This is the second article in the four part series. If you haven’t read the first one about managing your emotions click here. In this article I will dive into bad habits every trader has been through and how to get rid of them.

Habits are created by making a lot of smaller decisions regularly that eventually build up to be a part of your everyday life. Your brain does not distinguish between bad and good habits and it’s really difficult for your brain to break them once they become a part of you. Studies show it may take anywhere from 21 days for any minor habits, up to 90 days for major habits to break them. That’s why consistency is the only way to get rid of any bad habits you may have.

Whether it’s sticking to your diet, working out or just being lazy, we all have some form of bad habits that are holding us back from achieving our goals. It takes a lot of willpower to stop yourself from letting your habits control your day to day actions. Especially for us traders, where you have your money on the line every single time you take a trade and you already have 100s of emotions affecting your decisions. That’s why so many people never succeed in trading. It’s not because they don’t know how to trade, most people do, but most people don’t know how to control their emotions and their decision making process is controlled by all the bad habits they created.

Let’s go through some of the most common habits everyone faces.

Not following your game plan

You have a solid strategy you know 100% that works if you just stick with it. You find your ideal setup and you enter a trade, everything goes as planned. You’re feeling confident and excited about to hit your take profit, then something happens and the price moves against you. You remove your stop loss thinking it’s just some manipulation before pushing further in your direction and you don’t want to close your trade at break even in case it wicks it. But the price just keeps pushing and now you’re at a loss. Maybe you decide to add an extra entry thinking it’s just a bigger pullback, but the price just keeps pushing and you’re down half of your account already.

You close the trades devastated with the profit you just lost and the huge loss you taken, then the price goes and hits your take profit. Sound familiar? All of this could have been avoided if you just followed your rules, took partials on your way up and let the rest of your trade close at break even and potentially entered again at a better price, but you got emotional and you let yourself get rekt.

Become a VIP and get access to exclusive insights, powerful trading indicators and other resources, click here to join now.

That’s the story of every trader at some point. If you have a strategy and a game plan you know works, let it play out. You see most people try to hit a home run on every single trade but that’s not how trading works. 95% of your trades are small wins and losses, the other 5% are your big winners which may only happen once or twice a month. You never know what the market will do, you only know how you will react to what’s happening. Your job as a trader is to focus on the long term game plan, the trade you take right now does not matter. The next 100 trades you take do matter. Trading is a battle, your number one priority is to protect your capital, the money comes in in the process.

Revenge Trading

This relates to the previous story. You took the loss which could have been a win and now you’re trying to make it back. You’re forcing yourself to see things that aren’t there because you were emotionally attached to the trade and you end up taking more losses, maybe even blowing your account.

I’ve mentioned this in my previous articles, the “3 strikes and you’re out” concept. Which basically means if you take 3 losses in a row for the day, you’re done for the day. At least that’s what everyone else says. But I’m not a fan of this mentality, because you never know, maybe your 4th trade would be a big winner and you could have closed the day in the green. Losing is part of the game, just trade what fits your strategy. If you see a setup, why not take it just because you had a losing steak that day? However this only works if you’re not emotionally attached to your trades.

If you feel like you’re emotionally drained for the day, then quit for the day, but if you’re fine and your head is clear continue. This goes back to the previous section, the outcome of your trade does not matter. Trust the process.

Overconfidence

On the other hand, sometimes you win, you win a lot. That’s not good either because you end up being overconfident, you feel like you know it all, like you’re the king/queen of the forex game. You end up taking more trades, much bigger lot sizes etc. Then you take a big loss and you go back to revenge trading and not following your game plan. It’s a circle of doom where you never win.

Winning doesn’t teach you anything, losing will teach you everything.

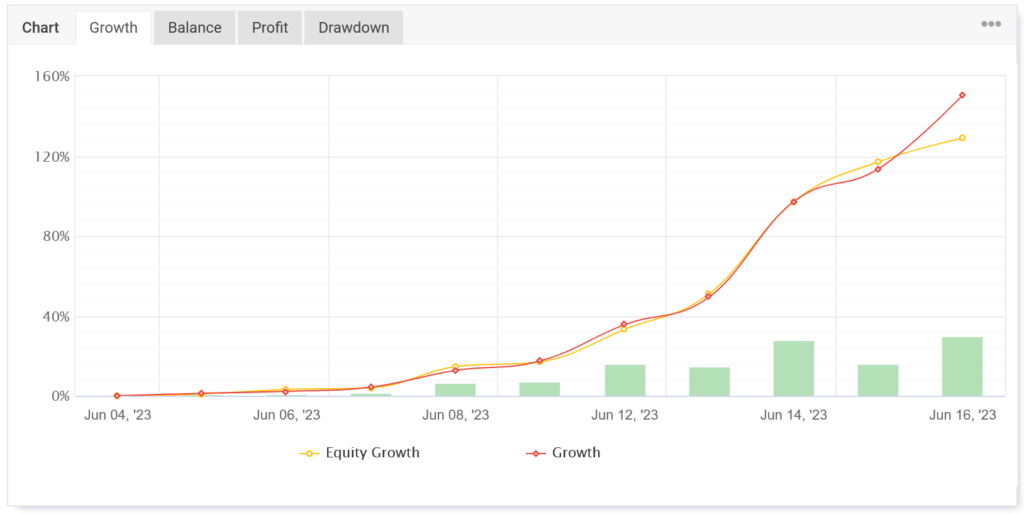

If you had a big winning streak, withdraw some of that profit and have fun, and play with the rest. What I liked to do when I was in winning streaks when I was still trying to build a decent 6 figure account (now I don’t risk as much), let’s say I made £50k in a month. I would withdraw half of it and take the other half and risk it big. I would find my favorite set up and put £10-15k on a single trade. If I win, it would be a very significant boost to my account, if I lost I still had my previous profits secured so I wouldn’t care much. That’s how I was able to build my account well over 6 figures in such a short time.

Overrisking and Overtrading

Both of these habits come from the fact that most of you trade accounts that are way too small to make any significant gains and you’re trying to flip your $100 account into 10s of thousands. Although it is possible, you’ve seen me flip £10 into £10k multiple times already. It is not achievable for most.

Our members already secured 7-figures in funding capital. Join the FXD Academy and take your trading to the next level, click here to learn more.

Don’t get me wrong, I’m a big advocate for flipping accounts and I do claim forex is a get rich quick scheme if you know what you’re doing. The problem is, most people don’t know what they’re doing. It takes a lot of skill, emotional intelligence and discipline to flip accounts. But I do understand that some people just have no choice and trading with $100 accounts is all you can afford. You just have to understand that in order to flip a small account you must have years of experience in the markets, it doesn’t happen overnight.

However if you have enough capital or if you’re a funded trader and you’re trading anything bigger than 1% per trade you’re just setting yourself up for failure. I will keep saying this, the outcome of your trades does not matter, focus on the process and the results will speak for themselves. 1-2 pairs, 1-2 trades a day is enough to make you a fortune.

Looking for validations

How often do you find yourself looking at other traders on Instagram, Twitter or Reddit or asking other traders for opinions about your trades or analysis which is affecting your decision making. My question to you is, why do you care?

You have a plan, you have a strategy. Why do you need someone else to validate your idea for you? Do you ask for opinions on everything else you do in life? Just focus on your own trades and your own process. There’s no one else in this world that thinks the same way as you do.

When I first started trading I would look at other traders too, and because this was something new to me I would listen to what they had to say. Do you know how many trades I lost because I listened to some random trader on Instagram with 100k followers instead of actually doing what I thought was right. As soon as I stopped caring what everyone else was doing, my learning curve skyrocketed.

Confirmation Bias

This is something that requires a full article of its own and that will be the 3rd part of this trading psychology series but I will give you a brief idea of what it is here.

Confirmation bias is a psychological term used to describe the human tendency to only seek out information that supports one’s beliefs. This is a massive issue not just for traders but for every single person in the world.

For example, let’s say you open a long trade on gold. At that point everything you will see on the chart will confirm your bias as to why this long trade will win. If the price moves against you will think it’s just manipulation to take out the early buyers and the price will continue in your desired direction. If your trade is in profit and it starts coming down, you will think it’s just a pullback because it must go hit your take profit. No matter what happens you will not accept the fact that you’re wrong and your bias is wrong.

It’s not an easy thing to overcome, you must disassociate yourself from your beliefs and focus on the process instead. Remember, the outcome of your trade doesn’t matter.

Leading broker 16+ years in the industry

Spreads starting from 0.0 pips

Up to 1:2000 leverage

Trade Forex, Futures, Stocks and Commodities

Instant withdrawals get paid in under a minute

To Summarise

- Outcome of your trades does not matter. Focus on the process.

- Your job as a trader is to protect your capital. Money comes as a result.

- If your emotions are getting the better of you, quit trading for the day.

- 1-2 pairs, 1-2 trades a day is enough to make you a fortune.

- Focus on your own trades, don’t worry about other people’s opinions.