The forex market is the largest and most liquid financial market in the world, with a daily trading volume exceeding $7 trillion. As technology advances, traders no longer need to rely solely on desktop trading platforms. Forex trading apps offer seamless, real-time access to the market, enabling traders to analyze price charts, execute trades, and manage risk conveniently from their smartphones or tablets.

But with an overwhelming number of apps available, choosing the right one can be challenging. This guide aims to help you navigate the best forex trading apps in 2025, comparing their features, pros, and cons. Whether you’re a beginner or an experienced trader, this article will equip you with the knowledge to find the best app for your needs.

Why Use a Forex Trading App?

Forex trading apps have become essential tools for traders due to their numerous advantages:

- Convenience: Trade from anywhere, anytime, without being tied to a desktop.

- Real-time data: Access live price feeds, technical indicators, and financial news.

- User-friendly interfaces: Most apps are designed for intuitive and seamless trading.

- Automated trading: Some apps allow algorithmic trading, reducing the need for manual execution.

- Push notifications: Receive price alerts and market trend notifications instantly.

- Demo accounts: Many apps offer risk-free demo accounts to practice trading before committing real funds.

Key Features to Look for in a Forex Trading App

1. Regulation & Security

Security should be your top priority when choosing a forex trading app. Ensure the app is regulated by reputable financial authorities such as:

- Financial Conduct Authority (FCA) – UK

- Commodity Futures Trading Commission (CFTC) – USA

- Australian Securities and Investments Commission (ASIC) – Australia

- Cyprus Securities and Exchange Commission (CySEC) – Europe

A regulated trading app ensures that your funds are protected, and the broker adheres to strict security guidelines.

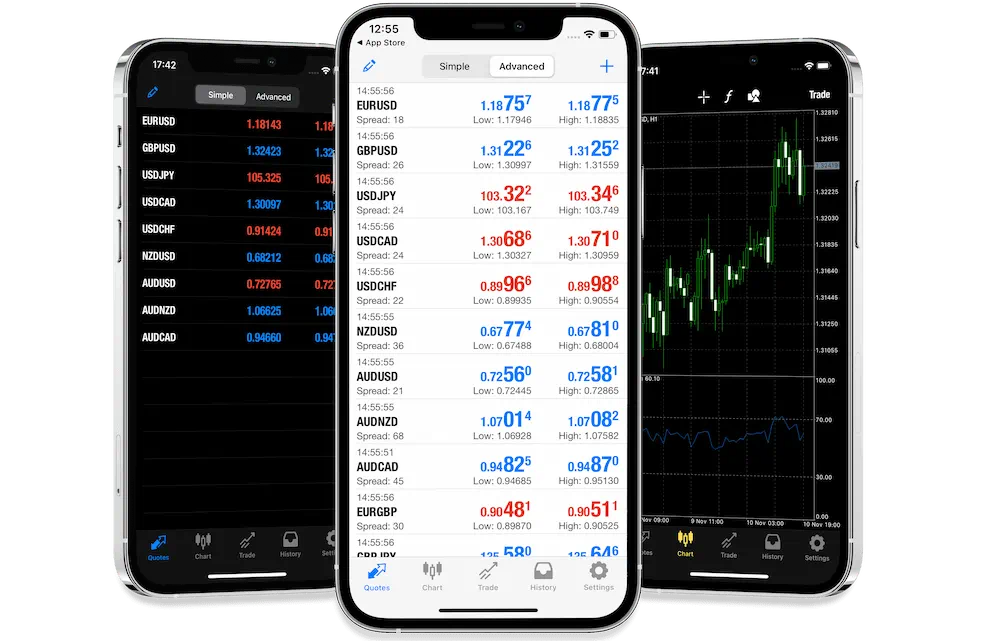

2. User Interface & Experience

An intuitive interface is crucial for smooth navigation. A well-designed app should allow users to:

- View real-time price charts

- Place trades with minimal effort

- Customize indicators and chart types

- Easily switch between different currency pairs

3. Trading Fees & Spreads

Forex trading apps typically charge fees in one of two ways:

- Commission-based: Low spreads but charge a commission per trade.

- Spread-based: No commission but wider bid-ask spreads.

Always compare the fee structures before committing to an app.

4. Order Execution Speed

Fast execution speed is essential to avoid slippage, especially in a volatile forex market. The best apps offer near-instant order execution.

5. Charting & Technical Analysis Tools

Advanced traders rely on detailed charting tools to make informed decisions. Look for apps that offer:

- Multiple timeframes (1-min, 5-min, 1-hour, daily, weekly)

- Technical indicators like Moving Averages, RSI, MACD, and Bollinger Bands

- Candlestick patterns for price action analysis

6. Risk Management Tools

Managing risk is essential in forex trading. Look for apps that provide:

- Stop-loss and take-profit orders to limit potential losses and lock in profits.

- Risk-reward ratio calculators to assess potential gains versus losses.

- Trailing stops to protect profits as prices move in your favor.

- Position sizing calculators to determine optimal trade sizes based on account balance and risk tolerance.

7. Customer Support

Reliable customer service is essential in case of technical issues. The best apps provide 24/7 support via live chat, email, and phone.

Top Forex Trading Apps in 2025

Based on research and user reviews, here are the best forex trading apps for 2025:

1. MetaTrader 4 (MT4) – Best for Beginners

- Regulation: Broker-dependent

- Spreads & Fees: Varies by broker

- Key Features:

- User-friendly interface

- Supports automated trading with Expert Advisors (EAs)

- Advanced charting tools and indicators

- Available for Android and iOS

Pros: Widely used and supported by most brokers / Easy-to-use interface for beginners / Customizable indicators and trading scripts

Cons: Lacks some advanced features of MT5 / Not as fast as newer platforms

2. MetaTrader 5 (MT5) – Best for Advanced Traders

- Regulation: Broker-dependent

- Spreads & Fees: Varies by broker

- Key Features:

- Additional order types

- More timeframes and indicators than MT4

- Integrated economic calendar

- Enhanced risk management tools

Pros: More powerful than MT4 / Supports algorithmic trading / Available for mobile and desktop

Cons: / Learning curve for beginners

3. cTrader – Best for Professional Traders

- Regulation: Broker-dependent

- Spreads & Fees: Varies by broker

- Key Features:

- Depth of Market (DOM) feature

- Advanced order types

- Transparent pricing

- Custom risk management settings

Pros: Fast order execution / Clean and modern interface / Advanced risk management tools

Cons: Not as widely supported as MT4/MT5 / Limited broker availability

4. TradingView – Best for Technical Analysis

- Regulation: N/A (Charting platform)

- Spreads & Fees: Subscription-based

- Key Features:

- Extensive charting tools

- Community-driven trade ideas

- Mobile-friendly and web-based

Pros: Best charting tools for forex traders / Social trading features / Customizable scripts using Pine Script

Cons: No direct trading (requires broker integration) / Some features require a paid subscription

Conclusion

Choosing the right forex trading app depends on your experience level, trading style, and required features. Whether you’re a beginner looking for a simple interface or a pro seeking advanced charting tools, there is a forex trading app tailored for you.

Take advantage of demo accounts to test different platforms before committing to live trading. Implement proper risk management strategies to protect your capital and trade responsibly. Happy trading!