In the dynamic world of forex trading, success is not solely determined by analytical skills or market knowledge. A significant component is the trader’s mindset. Developing a robust trading psychology is essential for navigating the volatile forex market and achieving consistent profitability. This comprehensive guide delves into the facets of a successful trading mindset, explores various trading styles—such as scalping, day trading, and swing trading—and offers actionable tips to enhance your trading psychology.

Understanding the Importance of Trading Psychology

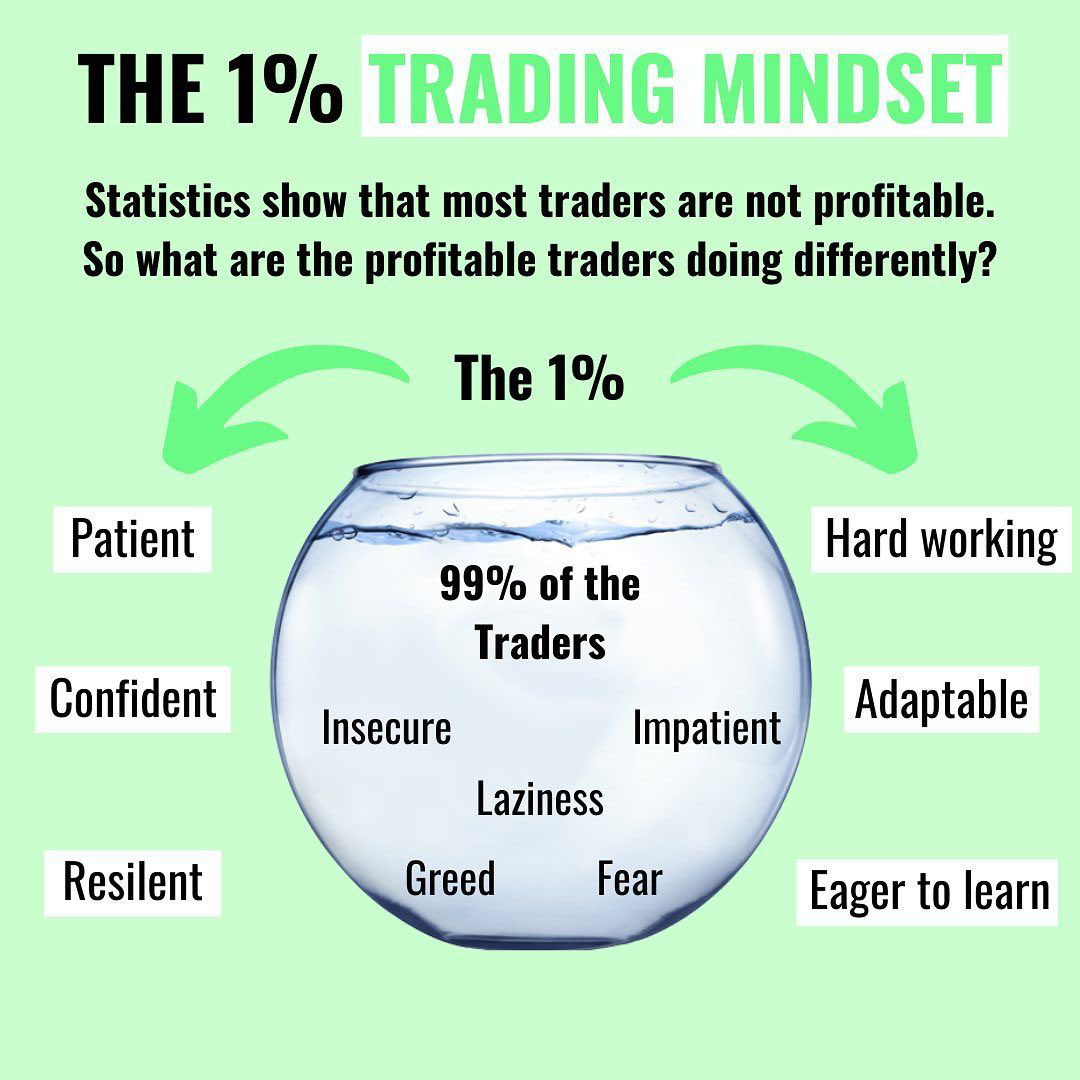

Trading psychology refers to the emotional and mental state that influences a trader’s decision-making process. Emotions like fear, greed, and regret can significantly impact trading outcomes. Recognizing and managing these emotions is crucial for maintaining discipline and making rational decisions.

The Role of Emotions in Trading

- Greed: The excessive desire for wealth can lead traders to take unnecessary risks, such as over-leveraging or deviating from their trading plan. While ambition can drive success, unchecked greed often results in significant losses.

- Fear: Fear can prevent traders from seizing profitable opportunities or cause them to exit trades prematurely. This emotion often stems from previous losses or a lack of confidence in one’s strategy.

- Regret: Dwelling on past mistakes can cloud judgment and lead to revenge trading—a scenario where traders attempt to recoup losses hastily, often resulting in further setbacks.

Managing these emotions involves developing self-awareness and implementing strategies to maintain emotional equilibrium during trading activities.

Our members already secured 7-figures in funding capital. Join the FXD Academy and take your trading to the next level, click here to learn more.

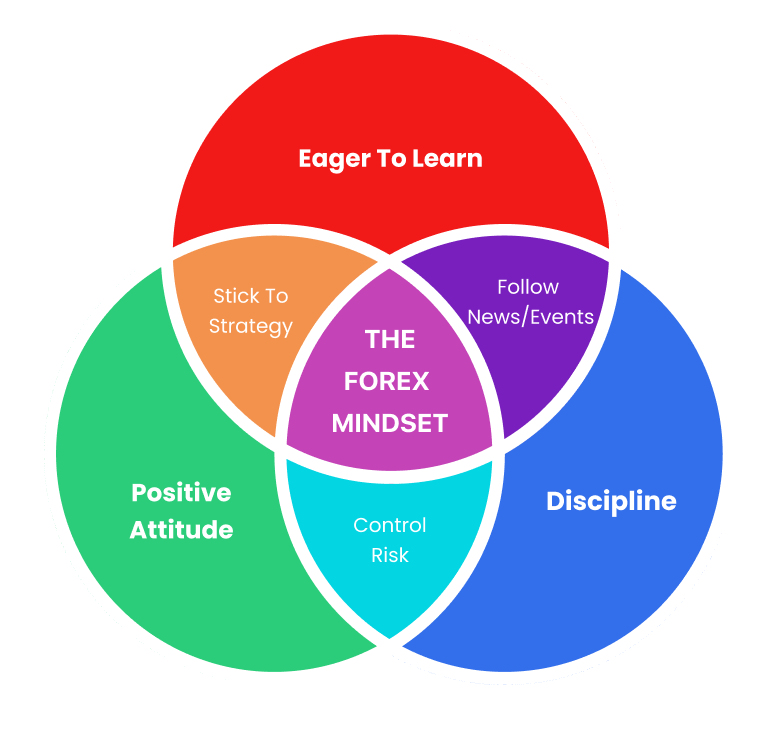

Building the Mindset of a Successful Trader

A successful trader’s mindset encompasses several key attributes:

1. Discipline

Adhering to a well-defined trading plan is paramount. Discipline ensures that traders stick to their strategies and avoid impulsive decisions based on market fluctuations.

2. Patience

The forex market offers numerous opportunities, but not all are worth pursuing. Patience allows traders to wait for setups that align with their criteria, increasing the likelihood of successful outcomes.

3. Adaptability

Market conditions are ever-changing. Successful traders remain flexible and adjust their strategies in response to evolving market dynamics.

4. Continuous Learning

The financial markets are influenced by a myriad of factors. Committing to ongoing education helps traders stay informed and refine their strategies accordingly.

Exploring Different Trading Styles and Their Psychological Demands

Various trading styles require distinct approaches and mindsets. Understanding these can help traders choose the style that best aligns with their personality and goals.

Scalping

Definition: Scalping involves making numerous trades to profit from small price movements over short time frames.

Mindset Requirements:

- Quick Decision-Making: Scalpers must process information rapidly and execute trades without hesitation.

- High-Stress Tolerance: The fast-paced nature of scalping can be stressful; maintaining composure is essential.

- Laser-Focused Attention: Constant monitoring of the market is required to identify and act on fleeting opportunities.

Day Trading

Definition: Day traders open and close positions within the same trading day, avoiding overnight exposure.

Mindset Requirements:

- Decisiveness: Similar to scalping, day trading requires prompt decision-making.

- Emotional Control: Handling the emotional highs and lows within a single day is crucial to prevent impulsive actions.

- Commitment to Routine: Establishing and adhering to a daily trading routine fosters consistency.

Swing Trading

Definition: Swing traders hold positions for several days to weeks, aiming to profit from medium-term market movements.

Mindset Requirements:

- Patience: Unlike scalping and day trading, swing trading requires waiting for trades to develop over time.

- Analytical Skills: In-depth analysis is necessary to identify trends and potential reversal points.

- Risk Management: Holding positions overnight exposes traders to additional risks; effective risk management strategies are vital.

Actionable Tips to Enhance Your Trading Mindset

- Develop a Comprehensive Trading Plan

- Set Clear Goals: Define what you aim to achieve with your trading activities.

- Establish Entry and Exit Criteria: Determine the conditions under which you will enter and exit trades.

- Implement Risk Management Rules: Decide on the amount of capital to risk per trade and set stop-loss levels accordingly.

- Maintain a Trading Journal

- Record All Trades: Document details such as entry and exit points, position sizes, and the rationale behind each trade.

- Review Regularly: Analyzing past trades helps identify patterns, strengths, and areas for improvement.

- Practice Mindfulness and Stress Management

- Mindfulness Techniques: Practices like meditation can help maintain focus and reduce anxiety.

- Regular Breaks: Taking breaks during trading sessions prevents burnout and promotes mental clarity.

- Engage in Continuous Education

- Read Reputable Trading Books: Expand your knowledge by learning from experienced traders and authors.

- Participate in Webinars and Workshops: Engaging with the trading community provides new insights and perspectives.

- Seek Support and Mentorship

- Join Trading Communities: Interacting with fellow traders offers support and shared learning experiences.

- Find a Mentor: A mentor can provide guidance, share experiences, and help navigate challenges.

Become a VIP and get access to exclusive insights, powerful trading indicators and other resources, click here to join now.

Recommended Resources for Developing a Trading Mindset

- “Trading in the Zone” by Mark Douglas: This book delves into the psychological aspects of trading and offers insights into developing a disciplined mindset.

- “The Disciplined Trader” by Mark Douglas: Another seminal work that explores the psychology of trading and provides strategies for developing mental discipline.

- “The Trading Book” by Anne-Marie Baiynd: This resource offers a comprehensive look at technical systems and trading psychology, suitable for traders seeking to enhance their skills.

Conclusion

Cultivating a proper trading mindset is a continuous journey that involves self-reflection, education, and practice. By understanding the psychological components of trading and tailoring your approach to fit your chosen trading style, you can enhance your decision-making process and work towards achieving consistent success in the forex market. Remember, the most successful traders are those who master both the technical and psychological facets of trading.