Smart money concepts entry models, also known as “SMC entry models,” are trading strategies based on the principles of smart money management and analysis. Smart money refers to institutional investors, large financial institutions, and professional traders who have significant resources and expertise in the financial markets. These models aim to identify entry points into trades based on the actions and behavior of smart money participants.

There are various types of SMC entry models, each with its own set of criteria and methodologies. Some common examples include:

Order flow analysis: Smart money entry models often involve analyzing the order flow in the market, looking for large institutional orders or significant volume spikes that indicate smart money activity. Traders may use tools such as volume profile, level 2 data, or footprint charts to identify areas of high liquidity and potential market turning points.

Supply and demand zones: Smart money traders focus on identifying supply and demand imbalances in the market, known as supply and demand zones. These zones represent areas where large institutional players are actively buying or selling, leading to significant price movements. Traders using smart money concepts entry models look for price reactions at these zones to enter trades in the direction of the dominant trend.

Price action patterns: Price action patterns play a crucial role in smart money entry models. Traders analyze price action on various timeframes, looking for patterns such as pin bars, engulfing patterns, or inside bars that indicate potential reversal or continuation opportunities. Smart money traders often prioritize trades that align with the dominant market sentiment and exhibit clear price action signals.

Market structure analysis: Understanding market structure is essential in smart money trading. Traders analyze market trends, support and resistance levels, and key chart patterns to assess the overall market environment. By identifying areas of accumulation or distribution by smart money participants, traders can make informed decisions about when to enter or exit trades.

Fundamentals and sentiment analysis: Smart money traders also consider fundamental factors and market sentiment when making trading decisions. They analyze economic indicators, corporate earnings, geopolitical events, and sentiment indicators to gauge market sentiment and identify potential market-moving catalysts. By aligning their trades with the prevailing market sentiment, smart money traders increase their probability of success.

Overall, SMC entry models provide traders with systematic approaches to entering positions in the market, helping them make informed decisions based on predefined criteria and strategies. These models can be tailored to suit individual trading styles, risk tolerance, and market conditions, offering a structured framework for trading success.

* Currently we are adding new models at a rate of 1-2 new models per week. If you wish to stay up to date bookmark this page and check back at your own convenience.

To download the models simply click “Download Image”, right click and save to your device. You can also download all images as a .zip file at the bottom of this page.

SMC Entry Model 1

This is probably my favorite entry model with the highest win rate. My best sniper entries usually come from this type of setup. Most of my entries based on this model are based on a higher timeframe which allows me to turn my trades into swing trades and catch much higher risk to reward trades.

If you ever wondered why the price seems to alway take out your zone, hit your stop loss and then proceed to go to your take profit this entry models solves that issue.

The markets are always looking to take out liquidity before heading in their desired direction. This model capitalizes on the fact that we’re entering the market after liquidity was taken out which is our major structure. This major structure might be an orderblock, internal swing high/low etc.

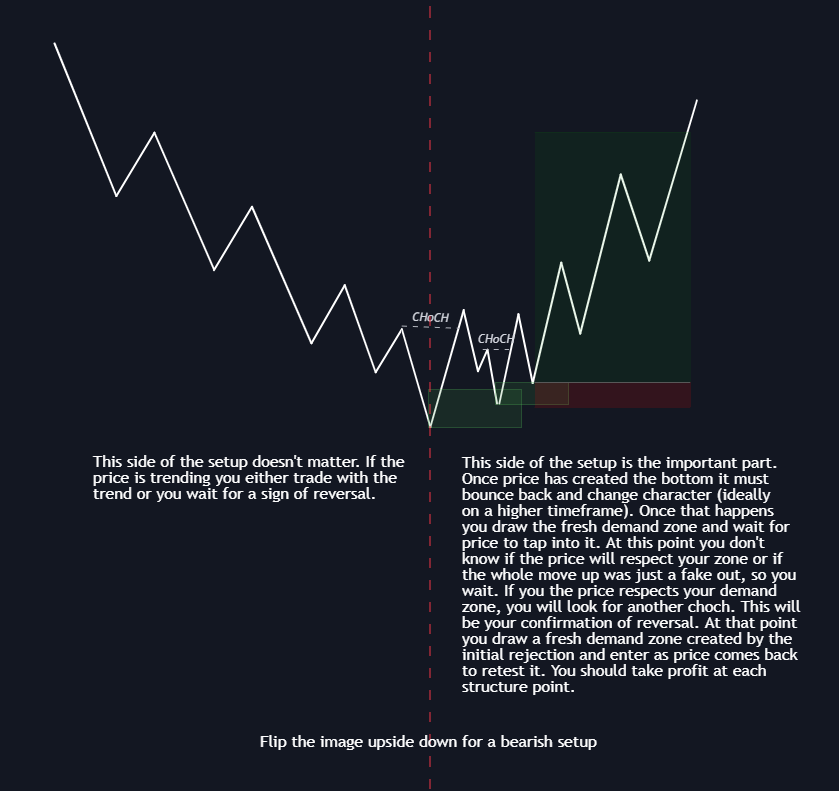

SMC Entry Model 2

This entry model is perfect for identifying trend reversals.

Obviously for this setup to work you should look for it on a higher timeframe. Although it still works just fine on smaller timeframes. You have to remember the overall trend and bias so you don’t get caught on the wrong side of the trade.

Higher timeframes don’t respect lower timeframes, higher timeframe only respect higher timeframes.

This entry model is basically a double ChoCh set up. First you’re waiting for the higher timeframe ChoCh, not just any ChoCh, it has to break a significant structure point.

Once that happens you can have an aggressive entry as the price comes back to retest a fresh supply/demand zone but at that point you don’t know if the initial move was a fake out or a real reversal so you wait for the price to reject the zone and ChoCh again. That’s your confirmed entry.

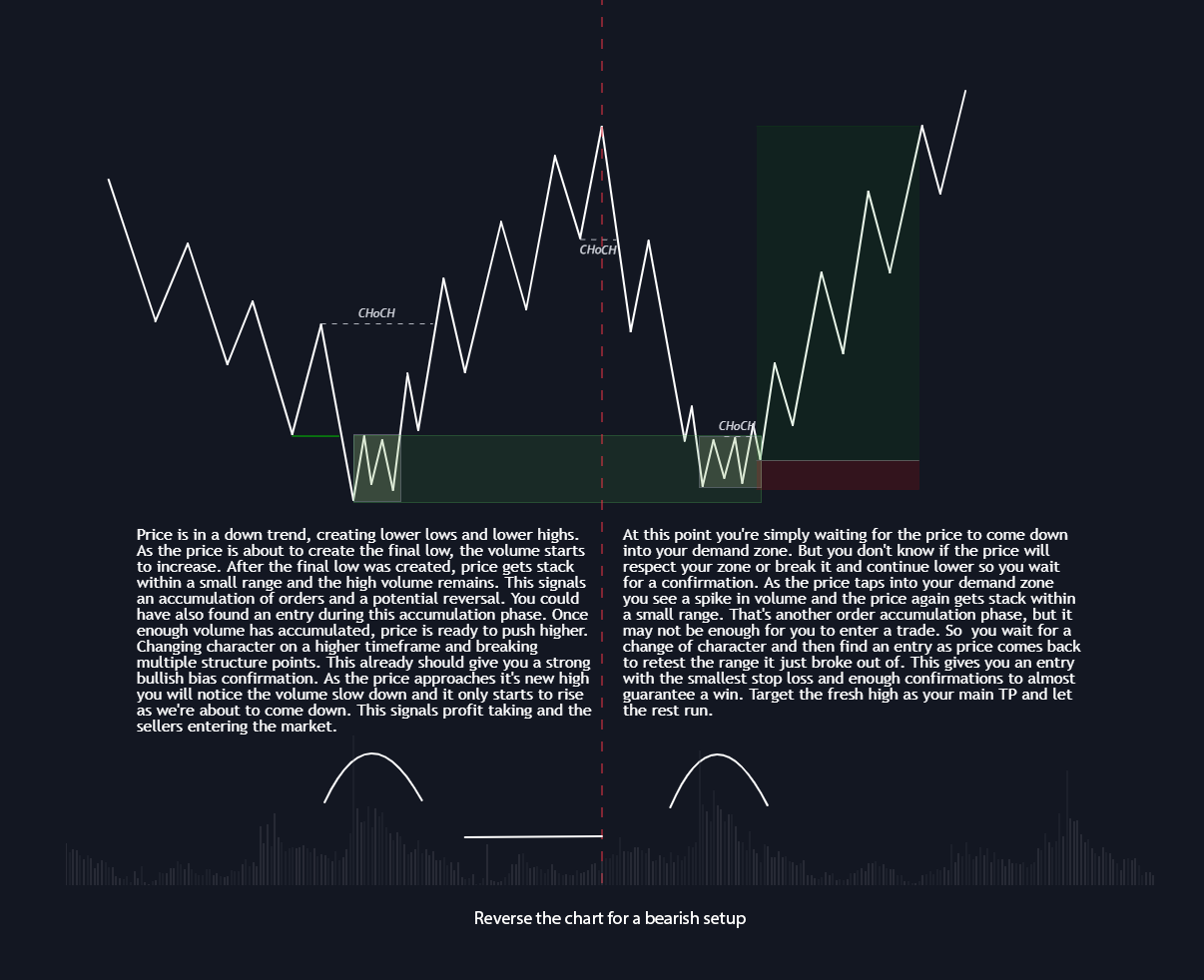

SMC Entry Model 3

This is a very simple entry model with the most confirmations and probably the highest win rate out of all of them.

As the previous entry model describes a reversal entry, this setup focuses on entries long after the reversal has already happened and you’re simply waiting to enter during a major retracement.

If you’re very patient and you’ll allow yourself to wait for the final set of confirmations this setup will allow you to catch one of the highest risk to reward trades.

The main reason as to why this entry model has such a high win rate is because of the two accumulation phases that happen at the demand/supply zone. The major players in the forex market can’t enter trades like you or me. They need to spread their orders over a longer period of time and they need to create the extra liquidity to actually fill their orders. This accumulation phase signals big money buy into the market.

If you wish to take part in our premium courses you can find them on the main page of our website, or just click here.

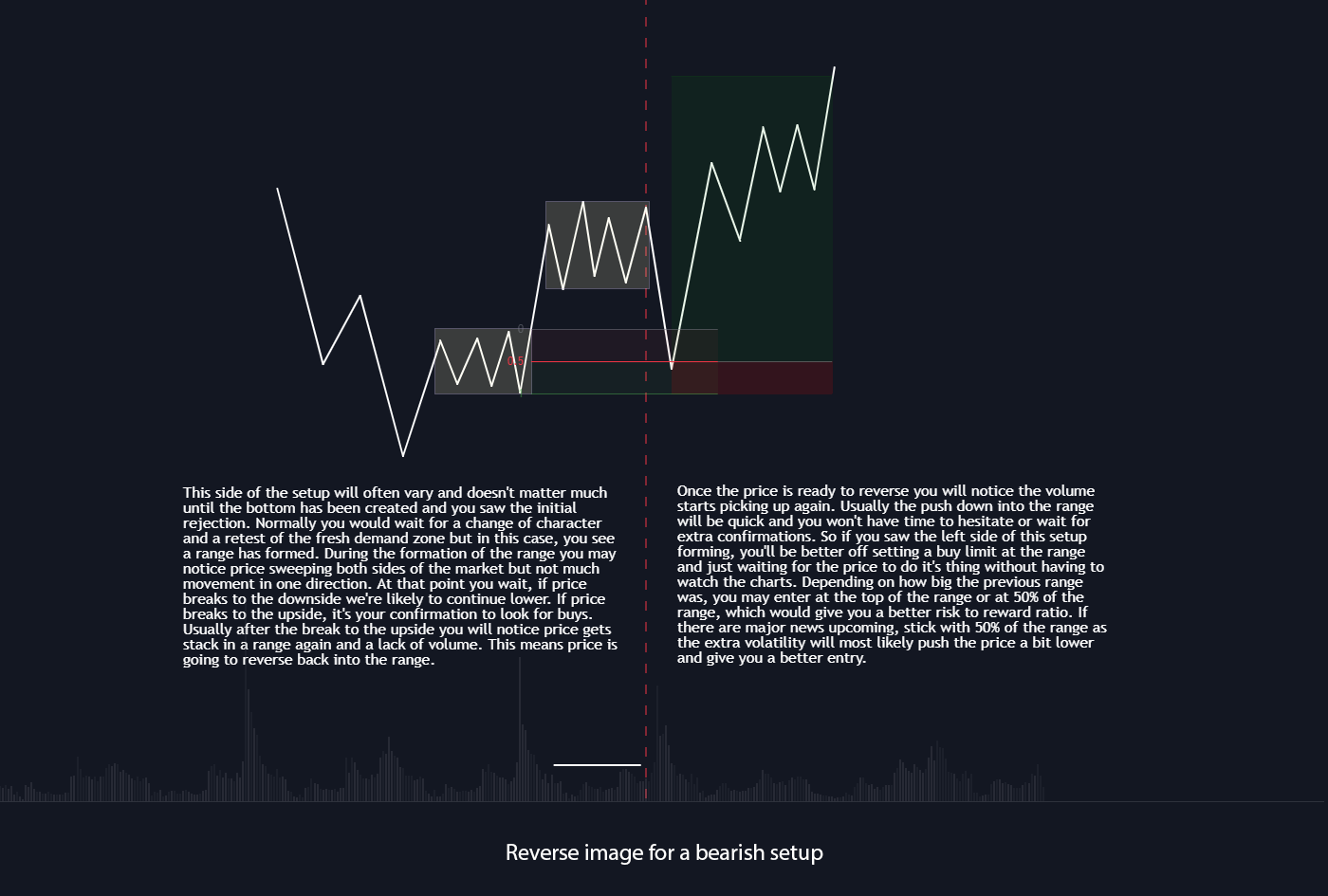

SMC Entry Model 4

This is another entry model with a high win rate. It is mostly used in a trending market or after high momentum reversals.

Usually as the reversal takes place we would expect the price to come back into the freshly created supply/demand zone. In this case however it doesn’t happen and the price simply get stuck within a range and continues higher after the reversal took place.This allows you to target the previous range as your entry.

The reason we use the premium/discount tool to enter at 50% of our zone is because the range we’re targeting will usually be very big. We don’t want to enter at the range with a 50 pip stop loss, that’s why we target the middle of the range which allows us to enter with much smaller stops.

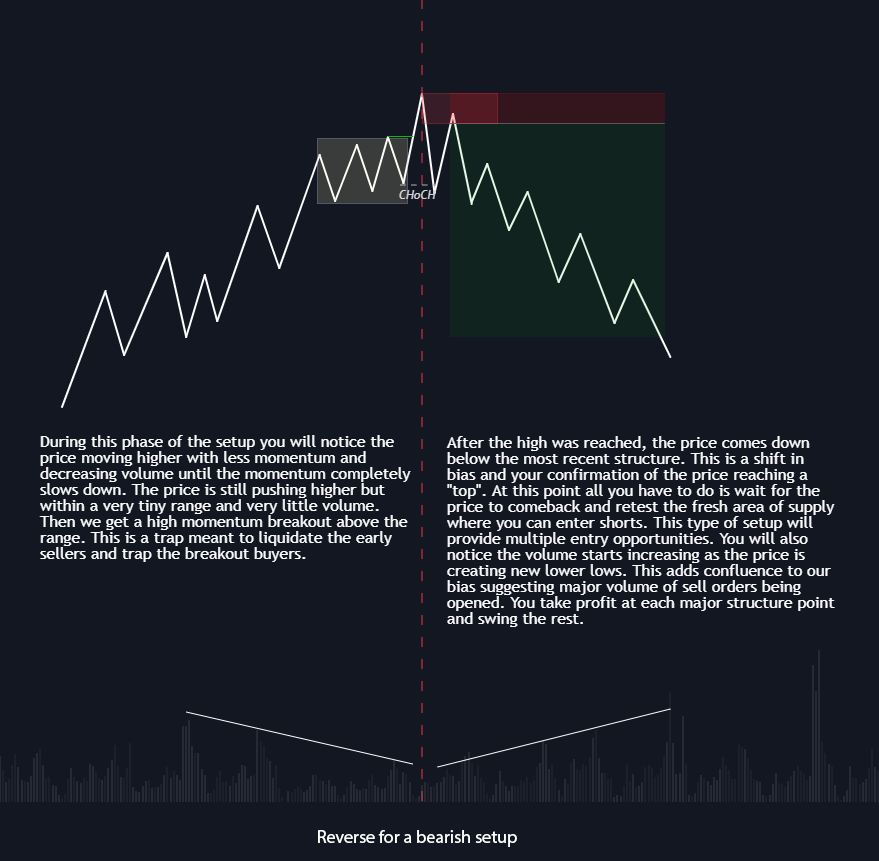

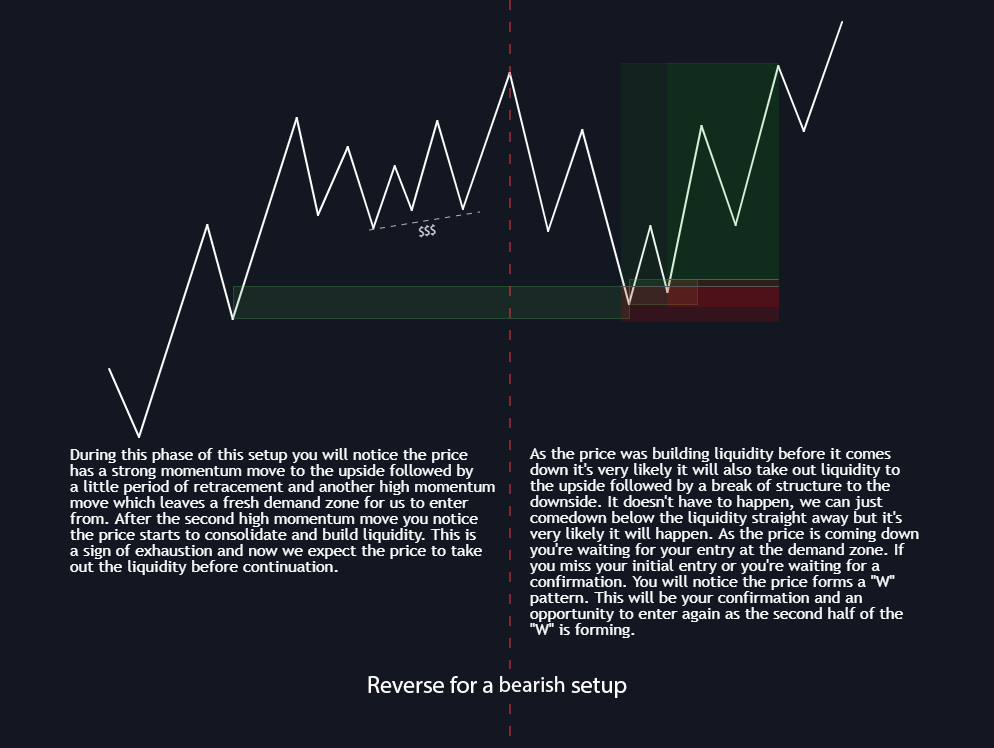

SMC Entry Model 5

This is an entry model which allows you to catch tops & bottoms. Although you can never be certain when the market is going to reverse, this setup has a very clear structure, it’s easy to spot and if executed at the right time it will give you a very high win rate with massive risk to reward trades.

The main concept this model revolves around is the accumulation phase as the price is at or near a strong supply/demand or very significant highs/lows. This also applies to new ATHs.

The range near these key levels suggests an order accumulation. That’s where most people are entering sells too. We know that price is always looking to take out liquidity so being smart trades we wait for a sweep of the range (liquidation of the early sellers).

If we’re right about this being the top, the price will sweep the range and come down below changing character. This is our confirmation and we simply enter as price retest the freshly created supply, it’s okay if you find an entry below the supply, price may not always retest the highest zone.

SMC Entry Model 6

This is the entry model you’ve probably seen the most on the internet but most people don’t explain it well enough for it to work.

The main thing that actually makes this entry model work is that the price has to be in a trend. If the price is not in a trend this setup will not work.

This entry model also explains why “Trade with the trend” trades will lose money catching the trends. It’s because price is always looking to take out liquidity so any break and retest type of entries don’t work long term in a trend.

With this model you identify a recent zone below liquidity and you enter as price takes out liquidity and taps into your zone. Usually you will get multiple entry opportunities with this entry model.

If you wish to join our SMC style signals click the green button in the menu of our website, or just click here.

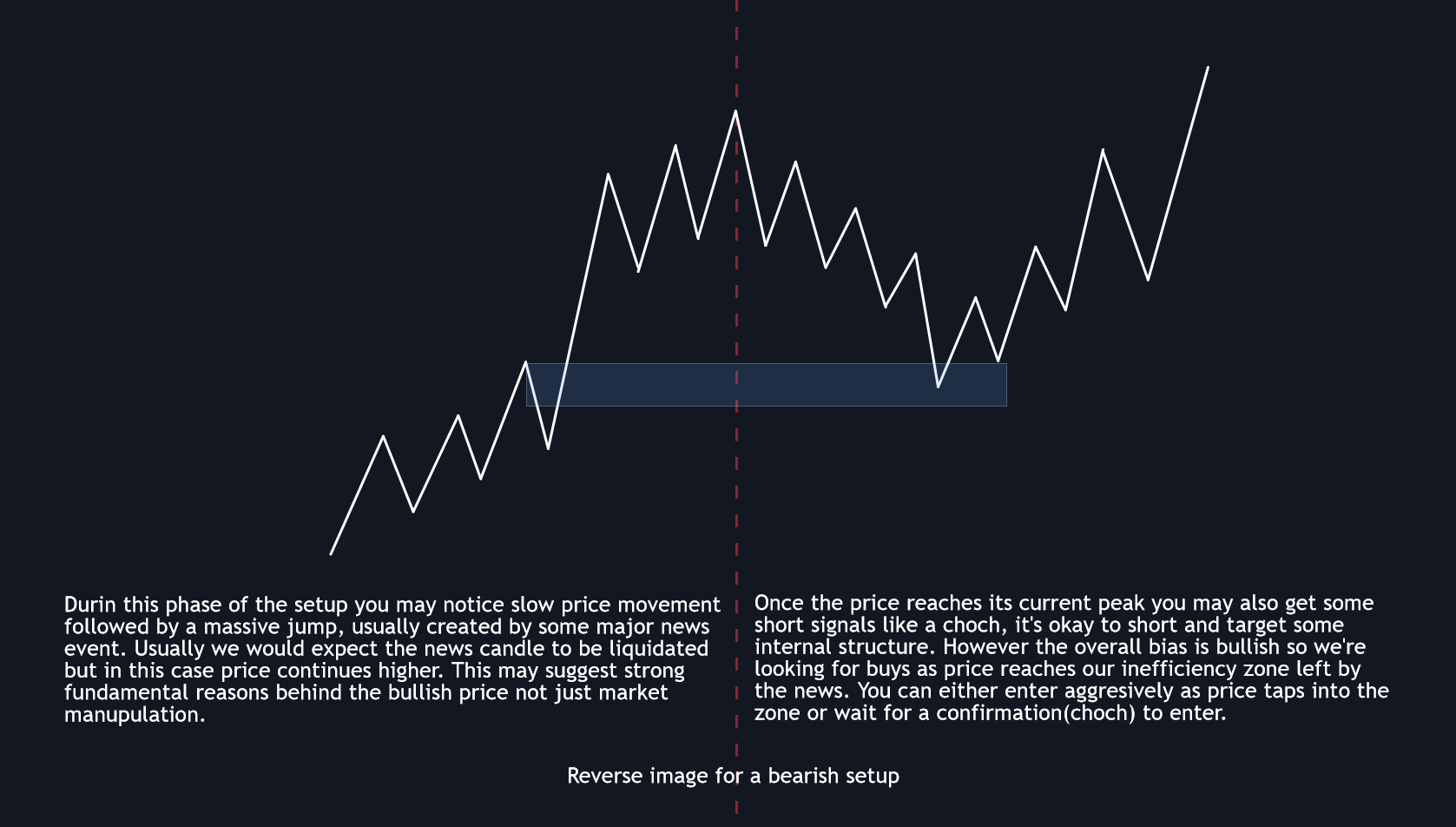

SMC Entry Model 7

This is the first entry model on our list which uses inefficiencies. The reason for this is because here at FXD we’re always expecting inefficiencies and orderblocks to be taken out because they are easy liquidity targets for smart money. So we usually want to enter after they are taken out.

However inefficiencies do work and it’s okay to take your trades from them, you just have to know what they might work and when they don’t.

In this model we’re in a trend. The price is slowly building up structure with the trend and then we get a massive jump (usually created by major news). Again, here at FXD we always expect news candles to be taken out, however in this model the price continues higher long after the news were released, this signals strong fundamental reasons for this move. This scenario is what makes inefficiencies work.

* Currently we are adding new models at a rate of 1-2 new models per week. If you wish to stay up to date bookmark this page and check back at your own convenience.

Click the button below if you wish to download all SMC entry models listed above in a .zip file