Let’s break down this monster of a trade. 1:250 RR trade on EUR/USD that have thaken place since March 16th to March 23rd this year.

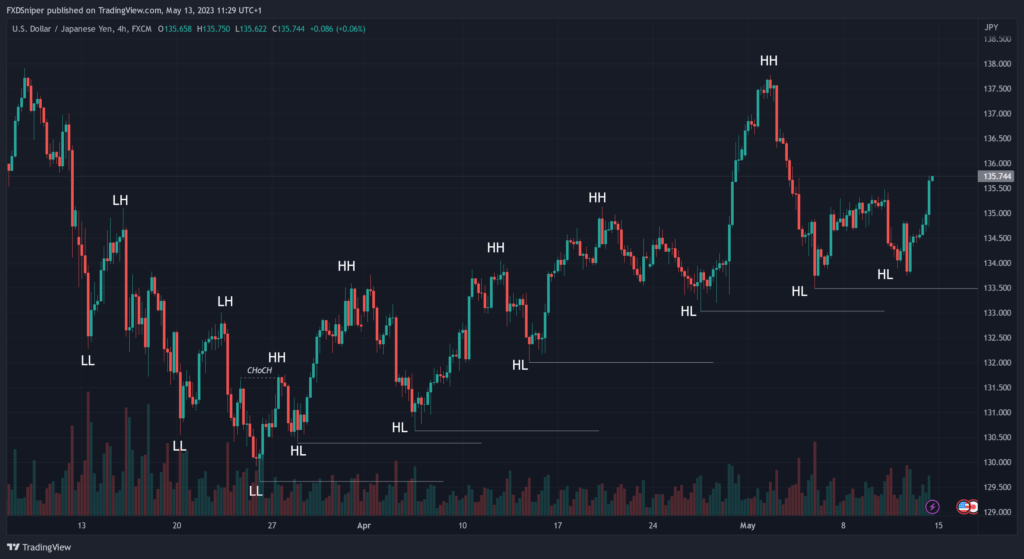

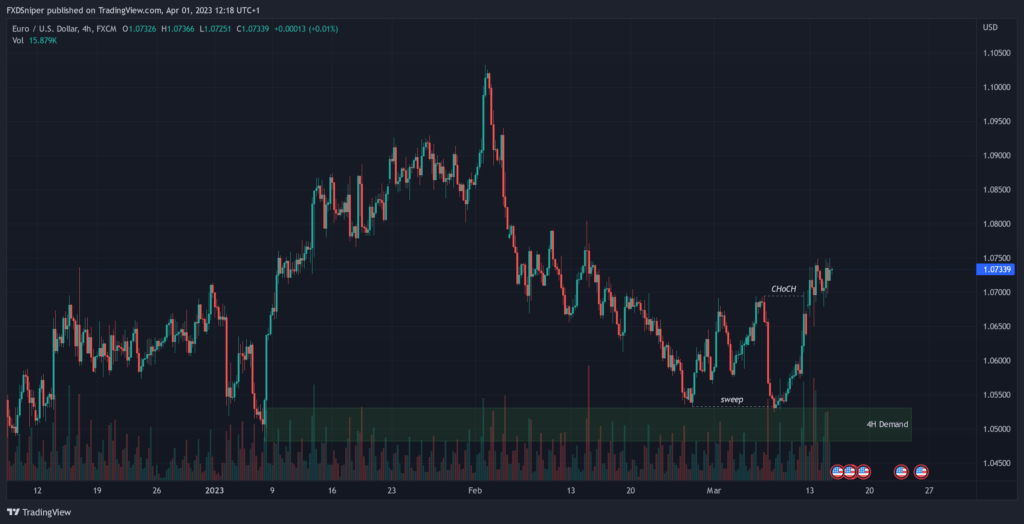

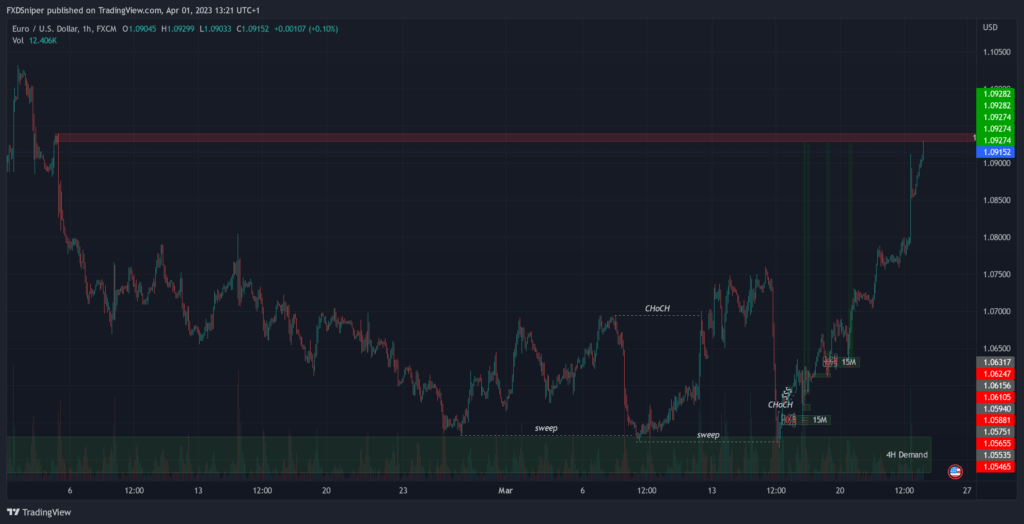

Price has been in an uptrend since September 2022 and the overall long term trend hasn’t changed so every pullback we’re expecting bullish momentum to continue. Price has created a very strong demand zone which haven’t been retested since January this year. First time price appreached the zone it had a strong push to the upside breaking structure on smaller timeframe possibly trapping the early buyers. However price never tapped into the zone and that’s where most of the volume is located.

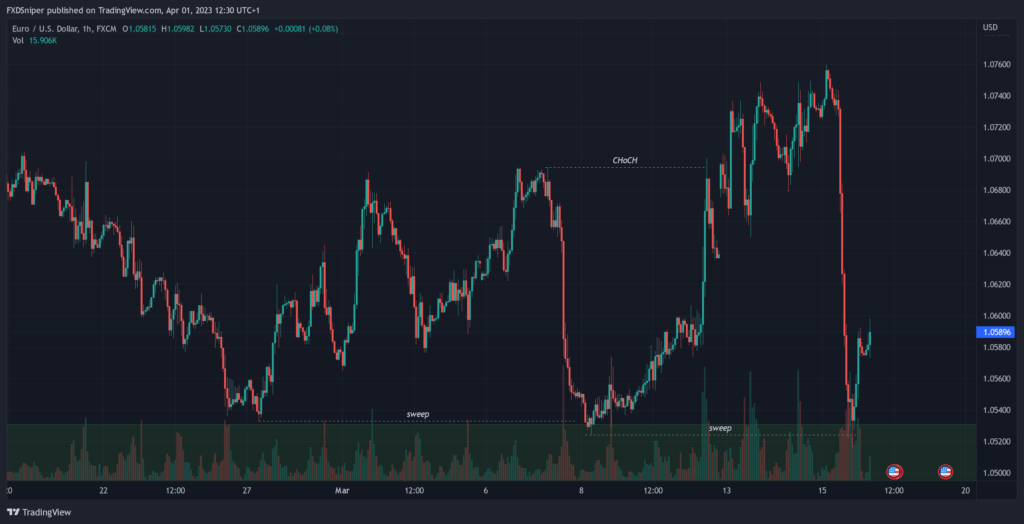

That’s why sooner or later I was expecting price to sweep the previous low, liquidating the early buyers and tapping into the demand zone and it did happen followed by change of character on the 4h timeframe. So at this point all you have to do is for price to return into previous demand zones created by the move to the upside and wait for confirmation to enter.

However it didn’t happen… Because of the US banking system situation at that time the big players decided to manipulate the price and sweep the low again trapping and liquidating even more buyers. Moves like this aren’t natural, this was pure manipulation that’s why I was still looking at buys and this was a golden opportunity. EUR/USD snipers began.

Become a VIP and get access to exclusive insights, powerful trading indicators and other resources, click here to join now.

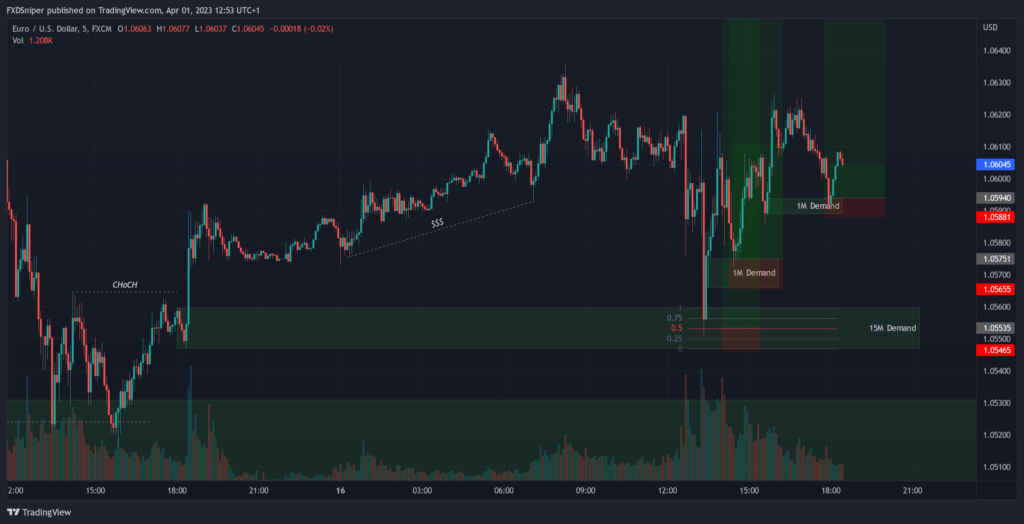

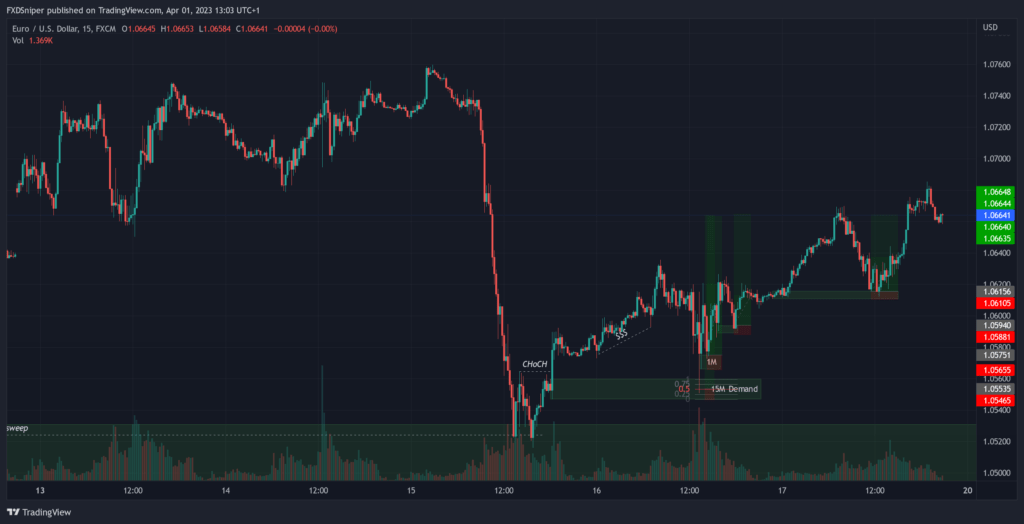

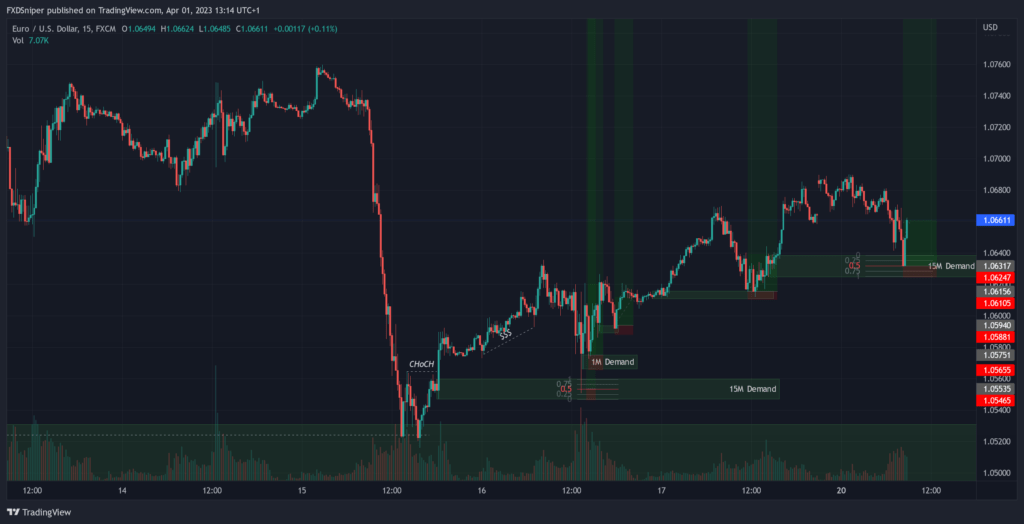

When we go down in timeframe, we see price changed character and broke more structure to the upside. At this point we know price will continue to go higher. We located the liquidty, we located the latest 15min demand zone and we simply wait. The stop loss was too big for my liking so I marked my entry at 50% of the demand zone.

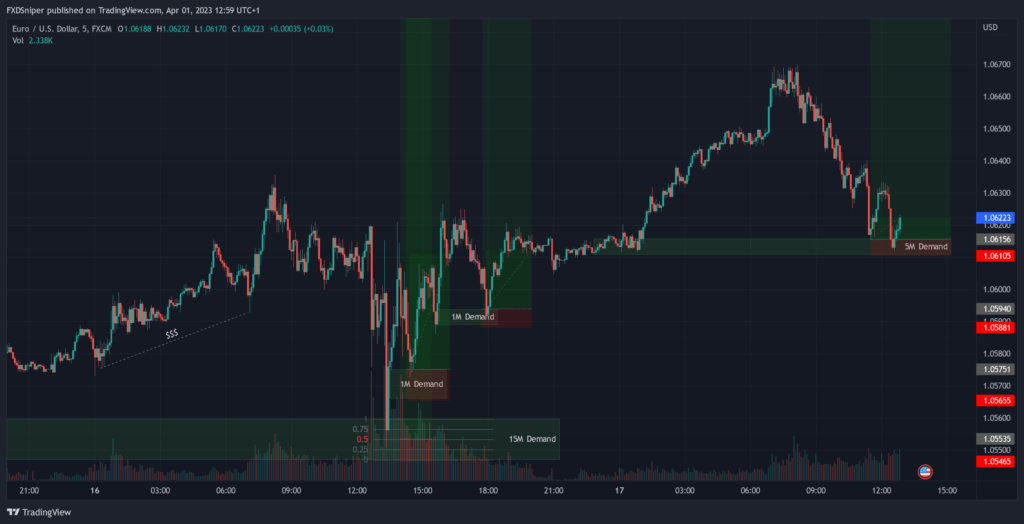

Price taggs us in and breaks previous structure, that’s another confirmation that we’re going up. So I go down to 1M timeframe and look for more entries.

This is how I found my 2nd and 3rd entry. All of this happened in a couple of hours. We have 3 sniper entries each taken with the same concept, now we just sit back and watch the price do what it wants.

That’s the end of day 1.

Next day price had a very nice push to the upside during Asia and early London session. And I saw an opportunity for an extra entry, I simply marked the 5min Asian demand and placed my entry there. It was a close one, alsmost hit the stop loss, but it played out at the end.

At this point we had 4 sniper entries all entered from 1-15min demand zones. 3 Days in and we’re edning the week with a total of 46.57 RR. Not bad for 3 days.

A new week began on EUR/USD and price was coming down which got me a little worried, however I did notice a 15 minute demand zone where price could potentially reverse from. Again I didn’t like how big my stop loss had to be so I entered from 50% of the demand zome. At this point I had 5 sniper entiers. No matter if I saw the best set up right now I would not have entered anymore trades. This was way too risky anyway, I’m not trying to push my luck.

At this point I just let all the trades run.

4 days later price has hit our take profit. This was the first supply zone above all previous liquidity that pushed the price down that’s why I had set this as my target.

7 days from start to finish, 5 sniper entries on EUR/USD for a total of 1 to 250RR. Simply unbelievable. 2% risk would have gotten you a 500% return that’s the type of trade that changes your life.

I hope you analyse and study the set ups taken in this case study and use that to improve your own strategy. Let’s make some money!