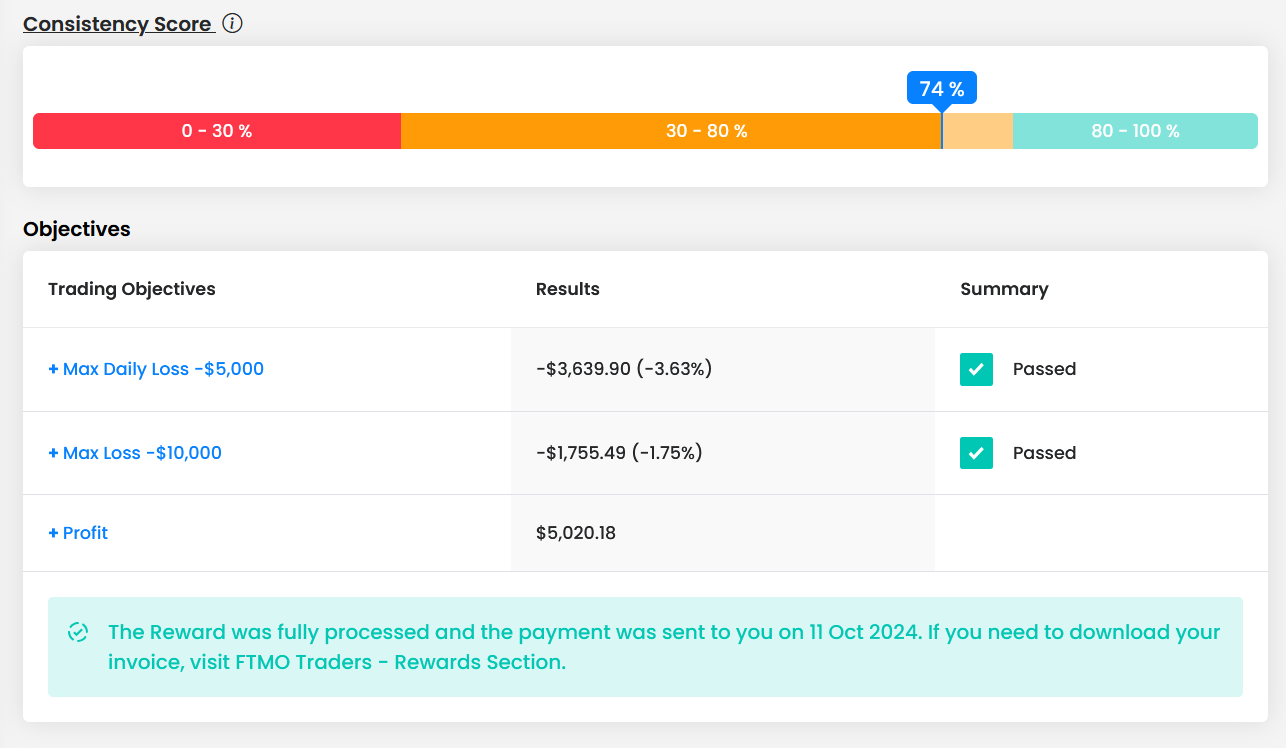

3rd Payout

The 3rd account was a bit more clean and less volatile than the 2 previous ones mainly because I just didn’t trade as much. Started off with a +$1.7k win, followed by some small losses and break even trades but eventually getting the account just over 5% and stepping back waiting for the payout.

I tried to get some more wins towards the end but just ended up getting a few more break even days. Not really much interesting happened on this account, I was spending much less time in front of the charts, that’s why I took less trades. The markets weren’t doing what I was expecting them to do, mainly gold so I realised I’m better off just not doing much at all.

All these payouts add up to $11,202.56.

And my total investment was $0. That’s how I was able to generate over $11k in the span of 55 days without spending a single penny of my own money.

What’s next and why did I do this?

I’m not a prop firm trader and never will be, I just don’t like being restricted. Trading my own funds allows me to trade the way I want without having to worry about violating some contract rules. And as much as I trust a prop firm like FTMO, before every payout I was questioning if I was even going to get paid. Maybe there were some rules I didn’t know about, maybe from their point of view I was over risking or something. I never question if my broker will send me my withdrawal as I always use regulated brokers and the worst case scenario is I just take them to court and get my money that way.

With prop firms, they have these rules in place so if you do get denied a payout, there’s nothing you can do. That’s why I will probably just go all in on this account and try to get that one last massive pay and just go back to trading my own funds.

As for why I did this, sometimes I do these challenge to see how far I’ve progressed as a trader as I’m forced to obey certain rules I don’t normally have to when I trade on my own. Also I’m beginning to work on FXD Academy, it will be a V2 of my course packed with so much information, even the biggest loser will become profitable with it. And I wanted to use this little prop firm journey as one of the ways to show you the possibility of learning my way of trading.

My prop firm strategy

My strategy for passing prop firm accounts is fairly straight forward. Pass as quickly as possible while maintaining a reasonable risk. Using a $100k account as an example. I will always start off with 5 lots for gold trades and 5-10 lots for any forex pairs. I don’t use a percentage risk, I use fixed lots for my trades just because my style of trading often requires quick decision making and I just don’t have the time to do any calculations before I enter my trades.

With my usual risk tolerance, a fixed 5 lot trade on gold is about 1-3% risk. That means if I can get a 1:3-5 trade, I’m able to pass the challenge in 1-2 trades. Simple enough.

Your first 1-2 trades are the most important ones. You want to guarantee you at least secure a little bit of profit which you can then use as a buffer for your future trades. Once you have a buffer you can then use that as the risk for your next trade.

Fore example, let’s say you’re still not confident enough in you trading abilities and you decide to take the challenge the slow way and you risk 0.5% on your first trade on a $100k account and it turns out to be a 1:2 win. You now have a buffer of $1,000. You can either split that into two 0.5% trades or a single 1% trade.

If you catch another 1:2 trade with the 1% buffer. You’re now up 3% in total. Now you can split that into three 1% trades or two 1.5% trades. You simply scale up your risk with each trade and use the previous profits for the next trade. Even if you use fixed lots like I do, you simply allow yourself to have more margin for error and you don’t have to be as perfect with your entries or you can even stack multiple entries.

However if you lose your first trade, you stick to your original risk until you’re account is above the starting balance. These challenges are meant for you to fail. There’s no need for you to lower your risk and waste your time slowly trying to bring the account back into break even. If it takes you 3-4 weeks or even more to pass a challenge you should reevaluate your strategy or your risk tolerance as you’re just wasting time. Follow the same plan and don’t panic. 1-2 good trades is enough to put you back in profit. All you have to worry about is the daily and total drawdown limits. Worst case scenario, you still have to wake up to work the next morning.

Once you get to the funded stage, the game changes a little bit. You now have to obey every single rule or you risk breaching the contract and losing the account. The only rule I was always worried about was the news trading rule as I do like to hold my trades through.

The risk I use for my funded accounts is based on an account half the size of my funded. For example, while I was trading all these account that got me the $11k in payouts I was treating each account as if it was a $50k account. If I was trading a $200k account I’d use adjust my risk as if it was a $100k account etc.

This approach will allow you to make sure the account stays alive long enough for you to get multiple payouts without any major risk to the account.

If you look at the equity curve of my accounts, I never went more than 1-2% into the negative and I’ve put a lot more effort to making sure my first few trades give me enough profit to cover any potential losing traders I may have later on. That’s the key to making sure you actually get paid more than once.

Most prop firm owners would tell you that all these people on the leaderboard making these huge returns you dream of, don’t even reach a second payout and struggle to get funded again. It’s just a lucky trade or a lucky winning streak for most. Most successful prop firm traders only make around 2-5% per month and that should be your goal.

Throughout this journey, even though I had multiple opportunities to make over $10k on each account if I just managed the trader properly, I never forced it and my goal was only to make a few % so I get paid and I can share this journey with you.

As for FTMO as a prop firm, there is nothing bad I can say about them. As soon as my profit split day closed I got payed the next day. The last pay took a little longer but it was the weekend so it’s understandable. Never experienced any trading issues either so it’s still the best prop firm out there in my opinion.

If you’re still struggling with trading and you need some extra tips, check out my free course available here:

Free forex trading course for beginners

Let’s get paid!