Hey, fellow traders! If you’re diving into forex and want to start making smarter trades, then understanding economic indicators is a game-changer. These little nuggets of economic data tell us what’s really happening behind the scenes in a country’s economy. Get them right, and you’ll be ahead of the market before most traders even react!

In this article, I’ll break down the most important economic indicators, how they impact forex trading, and how you can use them to your advantage. So, let’s level up your trading game!

What Are Economic Indicators?

Economic indicators are stats that give us clues about a country’s financial health. Governments and financial institutions release these reports regularly, and they shape the forex market in a BIG way.

These indicators fall into three main categories:

- Leading Indicators – These predict where the economy might be headed (e.g., stock market trends, building permits, and consumer sentiment).

- Lagging Indicators – These confirm trends after they’ve happened (e.g., unemployment rates, interest rates, and corporate earnings).

- Coincident Indicators – These move in real time with the economy (e.g., GDP, retail sales, and industrial production).

Knowing how these indicators interact can help you spot trading opportunities before the rest of the crowd catches on!

Major Economic Indicators That Affect Forex Trading

Let’s get into the most important economic indicators that drive the forex market. These are the reports you want to keep an eye on when planning your trades.

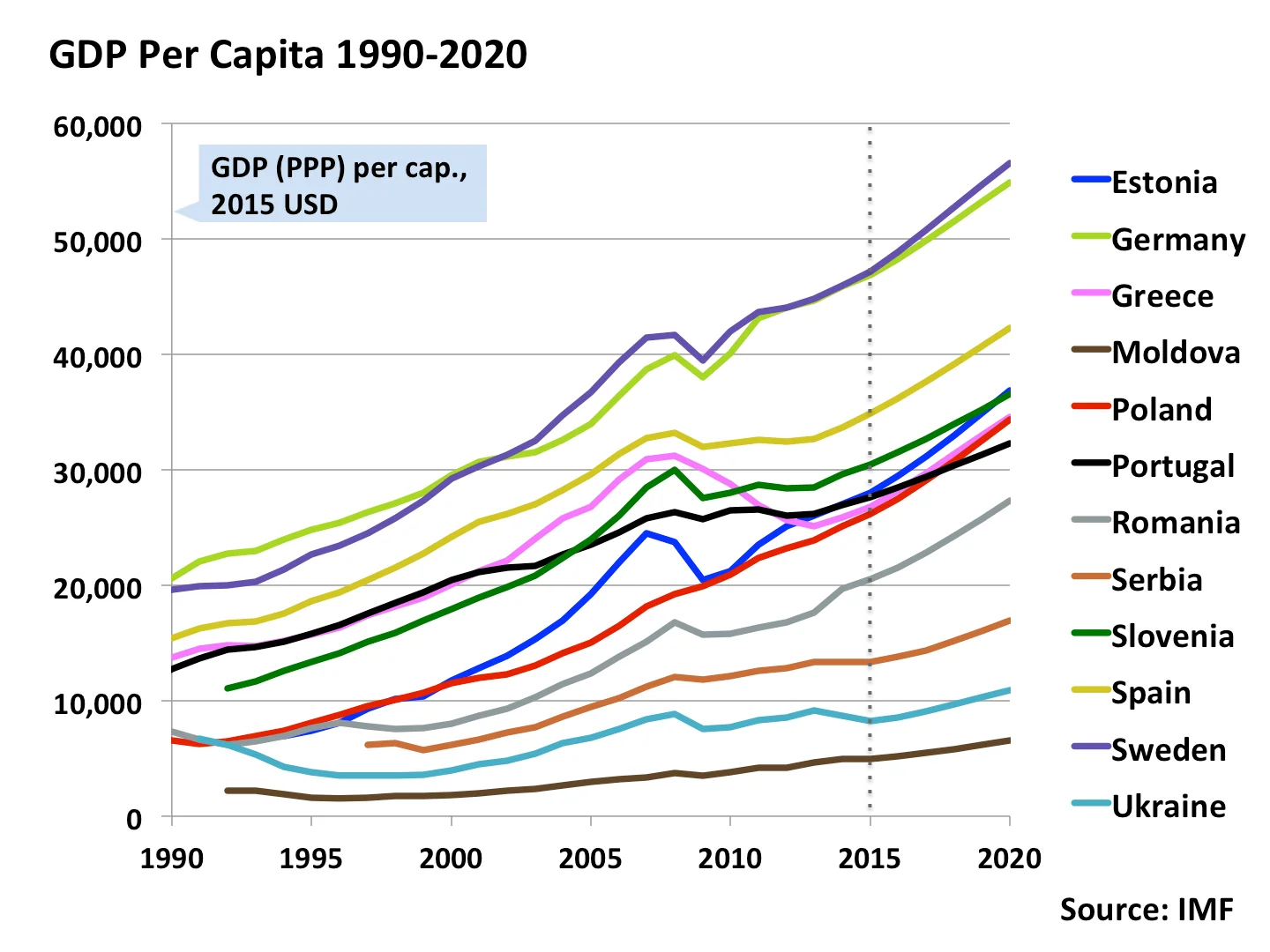

1. Gross Domestic Product (GDP) – The Big Picture

GDP is basically a country’s economic report card. It tells us how much a country is producing and how fast it’s growing. A strong GDP generally indicates a healthy economy, while a declining GDP can signal trouble ahead.

Why Traders Care:

- A booming GDP = Strong economy = Stronger currency.

- A slow or declining GDP = Weaker economy = Currency depreciation.

- If GDP numbers beat expectations, traders usually buy that currency, causing its value to rise.

GDP is released quarterly and is often revised multiple times, so traders must monitor both preliminary and final reports for the most accurate analysis.

2. Interest Rate Decisions – The Market Mover

Interest rates set by central banks (like the Fed, ECB, and BoJ) have a HUGE impact on forex. Higher interest rates usually mean a stronger currency because investors chase higher returns. Central banks adjust interest rates to control inflation, promote economic growth, or stabilize employment levels.

How It Moves Forex Markets:

- Higher interest rates = Stronger currency (more foreign investment).

- Lower interest rates = Weaker currency (less investment appeal).

- Sudden rate changes = Market chaos (be ready for volatility!).

For traders, tracking central bank meetings and monetary policy statements is crucial, as unexpected rate decisions can cause sharp market swings.

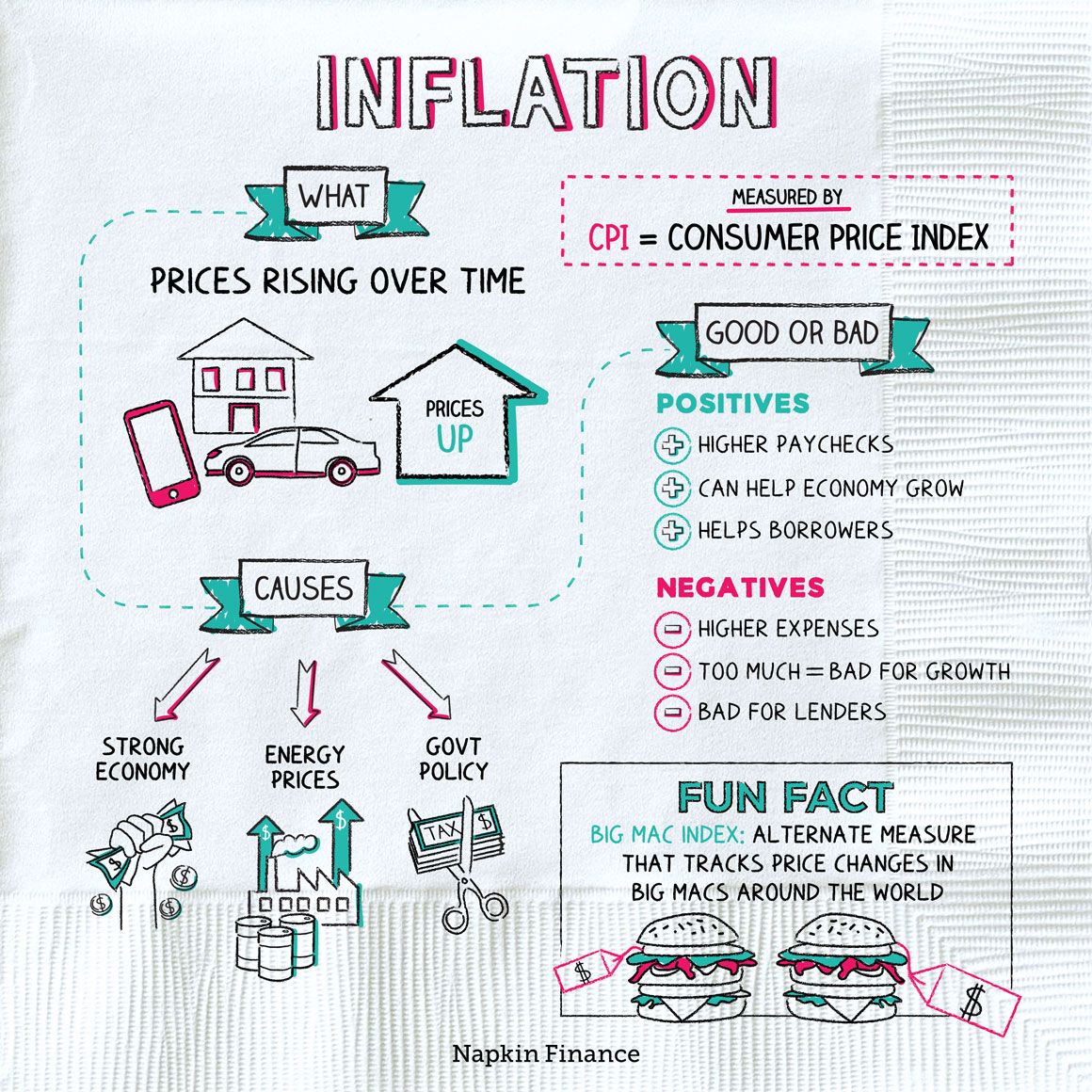

3. Inflation Reports (CPI & PPI) – The Silent Killer

Inflation measures how fast prices are rising. Moderate inflation signals economic growth, but excessive inflation reduces purchasing power and erodes consumer confidence.

Key Reports:

- Consumer Price Index (CPI): Measures price changes for everyday goods and services.

- Producer Price Index (PPI): Tracks price changes from producers and indicates potential future inflation trends.

How Inflation Affects Forex:

- If inflation rises too fast, central banks may hike interest rates → Currency strengthens.

- If inflation is too low, central banks may cut rates → Currency weakens.

- Inflation surprises (either high or low) can cause wild forex swings.

Inflation reports are closely watched by traders because they influence central bank policies and long-term economic stability.

4. Employment Data (NFP) – The Job Market Pulse

Employment figures provide insight into economic stability. The U.S. Non-Farm Payrolls (NFP) report, released monthly, is one of the most influential employment data points.

Why It’s Important:

- Strong employment numbers = Economic growth = Stronger currency.

- High unemployment = Economic slowdown = Weaker currency.

- A big difference between expected and actual NFP numbers can cause insane market volatility.

Employment data directly affects consumer spending, economic growth, and central bank policies. A weak job market could lead to interest rate cuts to stimulate economic growth.

5. Trade Balance – Who’s Winning the Trade War?

Trade balance measures the difference between a country’s exports and imports. A trade surplus strengthens a currency, while a trade deficit can weaken it.

How It Affects Forex:

- A country with a high trade surplus (like China) = Stronger currency.

- A country with a huge trade deficit (like the U.S.) = Weaker currency over time.

- If a major economy posts a surprise trade deficit/surplus, expect a strong market reaction.

Trade wars, tariffs, and geopolitical developments also affect trade balances, making them critical for forex traders to watch.

6. Consumer Confidence Index (CCI) – What’s the Mood?

CCI measures consumer optimism. Since consumer spending drives economic growth, this is a key indicator for forex markets.

Impact on Forex:

- A high CCI = People spending = Economic growth = Stronger currency.

- A low CCI = People saving = Economic slowdown = Weaker currency.

Traders use CCI reports to anticipate shifts in spending behavior, which affects GDP and inflation trends.

7. Political Elections & Geopolitical Events – Market Shake-Ups

Political events, such as elections, government policies, and geopolitical tensions, have a significant impact on forex markets.

How Political Events Affect Forex:

- Election uncertainty leads to currency volatility.

- Strong government policies can boost economic confidence and strengthen a currency.

- Geopolitical risks, such as trade wars or conflicts, can weaken affected currencies.

Pro Tip: Keep an eye on global political developments and trade relations. Unexpected political shifts can create high-impact trading opportunities!

Conclusion

Mastering economic indicators gives you an edge in forex trading. Knowing how GDP, interest rates, inflation, employment data, trade balances, consumer confidence, and political events impact the market allows you to anticipate price movements and trade like a pro.

Stay updated, be smart with risk, and always keep learning. The forex market rewards those who put in the work!

Got any questions? Drop them in my Discord. I’d love to help you level up your forex trading skills!